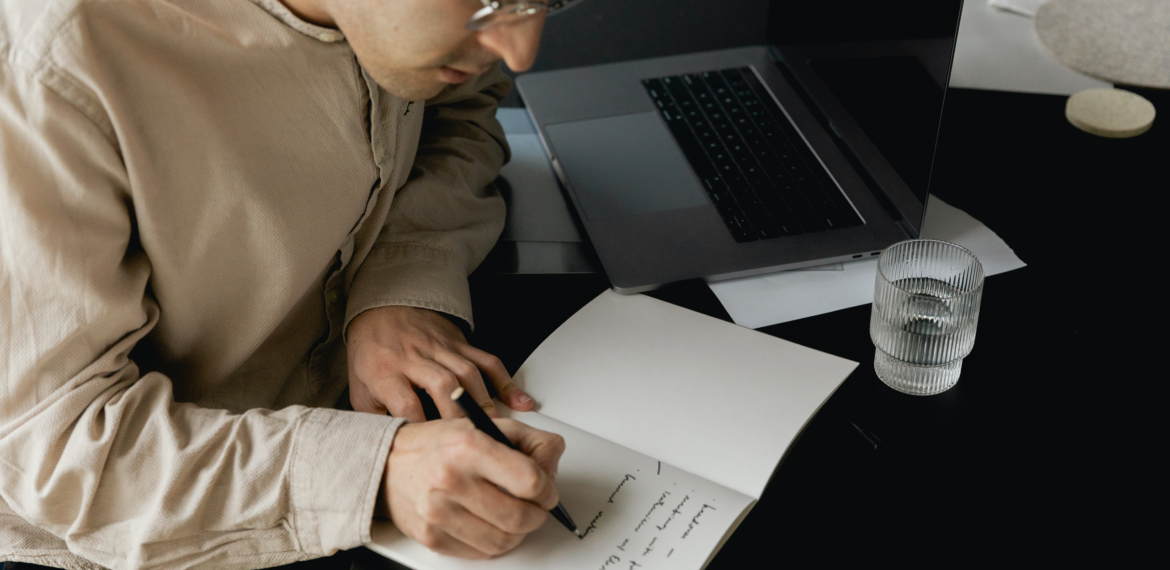

How to Choose the Best Personal Finance Software for You

Personal finance software isn’t just something for accountants and personal finance managers. Everyone can benefit from user-friendly software to help manage their money. The right solution can make it easier to plan and track your spending, helping you become a more fiscally responsible adult.There are plenty of easy-to-use tools available. You don’t have to stress about needing accounting skills or struggling to learn a complicated piece of software. Here’s what