by Dana Sitar, CEPF®, Jamie Cattanach

Online banking is a great way to manage your money without having to schlep to a brick-and-mortar location. Managing your money through an online platform can also help you avoid many of the fees associated with traditional banks.

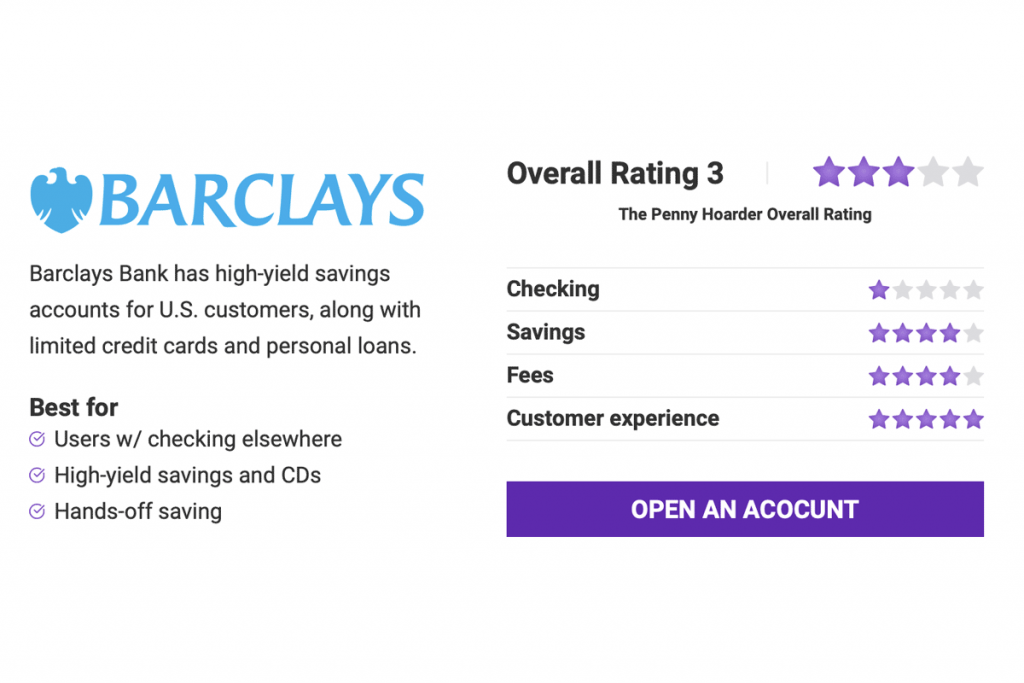

Many online banks offer a full range of financial products, including regular deposit accounts. But if you’ve already got your checking account taken care of, you might still be in the market for high-yield savings accounts. Barclays offers a competitive online savings account and CDs that can help you achieve your medium- and long-term financial goals.

Barclays does not currently offer a basic checking account in the U.S., so it’s not a viable option for an all-inclusive online banking experience.

In our Barclays Bank review, we’ll share the pros and cons about Barclays to help you decide if it’s the right fit for you.

The financial institution is best known for the Barclays Online Savings Account, a high-yield online savings account with no fees and no minimums.

In addition to the Barclays Online Savings Account, Barclays offers online CDs for longer-term savings.

Barclays U.S. CD Terms and Rates

Barclays doesn’t offer a checking account or investment accounts, but it offers a few additional financial products.

Barclays offers a variety of premium rewards credit cards under its Barclaycard line. Most are co-branded with travel and retail brands — so rewards are geared toward individual airlines, hotels, cruise lines and retailers.

Through its partnership with Upromise, you can open a credit card and connect a 529 college savings account to contribute cash rewards to saving for your child’s future education.

Barclays doesn’t offer mortgage or auto loans, but it’s recently started to offer personal loans by invitation only.

Barclays personal loans are aimed at debt refinancing to help you organize and repay your credit card debt. They come with no fees, and you can choose your payment due date so it’s convenient within your monthly planning.

Barclays doesn’t offer small business banking, though it does have a separate corporate banking entity.

Neither the Barclays Online Savings Account nor the Online CDs carry any opening deposit minimums or monthly fees. However, CDs must be funded within 14 days to avoid closure, and early withdrawal penalties may apply if you withdraw the funds before the term is over.

Barclays also assesses a Non-Sufficient Funds (NSF) fee for savings account overdrafts — though those aren’t super likely with a savings account.

In the U.S., Barclays is largely an online banking experience dedicated to hands-off savings. But it offers a few options for folks who want a touch of customer service.

Although Barclays is primarily an online bank, it does offer a few in-person branches, both in the U.S. and abroad. Barclays has one branch in each of the following states:

You can see a full list of its international branches at this webpage.

You don’t need to visit in person to access Barclays’ customer service. Its customer service phone lines are open from 8 a.m. to 8 p.m. ET toll-free at (888) 710-8756. (The automated system is available 24/7.)

Although Barclays doesn’t offer a wide range of financial products, it does give its users the opportunity to manage their finances via a mobile app available for both Android and Apple users. The user experience of the U.S. app has improved significantly over the past year: 4.5 stars in Android and 4.6 stars in the Apple App Store.

Barclays’ apps offer mobile check deposit, the ability to initiate one-time transfers to linked accounts, and an account overview so you can keep track of your balance.

In the U.S., Barclays banking is probably best for someone who has an established checking account but needs to set up some savings. If you want an automated savings account that’ll be out of sight (i.e. less temptation to spend it), this account could be a good fit for you. We’ve rounded up pros and cons to help you decide.

Here are our answers to commonly asked questions about Barclays Bank.

Dana Sitar is a Certified Educator in Personal Finance and has been writing and editing for online audiences since 2011, covering personal finance, careers and digital media. She is a former staffer at The Penny Hoarder. Her work has appeared in the New York Times, CNBC, The Motley Fool, Inc. and more. Information from former Penny Hoarder contributor Jamie Cattanach is included in this report.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings