by Dana Sitar, CEPF®

Contributor

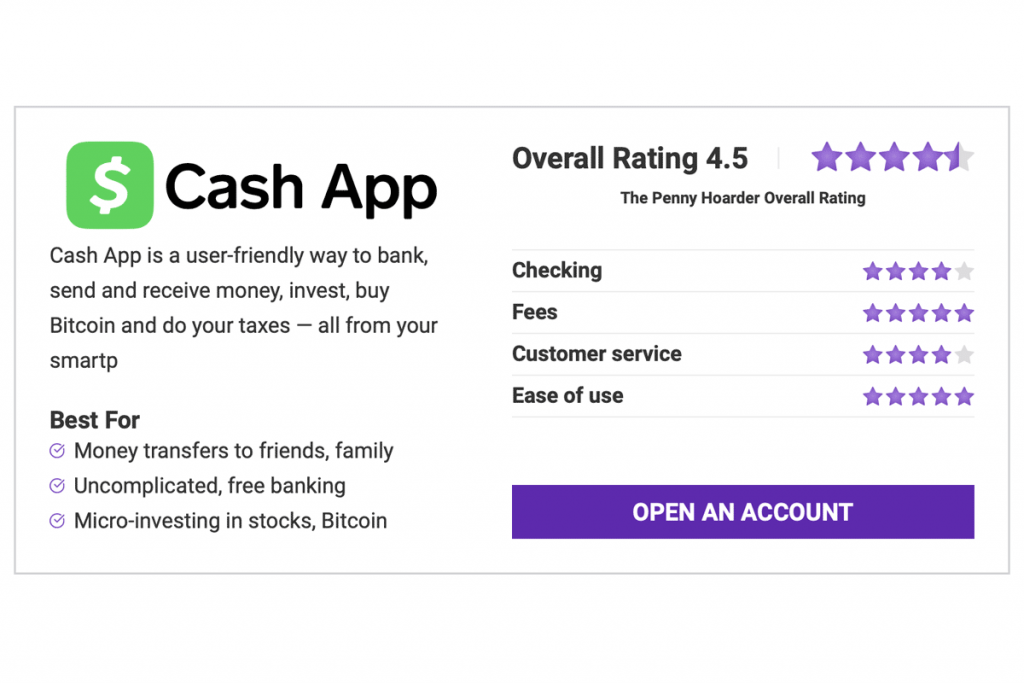

The way people bank, invest and manage money has been changing rapidly over the past few years, and Cash App is one of few platforms that’s been nimble enough to adapt and continue to serve customers’ needs.

The app by Block, Inc. (formerly Square, Inc.) — formerly called Square Cash — started as a money transfer app with a particular appeal to communities who are traditionally unbanked or underbanked for its ease of use, lack of fees and almost exclusively mobile design.

Cash App has continued to expand since its inception in 2013 to include more ways to uniquely serve this customer base and broaden its appeal. Now the app supports money transfers, banking, stock and ETF investing, Bitcoin trading and tax filing.

In our Cash App review, we’ll cover everything you need to know to figure out whether Cash App is the right place for your money — including its banking features, fees, perks and customer service.

Cash App Review: Accounts

Everyone who signs up for Cash App starts with a basic Cash App account, which you use to send and receive money. This peer-to-peer payment function is Cash App’s bread and butter, the app’s original purpose and the reason most people download the app.

When you create an account, you’ll choose a username called a $Cashtag. Friends can use your $Cashtag, email address or phone number to send you money through the app, or scan a unique QR code you can pull up in your account.

Cash App is available for users in the U.S. and UK, and you can only send and receive payments with users in these countries. The app supports USD and GBP currencies.

The following features can help you decide if the Cash App Account is right for you.

As soon as you sign up for a Cash App account, you’re ready to receive money. And you can send money as long as you have a balance — you’re not required to connect a bank account to use the app.

Before you can transfer money to friends, you’ll just have to enter your name, birthdate and last four digits of your Social Security number to verify your identity (as with any financial institution).

To cash out or send more money than you have in your balance, you can connect a bank account using your debit card information or your bank’s online login details. Cash outs usually send money to your bank account instantly.

Through Cash App, you can send funds as cash — like any payments app — as well as stock or Bitcoin. You don’t have to own stock or Bitcoin or have an investing account for either to send them through the app. Instead, Cash App just pulls the USD (or GBP if you’re in the UK) from your account balance and gives the recipient the option to use it to buy the stock or Bitcoin you “send.”

Others can send you money as stock or Bitcoin, too, and you have the option to accept or decline it.

To accept stock, you have to have or open a brokerage account in the app. To accept Bitcoin, you have to verify your identity in the app — but you don’t need a separate crypto wallet or anything. If you decline stock or Bitcoin payments, you’ll get the money as cash instead.

You can use your Cash App account directly to pay merchants who use Square for payments — for example, at markets, small businesses and online stores. You’ll just scan their QR code with your phone and follow the prompts to complete the payment from your balance.

A Cash App account on its own doesn’t work with other online or mobile payment systems; you need a Cash Card to do that.

To get more functionality out of your Cash App account, sign up for the Cash App debit card called Cash Card, a debit card that turns your Cash App account into a fully-fledged bank account.

With a Cash Card, your Cash App account becomes an FDIC-insured direct deposit account backed by Lincoln Savings Bank.

The following features can help you decide if the Cash Card is right for you.

You can use your routing and account number to set up direct deposit for your paycheck and other payments. You’ll get payments up to two days ahead of the scheduled payday, depending on when the payer initiates a direct deposit.

The Cash App account can only be funded through electronic payments: direct deposit, transfers from a linked bank account or payments from other Cash App users. You can’t deposit paper checks or use the account to receive wire transfers.

You can deposit cash into your account through retailers including Walmart Customer Service Desk/ Money Centers, Walgreens, 7-Eleven, Family Dollar, Sheetz, KwikTrip, Speedway, StopNGo and Dollar General.

You can withdraw cash from ATMs with your debit card, and Cash App will reimburse all fees each month as long as you receive at least $300 in direct deposits. Otherwise, you’re responsible for a $2 ATM fee charged by Cash App, plus any fees the ATM operator charges.

You can also use your bank account to pay bills and credit card payments by giving the payee your Cash App routing and account number to schedule a payment or set up auto pay.

You can use your Cash Card for purchases anywhere Visa is accepted. The fun part? When you order a Cash Card, you can add a custom doodle or emojis to the card’s design from right in the app — so you’ll be the only one with that card.

When you pay with your Cash Card, you have access to special deals from retailers with Cash Boost discounts.

Find Boosts from the Cash Card section in the app, and select a Boost you want to use. It’ll be added to your account and applied when you buy from that retailer.

A Bitcoin Boost is an offer that rewards you in Bitcoin for a purchase with your Cash Card. Those rewards go straight to your Bitcoin balance.

Probably better than any competitor, Cash App seamlessly integrates investing and Bitcoin collecting into the app alongside banking and payments.

You can use the Cash App to open a brokerage account and trade stocks and mutual funds. It shares stock market news and lets you see the recent performance of stocks before you buy.

The app is set up for active, self-directed stock trading, so it’s not a good fit if you prefer a robo-advisor to create a portfolio for you. But you can set up daily, weekly or bi-weekly auto-invest on particular securities. You can buy fractional shares of any stock or ETF with as little as $1 ($10 for auto-invest).

Cash App doesn’t make every stock or fund available, though it’s constantly expanding what you can access through the app.

For now, you can buy or sell stocks or ETFs listed on the New York Stock Exchange (NYSE) or Nasdaq that have more than $1 billion in market capitalization or more than $5 million average daily trade volume, as long as they’re supported by DriveWealth, the broker behind Cash App Investing.

You can use your Cash App funds to buy Bitcoin through the app without setting up a separate crypto wallet or an account on a crypto exchange.

You can always deposit Bitcoin into your Cash App Bitcoin account (a crypto wallet within your account) by sharing your wallet address with an external wallet. Don’t send any other cryptocurrencies to Cash App — the app doesn’t support anything but Bitcoin, and all other currencies will simply be lost in the transaction.

Withdraw Bitcoin to an external wallet by entering the wallet’s address in Cash App to make the transfer.

You can make payments in Bitcoin to friends, family or merchants using the option to pay with Bitcoin during the transaction. These transactions come out of your Cash App account balance, not your Bitcoin wallet balance. Technically, you send the recipient cash they can use to buy Bitcoin.

To send and receive Bitcoin directly between your wallet and another, you have to enter the other wallet address or scan their QR code in the Bitcoin section of the app. That way you can make an actual decentralized transaction on the blockchain. (This feature is available everywhere in the U.S. except New York state.)

Starting in 2022 (for the 2021 tax year), Cash App has taken over Credit Karma Tax to let you file your taxes for free from the app or online.

Cash App Taxes supports most common tax situations, including some for more complex filers, like business income and itemizing deductions. You can file a federal and state tax return for free and have the option to get your refund deposited directly into your Cash App account.

Like other tax software, Cash App Taxes comes with an accuracy and maximum refund guarantee.

If you want to use Cash App to get paid for products or services you sell in your business, you’ll need a business account in the app. It’s easy to change your account type right in your profile.

A Cash for Business account gives you unlimited daily transfers, while a personal account limits them, so you can accommodate the higher volume of transactions you’re likely to have as a business. And it lets you receive payments from customers using credit or debit cards by sending them a payment link.

Cash for Business is a good option for new and very small businesses, but its features are limited to just sending and receiving cash. As your business grows, you can switch to Square or another payment processor to access more features.

You’ll pay a 2.75% transaction fee to receive money through Cash for Business, though sending money is always free.

Fees in Cash App are minimal. The app does away with common financial services costs, including:

You can expect to pay these fees:

Cash App has a pared-down, intuitive and user-friendly design with an interface that makes it easy to set up in seconds and simple for anyone to figure out how to use it. You can easily flow between banking, sending and receiving money, stock investing and Bitcoin collecting from one screen.

The app is highly rated: 4.6 stars in the Google Play Store and 4.7 stars in the iOS App Store.

You can contact customer support for Cash App primarily through the app, and you can also reach them:

The biggest consumer complaint about Cash App is less about the app or company itself and more about how scammers have used the app to steal users’ information or money.

To avoid scams, Cash App recommends:

If you get scammed through the app, you can report an issue with the payment through the app and report or block the account. Cash App notes most transfers can’t be canceled, though you can file a dispute for a fraudulent Cash Card transaction.

Cash App is a straightforward banking, payments and investing app for individuals with uncomplicated financial circumstances.

Some people wonder how safe Cash App is. Most popular money transfer apps keep your money safe by encrypting your data, requiring security measures and offering bank-backed protection for your account balances. To learn more about Cash App’s major competitors, check out our comparison of Venmo versus PayPal.

Cash App might be right for you if you:

Cash App probably isn’t a fit for you if you:

This list will help you understand the great and not-so-great attributes of Cash App.

Here are our answers to common questions about Cash App.

Dana Sitar is a Certified Educator in Personal Finance®. She’s written about work and money for publications including Forbes, The New York Times, CNBC, The Motley Fool, The Penny Hoarder and a column for Inc. Magazine. She founded Healthy Rich to publish stories that illuminate the diversity of our relationships with work and money.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2022 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings