by Dana Sitar, CEPF®

Contributor

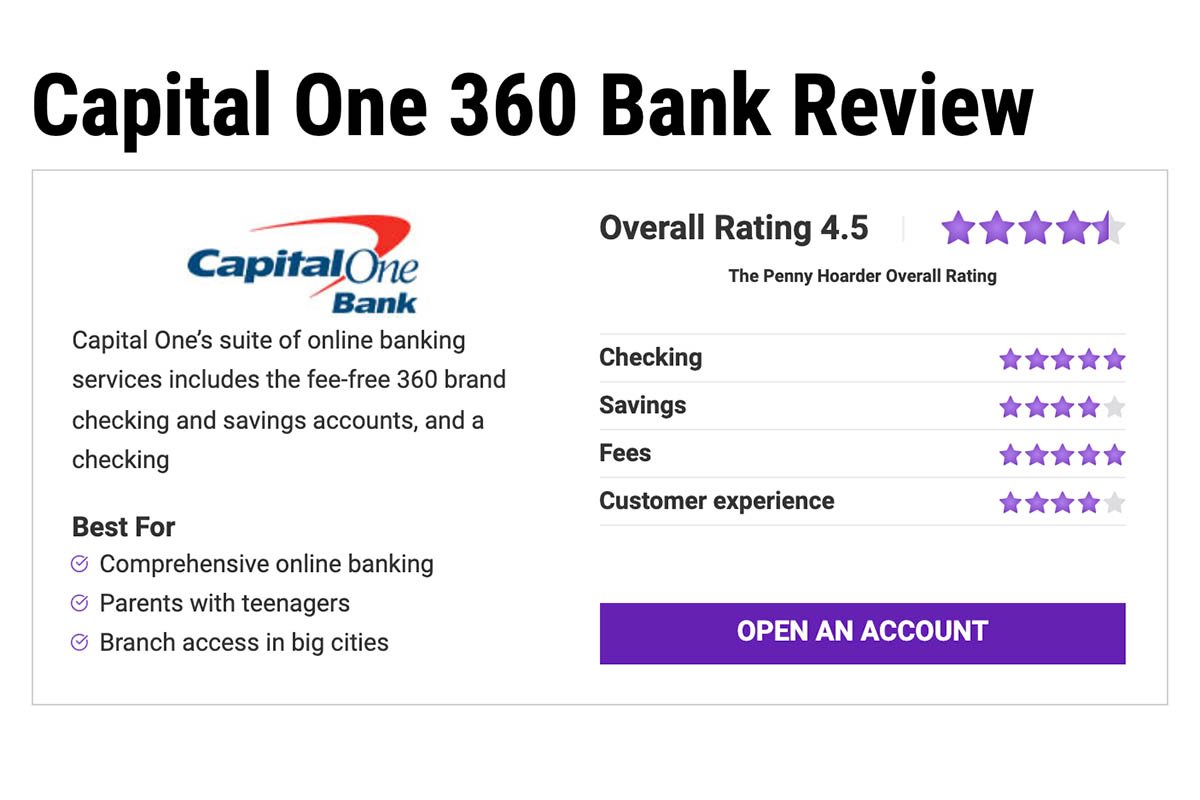

Capital One made a splash in the nineties with unprecedented mass advertising for credit cards — so we’re sure you’ve heard of the company.

You might not know, though, that it’s jumped on the online banking bandwagon over the past few years and has come out strong with digital-first banking services that rival competitors in traditional banks. It’s also continuing to improve its advantages. In early December, Capital One became the first of the nation’s biggest banks to eliminate all overdraft fees and by doing so gives up $150 million in annual revenue.

The Capital One 360 suite of bank accounts offers mobile-friendly, fee-free banking, with the added convenience of a smattering of physical locations around the country.

In our Capital One bank review, we’ll explore account options, fees, interest rates and other perks and drawbacks of the bank to help you determine whether it’s the right place for your money.

Capital One Checking Accounts

The biggest selling point for a Capital One 360 Checking account is the lack of fees. That’s common for an online account but rare for traditional institutions — two worlds Capital One straddles comfortably. You pay no monthly maintenance fee and face no minimum balance requirements, and you get access to a network of 70,000 fee-free Allpoint and MoneyPass ATMs.

As a Capital One customer you get additional perks that are common for online banks: Get your paycheck up to two days early if you’re paid by direct deposit and earn 0.10% annual percentage yield (APY) on your balance.

A couple of features you miss out on with other online-only accounts: You can deposit cash over the counter at CVS locations, up to $4,995 per month, and you can transfer money to friends with any bank account that works with Zelle.

A 360 account gives you options for overdraft protection, including:

The MONEY Checking account is designed for teenagers and kids ages 8 and older. It works much like a joint checking account, except that adults don’t get a debit card. Instead, you get access to the account as a joint account holder, so you can see transactions, get alerts, lock and unlock the debit card, and connect external accounts to add and remove money.

The mobile app lets you help your kids manage money by setting up savings goals and offering rewards. You can also set a recurring allowance or just add money to their account any time from a connected Capital One or other bank account.

Kids get a debit card in their name and get full access and control on the account. Through the app, they can check their balance, set goals, allocate money for spending or saving, deposit checks, set up direct deposit and receive text alerts.

Capital One offers two online savings accounts: the 360 Performance Savings for adults and the Kids Savings Account for kids and teens.

Capital One Savings Accounts

Capital One’s signature online savings account is pretty straightforward: no fees, no minimum balance or deposit, and a higher-than-average interest rate.

Earn 0.40% APY on all account balances, automate your savings with regular transfers from your Capital One 360 Checking or external checking account, and opt into Free Savings Transfer to use the savings account as free overdraft protection for a 360 Checking account.

Like most standard accounts, you’re limited to six “convenient” withdrawals per month, based on a now-defunct federal regulation. So use this account for medium- to long-term savings, like an emergency fund.

Note that, while Capital One still technically has a savings withdrawal limit, a customer service rep told The Penny Hoarder in November 2021 the institution is “temporarily pausing closures for … accounts that have exceeded their transfer or withdrawal limit.”

Its credit card selection is broad, with 30 cards available. Cards offer travel, cash back and other rewards, low or no intro APR, no annual fee, and options for all credit score levels. Some popular cards include:

As a savings account alternative (or add-on), Capital One sells Certificates of Deposit (CDs) it calls the 360 CD. There’s no minimum deposit to open a CD account, and CDs come with a guaranteed rate of return.

You can buy a CD for a term between six months and five years, and the APY goes up the longer the term.

Capital One 360 CDs

You can receive interest payments from your CD at the end of the term (which would have the greatest yield) or monthly or yearly.

Capital One also offers auto loans, plus business banking and lending, but no home loans or personal loans.

Capital One bank accounts are all mostly fee-free. You pay no monthly fees (with no minimum balance requirement) and no fees at Allpoint or MoneyPass ATMs for any checking or savings accounts. You have flexible options to avoid or eliminate overdraft fees, and you pay no foreign transaction fees and get your first book of 50 checks for free.

The accounts charge typical fees for some extras, including:

The Capital One bank customer experience is increasingly an online banking experience as the company continues to close branches and focus on its online and mobile products.

The company has tons of physical branches around New York City, and Capital One Cafes are scattered around major cities around the country. Other than that, your access to your account and customer service are limited to the app, website, ATMs and over-the-counter deposits at CVS.

As a mostly online bank, Capital One offers an app that’s more robust and user friendly than what you’d expect from most legacy financial institutions. It feels much more like a challenger bank than a traditional one.

You can manage all your Capital One bank accounts, loans and credit cards through the Capital One Mobile app for Android and iOS.

The app lets you see your bank balances, credit and debit card transactions and credit score (through CreditWise), plus send and receive money through Zelle and set up bill pay.

Through the app, you also get help keeping an eye on your money with Capital One’s virtual “financial assistant,” Eno.

Eno sends alerts of potentially suspicious spending on your account to help you spot and stop fraud, tracks your spending, and alerts you to ending free trials and recurring charges. And it’s a friendly chat bot you can use to ask basic questions about your account.

If you live near a Capital One bank branch or Cafe, you can stop in during business hours to speak with a customer service rep called an “Ambassador” to get answers to questions about your account.

If you’re not near a physical location (or just prefer to do your banking from your couch), you can find answers through the Support Center (i.e. FAQs) or by chatting with Eno through the app. Or you can get in touch with Capital One customer service online, via Twitter, over the phone or… by mail.

Evaluate Capital One pros and cons to determine whether banking with the company is right for you.

Here are our answers to some frequently asked questions about banking with Capital One.

Dana Sitar is a Certified Educator in Personal Finance and has been writing and editing for online audiences since 2011, covering personal finance, careers and digital media. She is a former staffer at The Penny Hoarder. Her work has appeared in the New York Times, CNBC, The Motley Fool, Inc. and more.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings