by Rachel Christian, CEPF®

Senior Writer

Quick Navigation

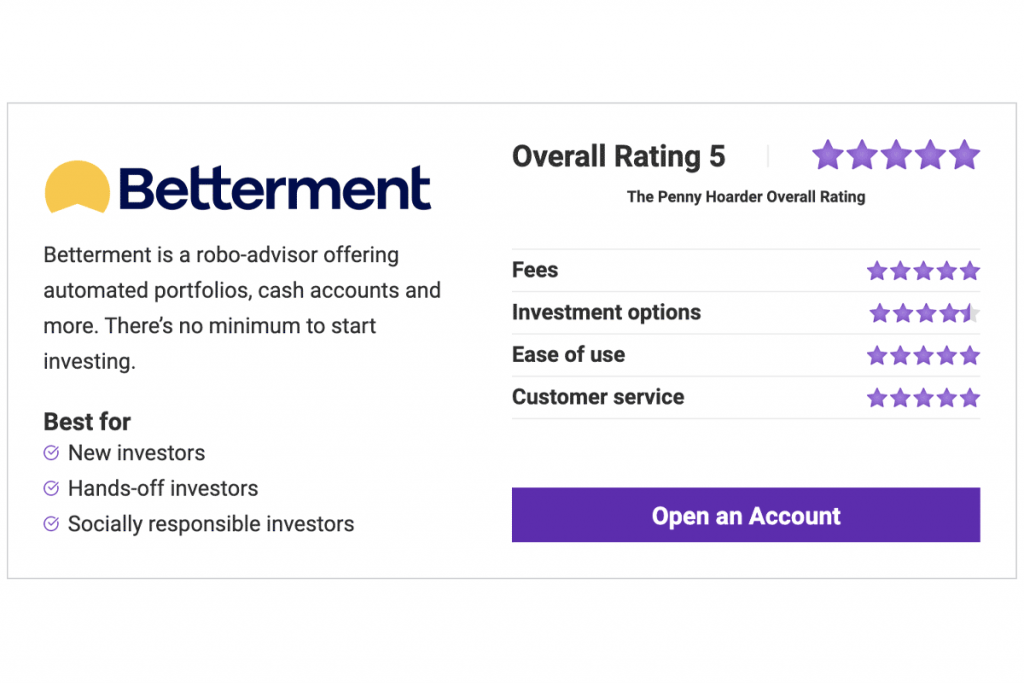

Betterment is one of the most well-known robo-advisor platforms on the market. Since its founding more than a decade ago, it has grown to include affordable banking and financial planning services that let you manage most of your financial life in one place.

The Betterment platform is primarily a robo-advisor, but also gives customers access to live human financial advisors.

Considering an account? In this Betterment review, we’ll tell you everything you need to know.

What Is Betterment?

Betterment is a financial services company that provides investment, banking and personal finance planning online and through the Betterment app. It’s best known as a robo-advisor for its automated investing service.

Like some other robo-advisors, Betterment offers customized investment and financial planning to people who can’t generally afford professional investment advisors or financial planners.

Features of Betterment

Betterment is on its way to becoming a one-stop shop for all your financial needs.

Its range of financial products and services can cover your spending, saving and investing goals, whether you’re a seasoned investor or opening a retirement account for the first time.

Betterment Review: Services and Features

| Feature | Details | |||

|---|---|---|---|---|

| Account minimum | $0 | |||

| Account management fee | 0.25% per year | |||

| Premium level option | Yes | |||

| Portfolio mix | Diversified mix of ETFs | |||

| Socially responsible investing | 3 portfolio options | |||

| Retirement account options | Roth, trad. or SEP IRAs | |||

| College savings account | No | |||

| Tax-loss harvesting | Yes | |||

| Automatic rebalancing | Free on all accounts | |||

| Access to human advisors | Yes, for a fee | |||

| Bank account/cash management account | Checking & savings | |||

| Customer service | (646) 600-8263 |

How Does Betterment Work?

Here’s what happens when you invest your money with Betterment.

Opening an Account

Betterment doesn’t charge an account minimum, unlike many of its robo-advisor rivals, including Wealthfront.

This means you can start investing on Betterment with just $1 if you want.

To create a Betterment account, you can sign up on its website with your email address.

Betterment is all about goal-based investing. You can set goals for retirement savings, retirement income, an emergency fund, a major purchase or just general investing, and Betterment will allocate your investments based on risk and other factors.

After entering your email, you’ll pick one or more of these goals:

- Manage spending with a checking account.

- Save cash and earn interest.

- Invest for a long-term goal.

- Save for retirement.

As your robo-advisor, Betterment uses this information to recommend the right level of savings and proper mix of investments to turn your goals into a reality.

Betterment’s algorithms and technology build a unique investment portfolio for each type of goal you select.

From there, you’ll connect external financial accounts to fund your Betterment portfolio and get a holistic look at your finances.

All Betterment investors, for the standard Digital plan 0.25% advisory fee, get access to the following account types:

- Individual taxable accounts

- Tax-advantaged individual retirement accounts (traditional IRA, Roth IRA or SEP IRA)

- Joint taxable account

- Trust accounts

- Cash Reserve: A high-yield cash account

- Checking account

You can always tweak your goals, timeline and account types. For example, you can opt for a more aggressive or more conservative asset allocation within any goal type, or select from a handful of additional portfolio strategies, such as socially responsible investing.

Betterment Fees

The benefit of working with a robo-advisor is that they’re easy on fees. With Betterment, you’ll pay account management fees, depending on your account level:

- Digital Plan: 0.25% annual fee

- Premium Plan: 0.40% annual fee

Premium Plan

Customers with a $100,000 minimum balance in Betterment accounts can opt into the Premium plan for an account management fee of 0.40%.

Premium customers get more in-depth financial advice and unlimited access to phone calls with a financial advisor.

For high balances, you’ll receive a 0.10% discount on the portion of your household balance above $2 million.

On all accounts, you’ll also pay some fees associated with trading particular exchange traded funds (ETFs), index funds and mutual funds. As of 2021, Betterment’s average expense ratios are around 0.11%.

An expense ratio shows the portion of an ETF’s funds that are used for overhead, rather than invested. Expense ratios are shown as a percentage; the lower, the more of your money can earn a return.

The account management fee and expense ratios are the only fees you’ll pay on Betterment.

How Betterment Invests Your Money

Betterment’s core philosophy for portfolio management is based on Modern Portfolio Theory — the industry standard that says you can reduce your risk and increase your returns by spreading investments across different asset classes.

An asset class is a group of things you can invest in, like stocks, bonds, real estate or cryptocurrencies.

Basically, Betterment won’t put all your financial eggs into one industry or company’s basket, so you’ll take less of a hit if any particular market plummets.

Portfolio Mix

The Betterment core portfolio consists of stock- and bond-based exchange-traded funds (ETFs), with asset allocation optimized for growth. It will automatically rebalance your portfolio based on your risk tolerance and time horizon.

You can go with that core portfolio or choose a different curated strategy based on your investing goals:

- Goldman Sachs Smart Beta Portfolio: Built by Goldman Sachs, this portfolio strategy uses a non-traditional approach to tracking the performance of stocks in an index (called advanced indexing) to improve your returns.

- BlackRock Target Income: This 100%-bond portfolio built by BlackRock is a “target-income portfolio,” which aims for less risk and higher return from income by protecting you from market volatility.

- Flexible Portfolio: Have your own investment strategy? You can opt to adjust the weight of individual asset classes within your portfolio, instead of going with Betterment’s recommendations. However, you can’t choose individual companies to invest in.

Betterment buys fractional shares of stocks — portions of equity that aren’t a full stock. That means all your money will be invested. Brokers that only buy full shares can’t necessarily invest your full deposit, so you’d often have leftover cash sitting in your account not earning a return.

Socially Responsible Investing

Socially responsible investing (SRI) is an investing strategy that aims to reduce portfolio exposure to companies with a negative social impact (such as businesses that profit from poor labor standards or bad environmental practices) while increasing exposure to companies with a positive social impact.

Betterment gives users not one, but three different socially responsible portfolios to choose from.

- Broad Impact portfolio: This is Betterment’s general ESG (environmental, social, governance) investing option. The portfolio aims to give exposure to all aspects of social responsibility, such as lower carbon emissions, ethical labor management and greater board diversity.

- Climate Impact portfolio: This SRI portfolio invests in ETFs with a specific focus on mitigating climate change.

- Social Impact portfolio: The Social Impact portfolio focuses on supporting equity and minority empowerment. It includes two additional ETFs with a focus on diversity.

Ready to start investing? Make sure to avoid these common stock-trading mistakes made by beginners.

More Betterment Features

Betterment does more than robo-advising. Its other top features include banking services and access to human advisors.

Checking and Banking Account

The company offers two cash management accounts: Betterment Checking and Betterment Cash Reserve.

- Betterment Checking: Get a fee-free checking account and debit card backed by NBKC bank. Betterment reimburses ATM fees and foreign transaction fees, and it doesn’t charge overdraft fees. There is no minimum deposit.

- Betterment Cash Reserve Account: Grow your savings with a no-fee, high-yield savings account (currently 0.10% APY but the rate is variable and can fluctuate). It is FDIC-insured up to $1 million through seven partner banks: The Bancorp Bank, Barclays, Citibank, Cross River Bank, HSBC, State Street Bank and Wells Fargo.

With its Two-Way Sweep feature, Betterment analyzes your checking account balance and spending before making automatic deposits into your savings account. This lets you maximize the interest income you earn on your cash while keeping just the right amount of money in checking to cover your daily expenses and spending habits.

Betterment also offers a joint checking account option and joint savings accounts.

Tax Management Features

Betterment offers automatic tax-loss harvesting on every taxable account.

Tax-loss harvesting helps lower your tax burden by reducing your overall capital gains from investing.

It does this by selling your stocks and other assets that drop in value. You’ll take a loss, but it helps lower your tax bill by offsetting capital gains tax.

Betterment automatically manages this feature, so you don’t have to worry about the details.

Betterment also offers a Tax-Coordinated Portfolio that spreads investments in certain assets across taxable and tax-advantaged retirement accounts. Investments with a smaller tax bite are placed inside a taxable account while tax-heavy investments are placed inside tax-advantaged accounts.

Finally, Betterment offers charitable giving. You can support causes you care about by choosing to donate shares from your taxable accounts to partner charities — and enjoy the tax benefits.

Access to Human Financial Advisors

Betterment offers access to financial advisors and personalized investment advice.

Betterment Premium users get unlimited access to human advisors for free.

Betterment Digital customers can set up a one-time phone call with a certified financial planner (CFP), but you’ll pay a relatively high fee for each session.

Packages include:

- Getting Started: 45-minute call to set up your Betterment account. Cost: $299.

- Financial Checkup: 60-minute call to review your financial situation and investment portfolio. Cost: $399.

- College Planning: 60-minute call to figure out how much to save and invest for your family’s education plans, including how to set up your state’s 529 plan. Cost: $399.

- Marriage Planning: 60-minute call with your partner for guidance on merging finances, including budgeting, goal-setting and debt management. Cost: $399.

- Retirement Planning: 60-minute call to review your retirement accounts (in and outside of Betterment) to create a plan to stay on-target for retirement. Cost: $399.

Customer Service

Betterment’s site hosts a robust archive of FAQs and resources to answer general questions about investing, personal finance and the app.

Betterment customers can also chat with financial experts through the app or book a call to get personalized advice from a human advisor.

For other inquiries, contact:

- Banking: Email [email protected] or call (718) 400-6898 Monday through Friday between 9 a.m. and 8 p.m. ET.

- Investment and general support: Email [email protected] or call (646) 600-8263 Monday through Friday between 9 a.m. and 6 p.m ET (closed on market holidays).

- Betterment for Business: Call (855) 906-5281 to ask about setting up a 401(k) for your employees.

Betterment for Business

Businesses can work with Betterment to provide an employer-sponsored 401(k) plan through Betterment for Business.

Pros and Cons

All robo-advisors have their pros and cons. Here are some of the advantages and drawbacks of Betterment.

Pros

- Goal-based robo-advisor.

- Low annual fee and no minimum investment amount.

- Diversified investment portfolios based on a user’s time horizon and risk tolerance.

- Hands-off investing or flexible portfolios for more advanced investors.

- Free financial advice from a human advisor (for Betterment Premium members).

- Socially responsible portfolio options.

- Full financial outlook when you link external accounts.

- Banking with no fees and a high interest rate on savings.

- Tax-loss harvesting.

- Automatic reinvestment of your dividends and automatic rebalancing within your portfolios.

Cons

- No borrowing options.

- No college savings account.

- No option to add individual stocks to your portfolio.

Is Betterment Right for You?

Betterment is a large independent investment firm well-known for its user-friendly, accessible investment accounts. Depending on your financial goals, it may or may not be a great fit for you.

Betterment might be great for you if:

- You want a low-cost, tax-efficient investment account.

- You’re new to investing and want a simple way to plan for long-term financial goals.

- You want to manage your banking, investing and savings all in one place.

- You want the convenience of a robo-advisor but remain hands-on with your investments.

- You have external accounts, such as an employer-sponsored retirement plan, and want to step up your investing game without losing track of all your accounts.

- You prefer to invest in companies based on their environmental or social impact.

Betterment probably isn’t a good fit for you if:

- Your primary investment goal is college savings.

- You’re interested in micro-investing.

- You want to pick your own individual stocks.

The app is a perfect place to dip your toe in the market — with no minimum investment. When you’re ready to wade into the deep end, premium options and additional flexibility let you take the reins on your personal investment strategy.

Frequently Asked Questions

There’s no minimum balance, you don’t need prior stock trading experience, and a suite of free and affordable financial planning tools helps set you up with a long-term plan.

Your accounts are also SIPC-insured, and Betterment uses bank-level encryption to protect financial information and personal data associated with your accounts. And it employs two-factor authentication to keep your account secure.

You can keep short-term savings, emergency funds and spending money in your Betterment Checking and Cash Reserve accounts or external bank accounts, where they aren’t subject to fluctuations in the stock market.

Rachel Christian is a Certified Educator in Personal Finance and a senior writer for The Penny Hoarder.

Quick Navigation

Betterment is one of the most well-known robo-advisor platforms on the market. Since its founding more than a decade ago, it has grown to include affordable banking and financial planning services that let you manage most of your financial life in one place.

The Betterment platform is primarily a robo-advisor, but also gives customers access to live human financial advisors.

Considering an account? In this Betterment review, we’ll tell you everything you need to know.

Betterment is a financial services company that provides investment, banking and personal finance planning online and through the Betterment app. It’s best known as a robo-advisor for its automated investing service.

Like some other robo-advisors, Betterment offers customized investment and financial planning to people who can’t generally afford professional investment advisors or financial planners.

Betterment is on its way to becoming a one-stop shop for all your financial needs.

Its range of financial products and services can cover your spending, saving and investing goals, whether you’re a seasoned investor or opening a retirement account for the first time.

Betterment Review: Services and Features

Here’s what happens when you invest your money with Betterment.

Betterment doesn’t charge an account minimum, unlike many of its robo-advisor rivals, including Wealthfront.

This means you can start investing on Betterment with just $1 if you want.

To create a Betterment account, you can sign up on its website with your email address.

Betterment is all about goal-based investing. You can set goals for retirement savings, retirement income, an emergency fund, a major purchase or just general investing, and Betterment will allocate your investments based on risk and other factors.

After entering your email, you’ll pick one or more of these goals:

As your robo-advisor, Betterment uses this information to recommend the right level of savings and proper mix of investments to turn your goals into a reality.

Betterment’s algorithms and technology build a unique investment portfolio for each type of goal you select.

From there, you’ll connect external financial accounts to fund your Betterment portfolio and get a holistic look at your finances.

All Betterment investors, for the standard Digital plan 0.25% advisory fee, get access to the following account types:

You can always tweak your goals, timeline and account types. For example, you can opt for a more aggressive or more conservative asset allocation within any goal type, or select from a handful of additional portfolio strategies, such as socially responsible investing.

The benefit of working with a robo-advisor is that they’re easy on fees. With Betterment, you’ll pay account management fees, depending on your account level:

Customers with a $100,000 minimum balance in Betterment accounts can opt into the Premium plan for an account management fee of 0.40%.

Premium customers get more in-depth financial advice and unlimited access to phone calls with a financial advisor.

For high balances, you’ll receive a 0.10% discount on the portion of your household balance above $2 million.

On all accounts, you’ll also pay some fees associated with trading particular exchange traded funds (ETFs), index funds and mutual funds. As of 2021, Betterment’s average expense ratios are around 0.11%.

An expense ratio shows the portion of an ETF’s funds that are used for overhead, rather than invested. Expense ratios are shown as a percentage; the lower, the more of your money can earn a return.

The account management fee and expense ratios are the only fees you’ll pay on Betterment.

Betterment’s core philosophy for portfolio management is based on Modern Portfolio Theory — the industry standard that says you can reduce your risk and increase your returns by spreading investments across different asset classes.

An asset class is a group of things you can invest in, like stocks, bonds, real estate or cryptocurrencies.

Basically, Betterment won’t put all your financial eggs into one industry or company’s basket, so you’ll take less of a hit if any particular market plummets.

The Betterment core portfolio consists of stock- and bond-based exchange-traded funds (ETFs), with asset allocation optimized for growth. It will automatically rebalance your portfolio based on your risk tolerance and time horizon.

You can go with that core portfolio or choose a different curated strategy based on your investing goals:

Betterment buys fractional shares of stocks — portions of equity that aren’t a full stock. That means all your money will be invested. Brokers that only buy full shares can’t necessarily invest your full deposit, so you’d often have leftover cash sitting in your account not earning a return.

Socially responsible investing (SRI) is an investing strategy that aims to reduce portfolio exposure to companies with a negative social impact (such as businesses that profit from poor labor standards or bad environmental practices) while increasing exposure to companies with a positive social impact.

Betterment gives users not one, but three different socially responsible portfolios to choose from.

Ready to start investing? Make sure to avoid these common stock-trading mistakes made by beginners.

Betterment does more than robo-advising. Its other top features include banking services and access to human advisors.

The company offers two cash management accounts: Betterment Checking and Betterment Cash Reserve.

With its Two-Way Sweep feature, Betterment analyzes your checking account balance and spending before making automatic deposits into your savings account. This lets you maximize the interest income you earn on your cash while keeping just the right amount of money in checking to cover your daily expenses and spending habits.

Betterment also offers a joint checking account option and joint savings accounts.

Betterment offers automatic tax-loss harvesting on every taxable account.

Tax-loss harvesting helps lower your tax burden by reducing your overall capital gains from investing.

It does this by selling your stocks and other assets that drop in value. You’ll take a loss, but it helps lower your tax bill by offsetting capital gains tax.

Betterment automatically manages this feature, so you don’t have to worry about the details.

Betterment also offers a Tax-Coordinated Portfolio that spreads investments in certain assets across taxable and tax-advantaged retirement accounts. Investments with a smaller tax bite are placed inside a taxable account while tax-heavy investments are placed inside tax-advantaged accounts.

Finally, Betterment offers charitable giving. You can support causes you care about by choosing to donate shares from your taxable accounts to partner charities — and enjoy the tax benefits.

Betterment offers access to financial advisors and personalized investment advice.

Betterment Premium users get unlimited access to human advisors for free.

Betterment Digital customers can set up a one-time phone call with a certified financial planner (CFP), but you’ll pay a relatively high fee for each session.

Packages include:

Betterment’s site hosts a robust archive of FAQs and resources to answer general questions about investing, personal finance and the app.

Betterment customers can also chat with financial experts through the app or book a call to get personalized advice from a human advisor.

For other inquiries, contact:

Businesses can work with Betterment to provide an employer-sponsored 401(k) plan through Betterment for Business.

All robo-advisors have their pros and cons. Here are some of the advantages and drawbacks of Betterment.

Betterment is a large independent investment firm well-known for its user-friendly, accessible investment accounts. Depending on your financial goals, it may or may not be a great fit for you.

Betterment might be great for you if:

Betterment probably isn’t a good fit for you if:

The app is a perfect place to dip your toe in the market — with no minimum investment. When you’re ready to wade into the deep end, premium options and additional flexibility let you take the reins on your personal investment strategy.

Rachel Christian is a Certified Educator in Personal Finance and a senior writer for The Penny Hoarder.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings