by Dave Schafer

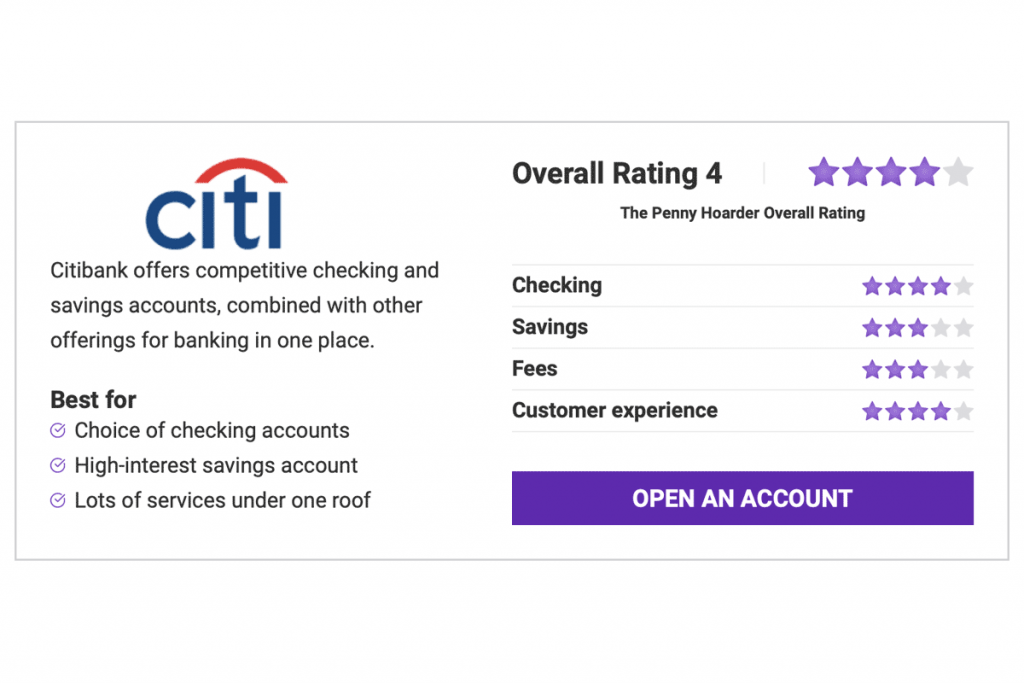

As one of the largest banks in the world, Citibank has a lot to offer its customers — from useful online features to thousands of free ATMs. It’s also a global bank, with thousands of overseas branches to complement the 700+ in the United States. That gives Citi a definite edge over online banks that have no local presence at all.

That said, Citibank falls short in a few areas — namely, the interest rates on some of its accounts are less than stellar. Additionally, Citi is heavy on the monthly fees, and while there are ways to waive them, we’d prefer to not deal with them at all.

At the end of the day, Citi is a solid bank that gets a lot right. But is a Citibank account right for you? Read on to find out.

Citi offers a variety of checking account options, ranging from basic digital accounts to high-yield interest checking. There are also several premium tiers available.

Citibank offers multiple checking account options. While you can open one up by itself, most of the Citi accounts make more sense when opened as part of a package. These packages include a linked savings account and a handful of other perks, and we recommend going this route if you choose to bank with Citi.

There are four Everyday Banking packages and three Premium Banking packages available.

Everyday Banking:

Premium Banking:

Most of the Citi checking account packages have a monthly fee, and in some cases it’s rather steep. However, there’s nearly always a simple way to waive that fee. For example, the Basic Banking Package has a $12 monthly service fee, but you can waive it in a number of ways:

Every account has at least one way to waive the monthly service fee, even if it’s just maintaining a certain minimum balance. That said, we’d still prefer no fees at all — which many of Citi’s competitors offer.

It’s also worth noting that the Access Account package doesn’t have an option for paper checks. If you need to write checks, you’ll have to go with a different Citibank account.

It’s also worth noting that while the featured Basic Banking checking account doesn’t earn interest, there are some interest checking accounts available with Citi. The Citibank Account Package offers interest checking with a 0.01% APY, while all the Premium Banking options offer an interest checking account with 0.03% APY. You can also opt for a “regular”, interest-free checking account if you prefer.

Speaking of all the account options — normally, we’re not a fan of too many choices. However, the various Citi checking accounts offer a reasonable progression from basic starter accounts through to the premium offerings, and it’s relatively clear when you’d choose which account. In this case, we’d actually say the variety works in Citi’s favor.

Unlike the checking account variety, Citi really only offers a single savings account option: Citi Accelerate Savings. However, this account is actually an outstanding option with a very competitive interest rate — you really don’t need much more.

A Citi savings account makes an excellent companion to one of the Citi checking accounts. The 0.50% APY rate is quite good, and there really aren’t any fees attached to the account — it’s generally very easy to meet the requirements to waive the monthly service fee.

Add in the benefits of a Citi banking package to your Citi savings account, plus the huge nationwide ATM network, and you’ve got a solid savings account option that’s easy to recommend. That said, if you’re only looking for a savings account, we think you can probably do better with another bank.

Being a large global financial institution, Citibank offers a variety of other products besides checking and savings accounts. These include CDs, IRAs, and a variety of small business offerings.

Certificates of Deposit accounts, or CDs, are a specific type of savings account that has a fixed interest rate and fixed terms. In practice, this means that CDs are safe investments, but that once your money is in one, you can’t access it (without penalties) until those terms are up. They’re ideal for holding money that you know you want to save for a certain date, or for a safe and guaranteed return on investment without much risk.

Citibank offers an array of CD accounts to meet your longer-term savings goals. There are three choices: a Fixed Rate CD, a Step-Up CD, and a No Penalty CD.

The Citi CD accounts offer a solid option for people that have specific savings goals in mind. The Fixed Rate CD is a standard CD account and offers a range of terms and interest rates, from 3 months to 5 years.

The Step-Up CD is a slightly different option to most CDs. This account is on a 30-month term and the interest rate increases every 10 months over that term, from 0.05% to 0.15% APY.

Finally, Citibank offers a No Penalty CD, which is a little more flexible than a typical CD account. The No Penalty CD has a 12-month term and enables you to withdraw your full balance without the usual penalties associated with a CD account. As a tradeoff, the interest rate on the No Penalty CD is fixed at only 0.05% APY, which unfortunately makes the account barely more interesting than a standard savings account.

Citibank’s size also helps make available a full-slate of banking features. Here are two that you would expect to have at a large bank. And when it comes to mobile banking, any bank really.

If you prefer a more long-term option for saving — say, to fund your retirement — Citi offers Individual Retirement Accounts (IRAs) with no annual fees. IRa stands for Individual Retirement Account, and its a type of long-term savings and investment account that is intended specifically for retirement savings.

Citi’s IRA options include both traditional IRAs and Roth IRAs, and the accounts earn between 0.01% and 0.55% APY, depending on the type of IRA you choose. Options include an Insured Money Market account, Variable CD, and Day-to-Day Savings accounts.

Generally, the money market account is going to be the best option for a long-term retirement account like this. A money market account won’t earn as high of an interest rate as a CD, but you can leave the money in the account much longer, so it will accrue much more over time.

The Citibank mobile app is extremely well-rated. It offers all the expected features of an online banking mobile app, from account management and check deposits to customer service and even a place to view your FICO credit score.

While there’s not necessarily anything groundbreaking about the app, it’s easy to use and well-designed. That means it excels at exactly what you’d want your banking app to do. Combined with physical branches, this makes Citibank a very convenient option for personal banking.

As for online banking, you can do everything you’d expect using Citi’s website, from transfers to paying bills. Plus, unlike even the best online banks, Citi actually has physical locations, so you can go get cash in hand if you need.

Below is a list of pros and cons about Citibank to help you decide if this bank is right for you.

Have questions about Citibank? We have answers.

Citibank isn’t perfect, of course — the interest rates are middle-of-the-road, and there aren’t as many local branches in the U.S. as some of its competitors. However, if you wan

Penny Hoarder contributor Dave Schafer has been writing professionally for nearly a decade, covering topics ranging from personal finance to software and consumer tech.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings