Credit rating scale: How to get an amazing credit score

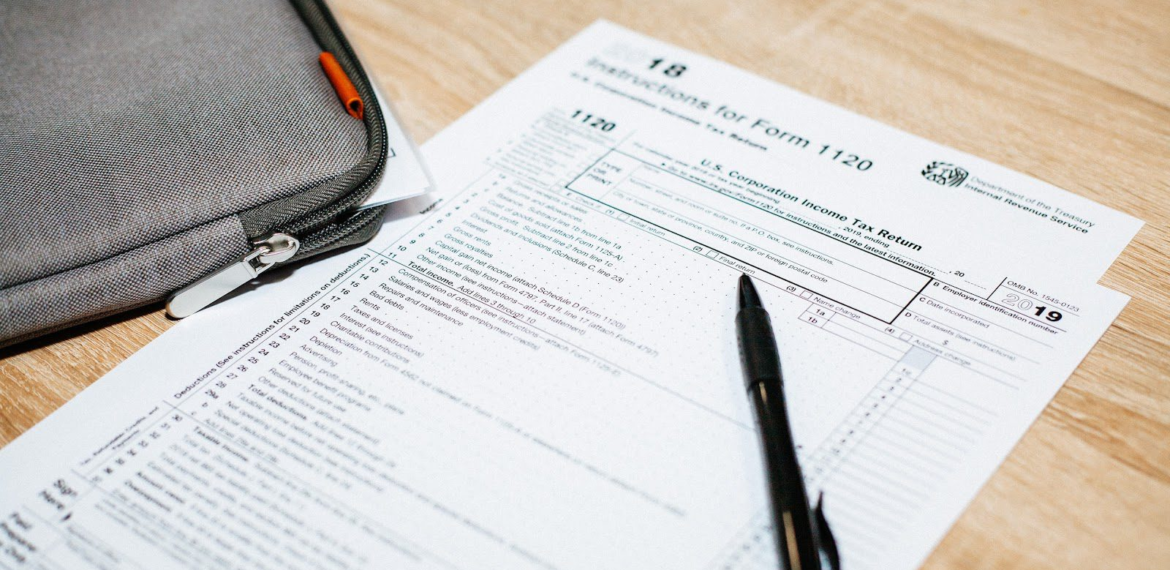

Your credit rating (or credit score) gives lenders an idea of how risky you are to lend to. But different bureaus use different credit rating scales. We’re going to take a look at the most common scale, FICO and show you how these little numbers can impact your ability to live a Rich Life. If your credit score is high, expect great interest rates on home loans, near-universal approval for credit