by Timothy Moore

Contributor

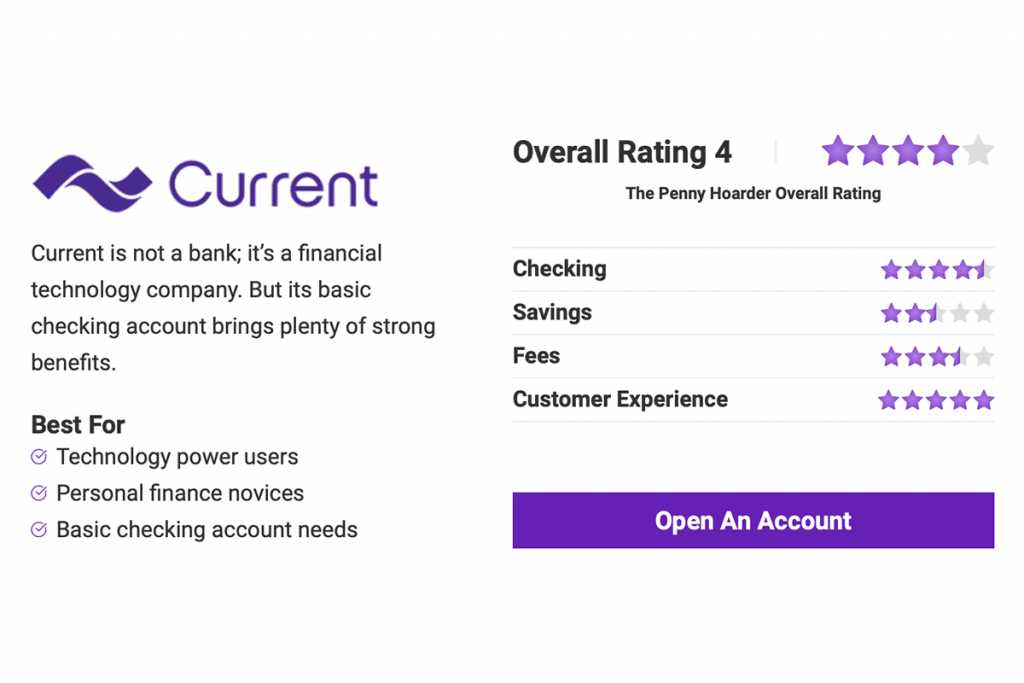

Current is a newcomer to the world of mobile banking (arriving in 2015), but already, the company is making waves with its noble mission of making banking “accessible and affordable for everyone.”

Current seeks to entice new customers with benefits like no hidden fees, faster direct deposit, fee-free ATMs, automated savings and fee-free overdrafts.

Technically speaking, however, Current is not an online bank. It’s a financial technology platform, colloquially referred to as a neobank, but it still offers the same assurances of a traditional bank. That is, it offers banking services through Choice Financial Group and Metropolitan Commercial Bank, which are both members of the Federal Deposit Insurance Corporation (FDIC). That means money you put into a Current account is FDIC insured.

While the three Current accounts available are all basic checking accounts, they do come with varying amounts of “Savings Pods,” which allow you to organize your savings within the checking account. However, these Savings Pods do not earn interest. If you are interested in a savings account with a high APY, look elsewhere.

Current says that signing up for an account takes less than two minutes. Simply download the Current app from the Apple App Store or Google Play and sign up for one of three accounts: Current Basic Account, Current Premium Account or Current Teen Account.

When you open the app for the first time, you’ll input your phone number and be sent a code. Just enter in the code and follow the prompts for the typical information (email address, legal name, birth date, etc.).

And like that, you’ve become a Current member.

Current offers three unique accounts, but you wouldn’t know that immediately by browsing its website or even the mobile banking app. When researching this financial technology company, it took some digging to learn that there was more than just the Current Premium Account (and that the Premium Account had a monthly fee; despite Current’s promise for “no hidden fees,” the monthly fee info was challenging to find).

To make it easier for you, we’ve broken down each account below. After, we’ll explore each of the benefits that Current touts and detail which accounts those benefits apply to.

Let’s explore each of the elements that Current touts as a benefit and identify which of the three accounts actually offer this benefit.

Available for: Current Premium Account only

Increasingly, banks are promising earlier access to your paycheck if you receive your payments via direct deposit. Current is among those financial institutions.

To set up early direct deposit, simply opt in to that feature in the Current mobile app. Doing so will allow you to get access to your paycheck up to 48 hours early.

How? When your employer submits payroll, this hits the Federal Reserve, which sends this info to Current. Current is thus aware that the money is incoming, even if it will take a couple of days. Instead of making you wait, Current makes that money available to you immediately.

Available for: All Current accounts

Current boasts that it has no hidden fees, but there’s an asterisk with that. If you look closely, there are out-of-network ATM fees. Current partners with Allpoint, meaning customers have access to 40,000 fee-free ATMs.

However, many of Current’s competitors offer ATM fee reimbursements (some unlimited); as of now, Current does not.

However, these out-of-network fees appear to be the only “hidden” fees associated with Current. Otherwise, the claim is pretty accurate: no monthly maintenance fees for Current’s Basic Account, no minimum balance fees and no overdraft fees for the Premium Account.

Available for: All Current accounts

Current is entirely digital. You won’t find brick-and-mortar locations anywhere, which means it needs a robust mobile app. Current delivers on this with an easy-to-use app that utilizes smartphone notifications to keep you on top of your own spending and potential fraud.

The iOS version of the app on the App Store has a 4.7 star rating based on nearly 100,000 reviews. Over on Google Play, the app has brought in even more reviews (106K+ at the time of writing) and maintained an average 4.6 star rating.

This is one of the top-rated apps of any online banks we review.

Available for: All Current accounts

How do you fund your Current bank account if there are no physical locations? Current makes this pretty manageable by partnering with more than 60,000 stores across the country. Just head to these stores (you can find them easily in the app) to fund your account.

Of course, you can also rely on the 40,000 in-network ATMs to fund your account as well for a grand total of 100,000+ physical locations to deposit cash to your Current account.

The ease of adding cash is a big selling point, even over more established online banks.

Available for: All Current accounts

Mobile check deposit is another way to add money to your bank account. Just snap a picture of the front and back of the check within the mobile app; the money should be available within a few business days.

This is a pretty standard feature for online banks.

Available for: All Current accounts

Younger customers who are still learning the ins and outs of personal finance will appreciate the automatic savings feature. This optional feature allows you to automatically round up the cost of any purchase to the nearest dollar. When you swipe your debit card, you’ll pay the merchant what you owe them and send the rest of that loose change into your Savings Pods, which you can create for various savings goals.

Savings Pods are easy to set up in the Current app, and they are a standout feature. Some banks don’t allow you to create these “sub” savings accounts that help you organize savings toward various goals. Being able to organize your money into various buckets (like house down payment, wedding and vacation) can be quite helpful.

With the Current Premium Account, you get up to three Savings Pods. The Basic Account and Teen Account each get one Savings Pod (and the Teen Account also gets you a Giving Pod for charitable donations).

However, please note: “Savings Pods,” though great for helping you set aside money toward a goal, do not have an APY. If you leave your money in a pod, you are leaving money on the table. If you are not at risk for overdrafting, you should instead move that money to a high-yield savings account.

Available for: Current Premium Account only

Current advertises fee-free overdrafts, which is mostly true. Most brick-and-mortar banks show no mercy when it comes to overdrafts while some online banks and credit unions, like Ally Bank and Alliant Credit Union, have done away with this dated, unfair practice altogether.

Current falls somewhere in the middle. With Current, you can overdraft up to $100 without incurring any overdraft fees, as long as you receive a qualifying direct deposit of $500 or more a month and enable Overdrive on the Current account.

But if you don’t receive direct deposits, haven’t enabled Overdrive or exceed the $100 threshold, be prepared to pay overdraft fees.

A caveat: You don’t immediately start with a $100 threshold. At first, Current caps you at $25. Over time, as you demonstrate responsible spending, Current will up the amount until you hit the $100 ceiling.

Note: Overdrive only works for debit card purchases. If you overdraft by transferring funds, writing a bad check or withdrawing more than you have in your Current account at an ATM, you do not have the same overdraft protection.

Available for: Current Premium Account only

One of the better features of Current is the cash back eligibility for debit card swipes. Use your debit card at one of more than 14,000 participating merchants to earn up to 15x points. These points are redeemable for actual cash in your Current account when you’ve earned enough.

The Current app makes it easy to find participating merchants (and how many points you’ll earn per debit card swipe).

Available for: All Current accounts

Current advertises no hidden fees, and that’s mostly true. However, if you incur a fee at an out-of-network ATM, you will have to pay, and Current doesn’t reimburse this fee.

That said, you’ll be hard-pressed not to find an in-network ATM. As part of the Allpoint network, Current offers 40,000 fee-free locations. You can easily find these in the app.

Available for: Current Premium Account only

One of the more unique features of Current is the gas hold removal. Gas holds can be challenging, especially for those who live paycheck to paycheck. Current aims to take away that added stress by removing gas holds for all Current Premium Account holders.

What’s a gas hold? Gas stations often hold $50 or more in funds from your account until they are sure the transaction has gone through. This can often take up to 72 hours, according to Current. But Current members don’t have to sweat it, as the neobank instantly replenishes your account with the held funds.

Available for: All Current accounts

The Current mobile app is chock full of various money management tools. With the app, you can track your spending insights, organize funds into Savings Pods and use budgeting tools to promote healthier financial wellbeing.

Available for: All Current accounts

Forget Venmo, Cash App and Zelle: Current lets you send and receive money within the app securely and quickly. And it’s free!

The only downside? You can only do this with other Current members. So until Current becomes a more popular financial institution, your options are limited for in-app transfers.

Current’s branding for the in-app cash sharing is ~tags. The tilde (~) acts like the at symbol (@) in most other platforms. Simply find other users with the ~ ahead of their username.

Available for: All Current accounts

Current may not be a real bank, but it takes security seriously. Some of its security features include push notifications for instant fraud detection, EMV chips on all debit cards and biometric logins (fingerprint and face ID).

Lose your card? No worries. Within the Current app, you can easily pause and resume transactions with the push of a button.

Still not sure if a Current bank account is right for you? We’ve weighed the pros and cons of using Current for your basic checking account needs.

Timothy Moore covers bank accounts for The Penny Hoarder from his home base in Cincinnati. He has worked in editing and graphic design for a marketing agency, a global research firm and a major print publication. He covers a variety of other topics, including insurance, taxes, retirement and budgeting and has worked in the field since 2012 with publications such as The Penny Hoarder, Debt.com, Ladders, WDW Magazine, Glassdoor and The News Wheel.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings