by Rachel Christian, CEPF®

Senior Writer

Quick Navigation

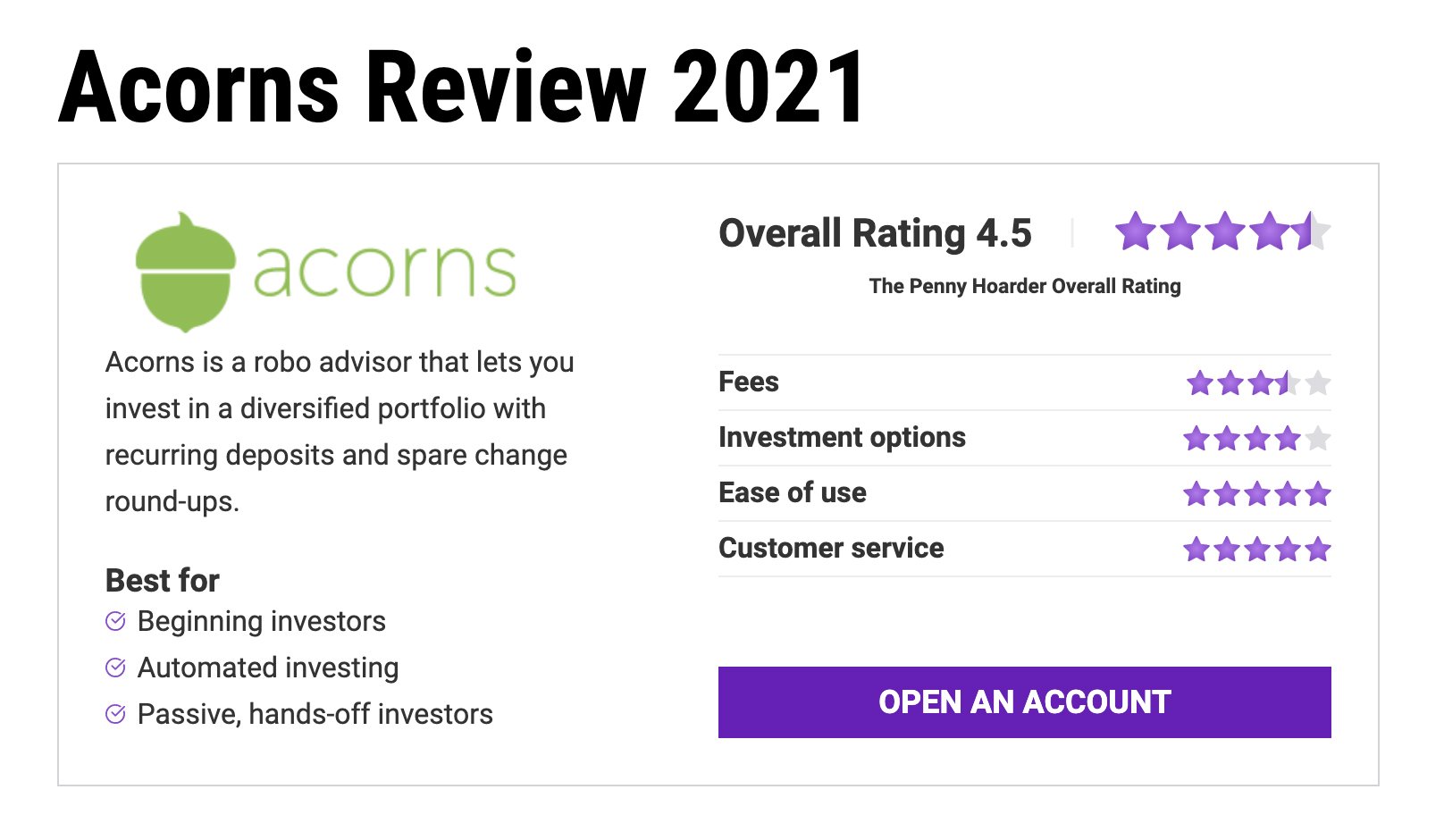

You’ve probably heard of Acorns. It’s a popular micro-investing app — even among people who don’t know a lot about investing — that helps you save money in a diversified portfolio.

By using one of its most popular features, you invest money without even really thinking about it. We love that convenience.

But investing is actually a serious endeavor. In this Acorns review, we’ll cover the app’s features, investing strategy and cost, along with other important details you should know before you get started.

Acorns is a California-based fintech company that helps simplify and automate investing. Users can contribute money to a passively managed, diversified portfolio through recurring transfers and/or spare change round-ups.

Founded in 2014, Acorns has quickly become one of the most profitable and popular micro-investing apps in North America. The start-up has an estimated 8 million subscribers and was valued at roughly $2.2 billion in May 2021, according to CNBC.

The company has steadily expanded its financial services over time. The Acorns app now offers banking products (including a checking account), educational resources, a debit card, custodial accounts for kids and an automated retirement account service.

Acorns derives about 80% of its revenue from monthly user subscription fees. The other 20% comes from interchange fees and brand partnerships.

Acorns offers two membership options to subscribers. Both accounts charge a flat monthly fee:

Personal

Family

Let’s dive into what these services include and other features in the Acorns app.

Getting started with Acorns is easy. You open an account by visiting the Acorns website or mobile app, enter some personal information and then link your banking account to the app.

Acorns has a $0 account minimum balance, but requires at least $5 to start investing.

Acorns markets its saving and investing features with five different names: Invest, Later, Spend, Early and Earn.

Most features are available with the $3 account, but Acorns Early is only available with the $5 Family account.

This is a taxable investment account that puts your money into a collection of exchange-traded funds (ETFs). Acorns creates your portfolio based on a questionnaire designed to gauge your risk tolerance and financial goals. You’ll answer these questions when you create your account.

You can add money to your Acorns investment portfolio via round-ups, recurring transfers from your bank or one-time deposits.

We’ll discuss more about how Acorns invests your money.

This is a tax-advantaged retirement account.

A retirement savings account is an investment portfolio, but it comes with some specific federal tax perks (and a few penalties, especially for early withdrawals).

The Acorns app lets you pick from either a traditional or Roth IRA. They also offer a SEP IRA option for self-employed people.

Saving for retirement is important. If your employer doesn’t offer a 401(k) plan, opening your own individual retirement account is a great way to start growing your nest egg.

The Acorns Later (IRA option) is a separate account from your Acorns Invest (taxable brokerage account). You get access to both with the $3 tier.

Like Acorns Invest, your IRA portfolio is made up of ETFs. You can also set up recurring transfers from your linked account to your Acorns retirement account.

Acorns Spend lets you open a checking account through the app’s partnership with Lincoln Savings Bank.

You’ll also get access to a Visa debit card connected to your Acorns Spend account.

The Acorns checking account doesn’t charge overdraft fees. Instead it pauses your account until you add funds and get your balance out of the red. It also doesn’t charge foregin transaction fees if you use your Acorns debit card abroad. Plus your card can withdraw cash from more than 55,000 fee-free ATMs globally.

You can fund your Acorns checking account four ways:

Acorns Early lets you set up investment accounts for your children, also known as a UTMA/UGMA account.

You can open multiple UTMA/UGMA accounts with an Acorns Family plan — whether they’re for your child, a grandchild, a niece or even a godson.

To get started, you’ll need the child’s full name, date of birth and Social Security number. Like Acorns’ other offerings, you only need $5 to get started with Acorns Early, and your money funds an automated, diversified portfolio of exchange traded funds.

A UGMA account is a custodial brokerage account for children. You can transfer this investment account to your child when they become a legal adult.

Unlike a 529 plan that can only be used for educational expenses, a UTMA/UGMA is more flexible on how the money can be spent (you can use the funds for anything that benefits the child).

Once the child reaches the age of transfer, usually 18 or 21, they become the account’s owner and can use the money for any reason.

Make sure to research the different types of investment accounts for kids or speak with a financial advisor to find the best account for you.

Formerly known as Found Money, Acorns Earn is the app’s online marketplace with over 200 brands.

When you shop with these merchants, extra money will be added to your Acorns Invest account, usually as a percentage of your order total or a flat dollar amount. For example, you can earn 50 cents on each Uber ride but 3.5% back on Uber Eats orders.

For “Tap and Get” offers, you have to go through the Acorns app and complete a purchase with their partner using your mobile phone.

For “Simply Spend” offers, you’ll receive cash back any time you use your Acorns-linked card to make purchases with partner brands.

Make sure to read the instructions carefully on each offer or you’ll likely miss out on the cash back.

Aa a final note: While there are some good offers on Acorns Earn, many are incentivizing you to buy things you may not really need. Purchasing a fancy product or service just to get a few bucks invested in your Acorns account kind of defeats the purpose of saving for your future.

Acorns also has a few features common to all of its investment accounts.

Round-up is probably Acorns’ best-known feature. After linking a debit card, your purchases are rounded up to the nearest dollar and the spare change is swept into your Acorns investment account.

For example, if you spend $10.20 on Amazon, you’ll be charged $11 and the 80 cent difference will be invested into your portfolio. This makes round-ups an easy way to invest when you spend money on everyday purchases.

If you have the Acorns Visa debit card, round-ups are automatically deposited into your account. If you don’t, Acorns transfers the money from your linked account to your investment account once it reaches at least $5.

You can set up automatic transfers from your linked banking account to your Acorns account on a daily, weekly or monthly basis.

Enabling recurring contributions is a great way to take advantage of dollar-cost averaging and consistently invest money for your future without thinking about it.

You can opt in for recurring transfers in addition to spare change round-ups to grow your account balance even faster.

Acorns also lets you make one-time lump-sum deposits.

This is the hub for Acorns’ educational articles and advice on personal finance and investing.

Articles are broken into different categories, like retirement and borrowing, and they’re written in simple terms digestible in an app-friendly format.

For more educational resources, you can check out the grow.acorns.com site, powered by CNBC, which features articles on market trends and financial literacy topics.

Acorns is a robo-advisor, meaning it uses computer software and algorithms to select a pre-made portfolio based on your age, income, risk tolerance and time horizon (how long before you may need to access your funds).

After answering a brief questionnaire, Acorns invests your money into a portfolio of exchange traded funds (ETFs), which bundle numerous stocks or bonds into a single fund. (FYI: ETFs are sometimes referred to as index funds.)

Acorns uses iShares and Vanguard ETFs, which come with very low expense ratios. An expense ratio is the operating fee charged by an ETF.

Acorns offers five different portfolios, ranging from conservative to aggressive. The aggressive option consists of stock ETFs while conservative options expose you to more bond ETFs.

You can choose a different portfolio if you disagree with the algorithm, but you can’t pick your own individual stocks or bonds with an Acorns account.

Acorns uses modern portfolio theory, an investment strategy that works by diversifying you across different asset classes to help lower risk and maximize returns.

ETFs span six different asset classes:

Because ETFs can cost hundreds of dollars per share, Acorns builds your portfolio with fractional shares. That’s how you can get started with as little as $5.

Once you start investing, your portfolio will be periodically rebalanced to maintain its target asset allocation. You also get the benefit of automatic dividend reinvestments.

Acorns gives users the option to save and invest in a sustainable portfolio made up of ETFs graded using environmental, social and governance (ESG) criteria.

Acorns says these socially responsible investing portfolios are designed to provide exposure to more sustainable companies, while still striving to perform as well as a traditional portfolio.

You can opt into Acorns’ sustainable portfolio for no additional monthly cost. However, the ETFs in this ESG portfolio come with slightly higher expense ratios.

Acorns charges a flat monthly management fee for its services. It advertises two different membership tiers: a $3 option and a $5 option.

Prior to Sept. 21, 2021, Acorns offered a third membership option for $1 per month. Acorns Lite gave you access to its automated portfolio and investment services. If you wanted an IRA or checking account, you had to upgrade to the $3 option.

Acorns recently phased out Acorns Lite. Existing customers can (potentially) still keep the $1 option, now called Acorns Assist, by following these steps on the company’s website.

Acorns Account Pricing

We suggest locking in that $1 Acorns Assist price if you can. Otherwise, spending $36 a year for a brokerage account is pretty expensive, especially if your account balance is low.

Other robo-advisors, such as Wealthfront and Betterment, charge a management fee as a percentage of your portfolio balance instead of a flat monthly fee. That may not sound like a big deal, but imagine this.

Let’s say you funded a new investment account with $100. Betterment charges an annual management fee of 0.25% for its basic account, which would cost you just $0.25 a year. Compare that with investing $100 in the Acorns Personal account, where the annual fee would total $36.

Obviously, Acorns’ management fees take up a smaller proportion of your balance as you invest more money. Still, you’d need about $13,000 in an Acorns Personal account to get down to an annual fee of 0.25%.

However, if you’re more comfortable with Acorns or want to give it a try, at the end of the day, we’re just happy you’re investing. It’s a good first step, just mind those management fees over time.

Here’s a closer look at the nuts and bolts of Acorns accounts.

Acorns Review: Services and Features

Acorns offers several advantages, but it’s not for everyone. It’s important to understand the pros and cons of any investing app before you sign up.

Yes, that’s the whole idea! You’ll make money as your investments gain value over time. You can also earn bonus investments, known as Found Money, by participating in offers from the company’s business partners. Finally, Acorns also offers referral bonuses to users who get their friends and family to sign up for the app.

Yes, Acorns is a safe and secure financial services app. Just like other brokerage accounts, Acorns complies with federal law and is registered with the U.S. Securities and Exchange Commision. Its checking account is also FDIC insured, giving you the same protection as a traditional bank.

Probably the biggest drawback of Acorns is that its $3 or $5 per month account options are relatively pricey for people with low account balances. Acorns phased out its $1 Acorns Lite option for new users in September 2021.

Rachel Christian is a senior writer for The Penny Hoarder.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings