by Lisa Rowan, Rachel Christian, CEPF®

A payday loan can offer a quick reprieve from unexpected expenses or temporary tough luck.

But if you don’t have enough money to pay back the loan next payday, you may need to take out another loan — or roll your balance into a new loan with interest rates that can exceed 300%.

More than a dozen states have banned high-interest, short-term loans, but it’s still easy to get a payday loan everywhere else — and get trapped in the debt cycle.

If you’re stuck in that loop, we have advice on getting out and getting some payday loan relief.

Almost 70% of payday loan borrowers take out a second loan within one month. And according to the Consumer Protection Financial Bureau, 1 in 5 new payday loan borrowers ends up taking out at least 10 payday loans.

This payday loan cycle can turn a short-term loan of a few hundred dollars into a growing mountain of debt totaling thousands.

The average repeat borrower pays $458 in fees on top of their principal over the course of a year.

And when you’re that far behind, it’s hard to get ahead.

“If you’ve gotten into the spiral, it’s really not your fault,” says Maurice BP-Weeks, co-director of Action Center on Race & the Economy. “Companies shouldn’t be allowed to peddle these products.”

If this sounds familiar, read on for practical tips on how to get payday loan debt relief.

The type of payday loan help that’s right for you depends on your credit, your debt burden and your overall financial situation.

Payday loan relief options include:

We’ll also discuss other ways to eliminate your payday loan debt, including cutting costs and boosting your income.

Facing this debt by yourself is hard. A trained credit counselor can help.

Credit counseling organizations are usually nonprofit groups staffed with certified financial counselors.

They can help you explore all your debt relief options, give you personalized advice and organize a debt management program for your payday loans.

A debt management program typically lets you make a single monthly payment to the counseling organization instead of paying several companies at different times.

The credit counseling agency then makes monthly payments to each of your creditors for you.

Credit counselors might also be able to reduce your overall monthly payment by asking creditors to lower interest rates on your loans and waive certain fees.

To find a credit counseling organization near you, check out:

An extended repayment plan lets you make smaller payments on your payday loans over a longer period without facing additional penalties or fees.

Some states require payday lenders to permit extended repayment plans — but laws do vary by state. Your lender may have the right to charge you a fee to sign up for a repayment plan.

A credit counselor can help determine if you qualify and get the repayment process started.

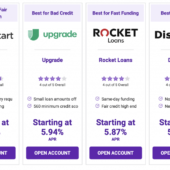

A debt consolidation loan is simply a new loan you can use to pay off other debts.

Debt consolidation typically groups multiple payday loans together into one big loan with a lower interest rate. The idea is to help you break the cycle of re-borrowing high-interest debt.

Payday loans often come with sky-high interest rates, as much as 300% to 400%. In contrast, personal loan interest rates typically range from 16% to a maximum of 35%.

And unlike payday loans, which are designed to be paid off in a couple weeks, a lender typically gives you one to five years to pay off a debt consolidation loan.

Debt consolidation can take the form of a personal loan or what’s known as a payday alternative loan offered by some credit unions.

You don’t have to roll all your debts into this new loan: You get to decide which ones to include in your debt consolidation.

Here’s how it works:

Payday loan consolidation can be a good option so long as you can:

Payday loan debt consolidation has a few drawbacks, though.

You usually need at least a fair credit score rating (580-669) to qualify for a personal loan, and you’ll need a good to excellent credit score to snag the lowest APR.

Some personal loans also require you to borrow a minimum amount, usually $1,000 or more, which may be more than you need.

Don’t qualify for a traditional personal loan? Consider getting a payday alternative loan.

These short-term loans are available from low-income credit unions and don’t require a credit check to qualify.

You can usually borrow up to $1,000 with a six-month repayment term and a maximum 28% annual percentage rate.

You must belong to a credit union for 30 days before you can qualify for payday alternative loans. You may also need to pay an application fee of up to $20.

Debt settlement involves offering your payday lender a lump-sum payment in exchange for erasing the rest of your debt.

Let’s say you owe $1,000 in payday loans. If you offer to pay $700 in cash today, the lender might agree to accept this smaller sum as final payment on the account.

You can settle the debt yourself or use a debt settlement company to do it for you. These companies employ professional negotiators who haggle with the lender on your behalf — but the service isn’t free and results aren’t guaranteed. Debt settlement company fees often range from 15% to 30% of your debt.

Comfortable with negotiating? Here are some tips on how to settle payday loan debt yourself:

Filing for bankruptcy is a last-resort measure. If you’re drowning in debt with no other viable options, filing for chapter 7 bankruptcy can wipe out many forms of debt under the protection of a federal court.

Chapter 7 is the fastest and most common form of bankruptcy. It erases most unsecured debt, including medical bills, credit card debt — and payday loans.

Filing for bankruptcy is a complex process that can take three to six months to complete. You’ll need to undergo credit counseling, work with a bankruptcy attorney and appear in court before your debt is erased.

Declaring bankruptcy leaves a mark on your credit report for 10 years. However, your credit score will likely rebound within six months, and it will continue to improve if you follow smart credit management practices.

Payday loan lenders have a sketchy reputation for a reason.

For example, some payday lenders threaten to garnish wages in order to get borrowers to pay — even if the company doesn’t have a court order or judgment to do so.

If you believe your payday lender is breaking the law or exhibiting predatory behavior, you should contact an attorney.

You have a few options:

People often get caught in a payday loan debt spiral because the lender keeps taking money out of their bank account.

Technically, the company can do this if you signed a payment authorization, also called an ACH Authorization when you took out the loan.

But you can also stop them.

You can stop payday loan companies from pulling money from your account — even if you gave them permission and signed an authorization form.

Here’s how to do it:

Fill out a “revoking authorization” form and mail it to the payday loan lender. Use this sample letter from the Consumer Financial Protection Bureau.

Let your bank know you revoked authorization for the company to take automatic payments from your account. The CFPB has a sample letter for that, too.

You can stop any automatic payment from being charged to your account by giving your bank what’s known as a stop payment order.

Give your bank this letter at least three business days before the lender is scheduled to take money out of your account.

You can also give the stop payment order over the phone or in person, but your bank may require you to send a physical letter anyway.

Your bank may charge you a fee to place a stop payment order. If it does, it usually ranges from $15 to $35.

The payday loan company can’t take out any more automatic deductions from your account after you submit this order letter to your bank.

Remember: This move won’t eliminate your existing payday loan debt. But revoking authorization on ACH payments will at least stop the company from raiding your bank account every payday.

Climbing out of payday loan debt can feel overwhelming. But tried-and-true debt elimination strategies can help.

This approach isn’t easy — it requires hard work, time and discipline. But by cutting costs and earning more money, you can make your payday loan nightmare a thing of the past.

Reducing your expenses is one of the toughest ways to get out of the payday loan trap if you’re already living on a fixed budget and struggle to find ways to save.

If you can’t cut costs, you may need to ask for help to defray some of your costs temporarily.

You may be able to access free meals for your school-age children or visit a local food pantry to get by on a lower grocery budget. College students may be able to request help from an emergency financial assistance fund.

Your church or local community groups can also provide temporary help.

You can also call 211, the United Way’s health and human services referral line, which can direct you to services in your area, or visit 211.org to locate resources.

If you have any spare time and energy, it might be worth it to pick up a side gig.

Think about selling your services as a pet sitter, babysitter, Uber driver or errand runner — these side hustles don’t require much in the way of startup costs.

Lisa Servon, a professor at the University of Pennsylvania, has studied the payday loan landscape for years, talking to hundreds of borrowers about their experiences.

She said getting out of the payday loan cycle often requires some sort of windfall, recalling one woman she interviewed who used her tax refund to pay off her loan.

“She really targeted her tax refund from the earned income tax credit, paid off the loans and then really cut back on spending and watched her expenses,” Servon says.

You may be able to negotiate lower bills on essentials like utilities or set up an interest-free payment plan to make larger bills more manageable.

Rachel Christian is a Certified Educator in Personal Finance and a senior writer for The Penny Hoarder. Lisa Rowan is a former staff writer.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2022 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings