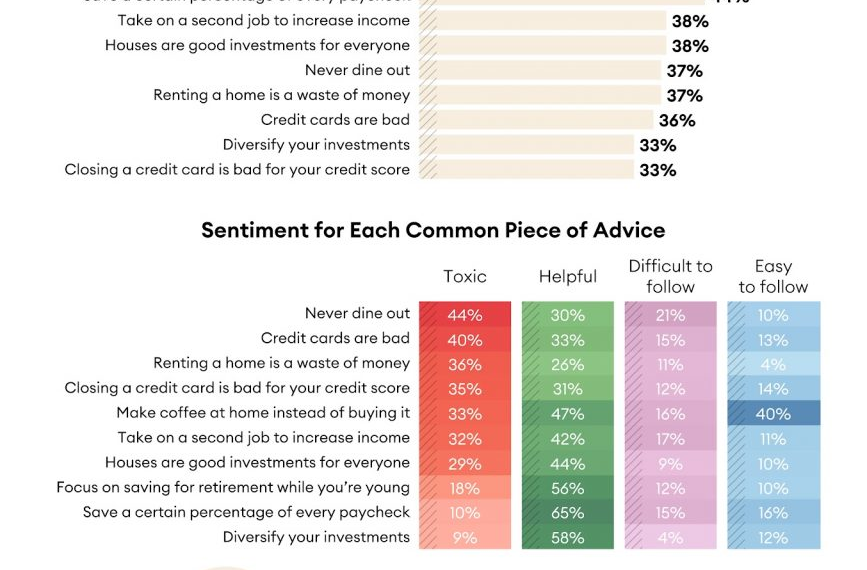

Less than half of financial advice is considered helpful by those who receive it [Survey]

Key TakeawaysFinancial advice is often given freely by well-meaning friends and family. Though well-intended, much of this advice may not always be helpful.With so many financial strategies floating around, some might not fit your specific objectives. Other times, money management tips can be downright toxic to your financial health. To gain insight into the topic of money management advice and whether it’s helpful, we surveyed over 1,000 respondents. Read along