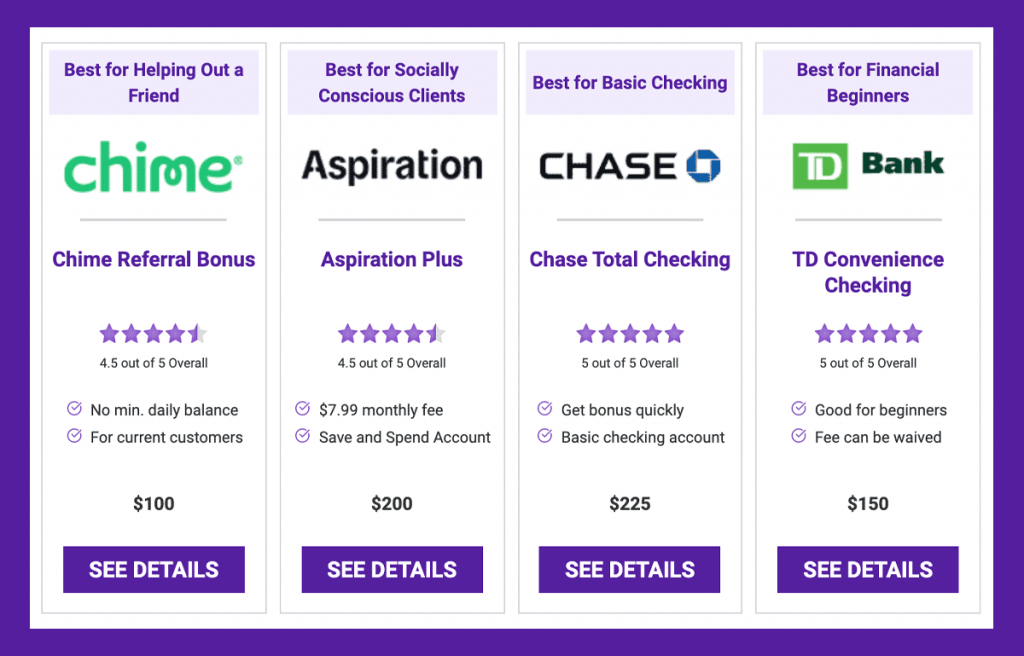

Best for Helping Out a Friend

Chime Referral Bonus

$100

Best for Socially Conscious Clients

Aspiration Plus

$200

Best for Basic Checking

Chase Total Checking

$225

Best for Financial Beginners

TD Convenience Checking

$150

by Timothy Moore

Contributor

So, you’re looking for a new bank account.

You’ve got several factors to consider — ATM access, interest rates, monthly account fees, minimum balances, online bill payments and more.

Another factor: sign-up bonuses. Banks and credit unions frequently run promotions to entice prospective customers to open a new account — and they often come with cash. You have to meet specific criteria, such as making a minimum opening deposit, and generally the account must remain open for a certain amount of time — at least long enough to earn the cash bonus.

Many banks offer such sign-up bonuses, but often, they aren’t advertised. We did some digging to find the best bank promotions currently on offer.

Keep an eye on what each promotion requires, as well as any limitations. Recurring direct deposits and maintaining a minimum balance are common requirements in securing bank bonuses. Also pay attention

17 Bank Promotions That Give you Cash

The Aspiration Account boasts unlimited fee-free ATM withdrawals at all in-network (Allpoint) ATMs, plus up to 5% cash back on Conscience Coalition debit card purchases. You can even opt to plant a tree with every purchase roundup. You can access your paycheck up to two days early and earn up to 1.00% APY on your savings.

The Aspiration Plus Account boasts unlimited fee-free ATM withdrawals at all in-network (Allpoint) ATMs, plus up to 10% cash back on Conscience Coalition debit card purchases. You can even opt to plant a tree with every purchase roundup and get carbon offsets for your gas purchases with Planet Protection. You can access your paycheck up to two days early and earn up to 5.00% APY on your savings.

The Chase Total Checking account gets you access to more than 4,700 branches nationwide, plus 16,000 ATMs. The easy-to-use mobile app is highly rated. While Chase does charge a $12 monthly service fee, you can waive it by earning $500+ in monthly direct deposits, maintaining a daily balance of $1,500+ or having $5,000 across all your Chase accounts at the start of each day.

The TD Bank Beyond Checking Account’s monthly maintenance fee is steep at $25, but you have three easy ways to waive it (the $2,500 daily balance might be the easiest). Beyond Checking offers two overdraft fee reimbursements a year and no ATM fees, even for out-of-network ATMs (as long as you’ve got that $2,500 balance). Though the account boasts that it earns interest, the growth is inconsequential at 0.01% APY.

The TD Bank Beyond Checking Account’s monthly maintenance fee is steep at $25, but you have three easy ways to waive it (the $2,500 daily balance might be the easiest). Beyond Checking offers two overdraft fee reimbursements a year and no ATM fees, even for out-of-network ATMs (as long as you’ve got that $2,500 balance). Though the account boasts that it earns interest, the growth is inconsequential at 0.01% APY.

Though not technically a bank, Chime is becoming increasingly popular as an online financial institution for banking customers of all ages. Top features include early access to direct deposit, fee-free overdraft, 60,000+ ATMs, a 0.50% APY for the high-yield savings and plenty of features to automatically grow your savings.

The Ultimate Opportunity Savings Account from Alliant Credit Union has a lot to like: 80,000+ fee-free ATMs, no monthly fees if you opt in to online statements, a leading mobile app, and a strong APY at 0.55%.

Bank of America’s Advantage account is broken into three tiers: SafeBalance Banking, Plus Banking, and Relationship Banking. SafeBalance boasts no overdraft fees or non-sufficient funds fees; Plus offers multiple ways to waive the monthly service fee; and Relationship earns interest (though the percentage is quite low).

Smart Advantage is BMO Harris’ most popular checking account. It requires no minimum balance, charges no monthly fees when you opt for paperless statements and gets you fee-free access to 40,000+ ATMs nationwide with the Allpoint network.

Like Smart Advantage, BMO Harris’ Smart Money has no minimum balance required. It’s also noteworthy for having no overdraft or NSF fees. With this account, you will get unlimited fee-free transactions at in-network ATMs (40,000+ nationwide). However, you’ll pay a monthly fee if you’re 25 or older.

The highest bonus at BMO Harris comes from the Premier Account with Relationship Packages that reward you with more perks for banking more with BMO. The account earns interest, and the amount you earn increases with the amount of funds in the account. You also get unlimited access to any ATMs, in-network or not.

Fifth Third’s checking account boasts immediate funds for all check deposits, Extra Time for overdraft fee avoidance, early paycheck access, no minimum balance and no hidden fees. The account also offers basic fraud protection services and unlimited check writing.

The Discover Bank Online Savings Account offers a competitive APY (0.40%) with interest compounded daily instead of monthly. THere’s no monthly fee with Discover, no minimum deposit and no insufficient funds fee. All in all, not a bad offer.

Huntington’s Asterisk-Free Checking Account doesn’t pay out any interest, but the lack of a monthly maintenance fee does make it appealing for an easy checking account. Key features include mobile banking, the No Overdraft Fee $50 Safety Zone and the 24-Hour Grace Overdraft and Return Fee Relief.

While the Huntington 5 account does have a monthly $5 fee, you can waive it by having $5,000 across accounts with Huntington. By upgrading to this account, you’ll get a higher bonus and ear 0.02% interest on your balance. Plus, you get five free ATM withdrawals.

The HSBC Premier pays a handsome bonus of $450, but it’s also a lot less attainable for average Americans. The $75K minimum balance across all HSBC accounts and investments, for example, is a hard criterion to meet to waive the monthly fee. Some more attainable accounts include Advance, Choice Checking and Basic Banking, but you’ll lose out on the bonus opportunity.

PNC bonus offers are based on amounts of qualifying direct deposits and the offer is good in 22 states across the country. Your Zipcode will be used to determine if you are in a participating state.

Earn a $50 for making $500+ in direct deposits into the Virtual Wallet account; $200 for receiving $2,000+ in direct deposits into the Virtual Wallet with Performance Spend account; or $300 for receiving $5,000+ in direct deposits into the Virtual Wallet with Performance Select account.

To waive the Virtual Wallet monthly maintenance fee ($7), earn $500+ in monthly direct deposits to the Spend account or maintain a $500+ monthly balance across the Spend + Reserve accounts. If you’re 62 or older, the fee is automatically waived.

Instead of listing approximately 193 bank promotions, we kept this list short and sweet — only highlighting the best bank promotions for checking and savings accounts.

But maybe you’re interested in banking with your local credit union, opening a small business checking account or exploring what investment accounts are available. There are often cash bonuses attached to these accounts too.

Banks don’t always make finding these promotions easy, so here are a few tips to help you get your hands on that cash bonus.

Overall, be smart. Don’t let the promise of a cash bonus blind you. Read the fine print so you don’t get stuck paying high monthly fees, interest rates or closing penalties.

If you’re worried that opening a new bank account or closing an old one will hurt your credit score, don’t be. Your bank accounts are not included in your credit report and therefore have no effect on your credit score, unless you have an outstanding negative balance that the bank turns over to a collection agency.

Sometimes when you go to open a new account, banks will do a soft credit check. However, that won’t affect your credit score.

Timothy Moore covers bank accounts for The Penny Hoarder from his home base in Cincinnati. He has worked in editing and graphic design for a marketing agency, a global research firm and a major print publication. He covers a variety of other topics, including insurance, taxes, retirement and budgeting and has worked in the field since 2012.

Editorial Disclosure: This content is not provided by the bank advertiser. Opinions expressed here are the author’s alone, not those of the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings