Women have fought for a place at the proverbial table, and now they’re showing up strong. During the pandemic, more businesses have been started by female founders, and more women than men have entered higher education.

Even so, fewer investors are female, and the gender pay gap persists. That’s where Ellevest comes in.

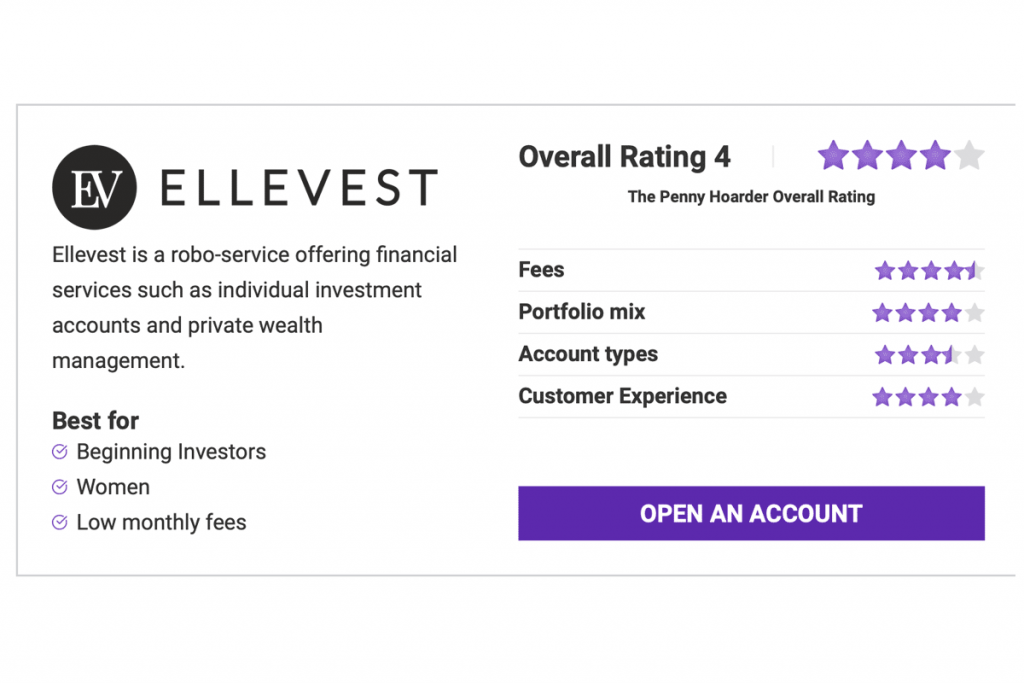

Ellevest is an investing service aimed at tackling women’s unique financial burdens, taking into account things like reduced wages growths, career breaks and longevity. We love this focus but also like that Ellevest is open to all users, regardless of gender or identity.

In fact, whether these gender burdens apply to you or not, Ellevest’s personalized advice for banking and investing makes Ellevest a good investing choice. Plus, with three membership plans, you can tailor the service to find your financial fit.

In our Ellevest review, we’ll start with a quick rundown on how investing with Ellevest works, then walk you through the membership options, and finally flesh out each of the important features Ellevest offers so that you can get all the information you need to decide how best to start growing your money your way.

Ellevest uses a robo-advisor to develop an investing portfolio that matches your targeted goals and timeline. You simply download the app, enter some basic information like your age, gender, income, etc, and then set a financial goal.

Do you want to buy a house in five years? Start a family? Create an emergency fund? Or build wealth in general? Ellevest will take specific goals into account and create a mix of ETFs (exchange traded funds) and mutual funds for you to invest in.

Before moving onto the portfolio specifics, however, you have to sign up for the specific Ellevest membership that you want. Starting at just $1 a month, Ellevest offers three membership tiers with different costs and perks for each. Jump to the next section if you’re curious which one will work best for you.

Once you’ve signed up for your membership, you’re ready to invest. With Ellevest, you don’t get to choose individual stocks or bonds; instead, you simply pick between their two portfolio offerings:

While both are created with your particular risk tolerance and financial goals in mind, the Ellevest Impact Portfolios are focused on furthering positive social impacts and advancing women’s leadership positions.

Because Ellevest’s first priority is helping you meet your financial goal, not all of your funds will be placed in impact investments if you choose the Impact Portfolio, but Ellevest will find the best way to balance your financial needs with positive social change. Socially conscious and fiscally responsible, we love it!

This specialization and impact does come with slightly higher fund fees (between .13% to .19%), so if you’re strictly looking for financial gains, the Ellevest Core Portfolio is a good option. Like the Impact Portfolio, it’s diversified and personalized for you with slightly lower fund fees of .05% to .10%.

Once you’ve picked your portfolio, then you’re done–you’re officially an investor.

While the investing is done, Ellevest doesn’t stop trying to help you grow your wealth–and financial knowledge–with perks like automatic paycheck direct deposit that allows a set amount to be deposited into your investment each month or free financial workshops and articles. If there’s anything we love, it’s a no-stress way to grow wealth and stay well-informed. Well done, Ellevest.

In order to invest with Ellevest, you have to pick a membership. Most other investment options have a percentage-based fee that charges more the more money you put into your investment; Ellevest, on the other hand, has flat fee memberships. Basically, you can put in a dollar or a million and your fee doesn’t change.

Ellevest offers three different membership plans:

Each of these plans include discounted access to financial planners and career coaches, free educational resources, and an Ellevest savings account and checking account with debit card. The differences come down to access to retirement accounts, the discount on one-on-one help, and the number of accounts you can set up.

Depending on your membership, Ellevest offers individual taxable accounts, and traditional, Roth, and SEP IRAs. At first, we were a little disappointed in the simplicity of portfolio offerings. Ellevest doesn’t offer specialized accounts like 529 educational accounts or joint or custodial funds. While this is a bummer, it’s this simplicity that makes investing with Ellevest easy.

Basically, if you’re looking for every financial vehicle on the market, look elsewhere, but if you’re looking for an easy start, Ellevest is a good investing choice.

Ellevest offers Private Wealth Management for high and ultra-high net worth individuals, families, and institutions. Again, Ellevest approaches private wealth management with personalization in mind. They work as a fiduciary with straightforward fees and well-published services that start with your financial goals.

Ellevest also brings its belief that every dollar can have an impact to its private wealth management services by allowing you to share your values with your advisors and helping develop an intentional strategy for your wealth.

With any of Ellevest’s memberships, you get access to your own Ellevest Save and Spend account: a banking account run through Ellevest and provided by Coastal Community Bank. The accounts have no minimum balance fee, no transfer fees, no overdraft fees, and reimbursable ATM fees within the United States.

Ellevest also includes a complimentary cash back debit card with your account, where you’ll earn an average of 5% back on eligible purchases. Unfortunately, the savings account is not interest-earning, meaning that, unlike most savings accounts on the market, you won’t earn money on your funds sitting in this account.

On the other hand, the Roundup feature is included with the account as a way to focus on saving and earning more. Ellevest’s Roundup setting rounds up each purchase made with the Ellevest debit card to the nearest dollar and deposits that extra change into your Save account or your investment account.

We know most people aren’t looking into Ellevest for the bank access alone, so it’s up to you if you use it or not. Still, it’s nice to know it’s available.

Ellevest offers coaching in an a-la-carte fashion that allows you to get exactly what you need. There are special coaching sessions for all your financial needs: how to find a job, negotiate your salary, create a budget, prepare for retirement, etc.

Packages range from $30 for group workshops to several thousand for a full financial planning package. Remember, you get discounts on these packages depending on your Ellevest membership. You get anywhere from 20% off with Ellevest Essential to 50% off with Ellevest Executive.

It’s aggravating to earn money through investments and then watch it all disappear to capital gains taxes. Ellevest does its best to develop the best strategy to leave your money in your own hands through Ellevest Tax Minimization Methodology (TMM). Through TMM, Ellevest strategically reduces your taxes, when possible, through a combination of taxable and tax-deferred investments.

Most robo-advisor services do automatic tax loss harvesting. Ellevest, however, believes that the benefit of tax loss harvesting depends on your specific tax situation, investments, and tax rate, so they don’t automatically apply tax loss harvesting. For some, this will be beneficial and for some this will be a loss. It just depends on your personal situation, so Ellevest does not apply it to your portfolio.

There are different perspectives on tax loss harvesting, but for Ellevest, it’s always about doing what’s right for each investor’s situation.

We know that’s a lot of information, so here’s the breakdown of how we think each feature and aspect of Ellevest stacks up.

In all honesty, we love Ellevest. With goal-focused investing, Ellevest makes investing manageable and achievable. We do wish they’d have more options for account types, missing joint, custodial, and 529s, but we applaud the simplicity.

Plus, Ellevest tackles sometimes ignored gendered issues like longevity and career breaks and make gaining wealth approachable, achievable, and – with the impact portfolio option – socially responsible.

Still have questions? We’ve gathered up all of the most common questions to help you make your decision.

When it comes to the banking side of things, Ellevest is similarly protected. It’s FDIC insured and includes such safety structures as a 256-bit account encryption and locked lost card on the app.

Contributor Whitney Hansen writes for The Penny Hoarder on personal finance topics including banking and investing.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings