by Timothy Moore

Contributor

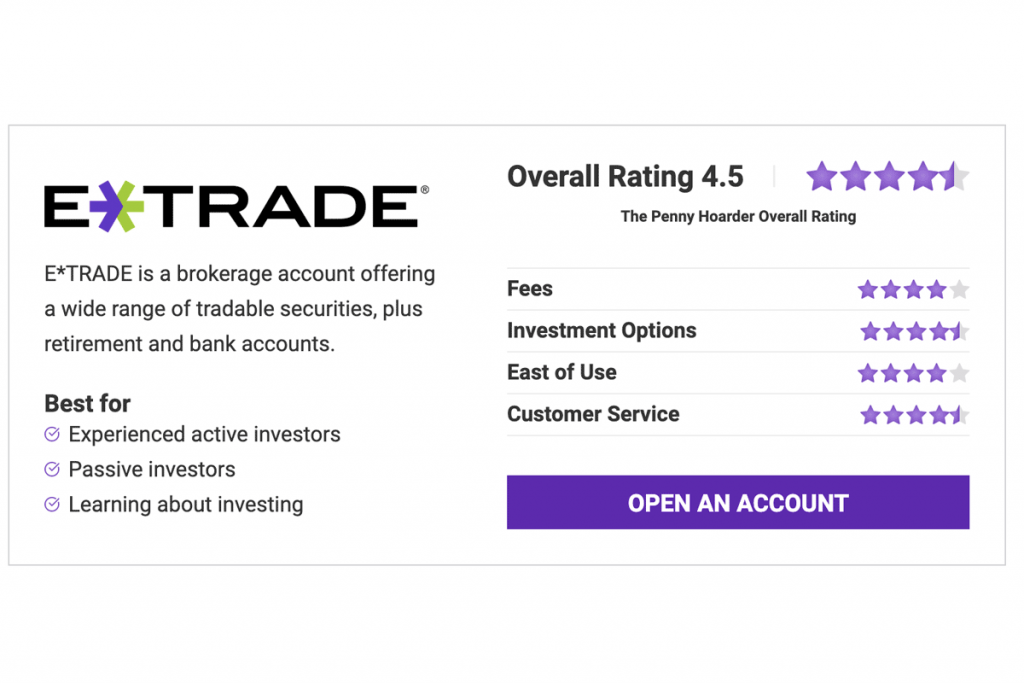

E*TRADE is one of the most popular online brokers and even has a physical footprint in the U.S., though branches remain closed because of the pandemic.

New investors can learn the ropes quite easily with E*TRADE’s wealth of educational content, but experienced investors also have a home with E*TRADE via the more advanced Power E*TRADE platform.

In addition to the core brokerage accounts, E*TRADE offers a Custodial Account, an Education Savings Account (ESA), traditional bank accounts (including two checking accounts), managed portfolios for passive investors and a full suite of personal and small business retirement accounts.

E*TRADE has been a staple of online trading for many decades. It was founded in 1982 and had its first online trade the year after. It currently employs more than 4,000 workers, has 30 branches across the United States and was acquired by Morgan Stanley in 2020.

In this E*TRADE review, we’ll explore all elements of the financial institution, but we will specifically look at the core E*TRADE trading platform and the more elegant Power E*TRADE platform for experienced investors.

However, if you are a veteran investor and are looking for an advanced investment tool, consider using the Power platform (with its own app). Though not a different brokerage account, this trading platform gives you much more at your disposal.

With this more advanced view of your investments, you can take additional actions you cannot within the basic platform, like place multiple stocks, ETFs (exchange-traded funds), options and futures on a single trade ticket; access interactive charts and 100+ studies to research potential trades; and play out options strategies with the customizable options chain.

If all that sounds way too complex for your knowledge level, it’s better to stick with the core E*TRADE trading platform. But the fact that E*TRADE offers these advanced features free of charge is a differentiator in the market.

In this section, we’ll break down the fees, tradable securities, offerings and key features of E*TRADE to make sure if it’s the right fit for you.

E*TRADE at a Glance

E*TRADE is a great platform to trade stocks and exchange-traded funds because there are absolutely no commission fees. You will, however, pay fees for trading mutual funds, options, bonds and futures.

Trading Fees at E*TRADE

Our Take: Commission-free trading for stocks and ETFs is a great reason to consider E*TRADE. Coupled with the massive library of educational resources (more on that below), free trades make E*TRADE a top contender for best online brokerage accounts. And though active traders will pay for things like mutual funds and options trades, the fees are relatively cheap compared to some competitors.

A strong point for using E*TRADE as your investment platform is the wide range of tradable securities. Some online brokers restrict you to just stocks and ETFs, especially market newcomers, but E*TRADE offers a wide range of investment options:

E*TRADE does fall short in two areas, however. There are no fractional shares, and there is no direct cryptocurrency trading. As of now, E*TRADE promises “exposure to popular cryptocurrencies via securities and futures” but nothing direct. However, in the future, E*TRADE’s website says that they do “expect to offer more investment options as the regulatory environment develops.”

Note: You can trade penny stocks on E*TRADE, but in general, we do not recommend investing in penny stocks. It’s easy to lose money from penny stocks.

Parents or guardians can open E*TRADE’s Custodial Account for minors. The account has no contribution or income limitations, and the first $1,050 of earnings are not subject to federal taxes. Even better, this account is eligible for the $15,000 annual gift tax exclusion.

Like E*TRADE’s core brokerage account, the Custodial Account offers stock trading and ETF trades free of commission. Options trades are also commission free.

An adult retains control of the account until the child turns 18 or 21, depending on the state.

The Custodial Account isn’t the only option for parents. You can also open an Education Savings Account (ESA) for your child. The earnings are tax deferred, and any withdrawals for qualified educational expenses are tax-free. You can contribute up to $2,000 a year.

If the thought of managing your own investments terrifies you, that doesn’t mean E*TRADE is wrong for you. You just might better benefit from a managed portfolio, most likely a Core Portfolio.

For the Core Portfolios, E*TRADE provides a diversified portfolio that they will monitor and manage (including rebalancing) to meet your investment goals. It’s just a $500 minimum to get started, and E*TRADE charges an advisory fee of 0.30%.

Our Take: This is a good deal if you want to invest but have no interest in learning and keeping up with the news.

You can also consider the Blend Portfolios of mutual funds and ETFs ($25,000 minimum) or the Fixed Income Portfolios of bonds ($250,000 minimum).

With any of the managed portfolios—Core Portfolios, Blend Portfolios or Fixed Income Portfolios—you can access real human financial advisors for investment advice. You can also chat with the financial consultants about your own financial goals; this helps them design a portfolio custom-built for your financial situation.

The breadth of retirement accounts offered by E*TRADE is impressive, and there are options for both individuals and small business owners.

As an individual, you can open the following retirement accounts with E*TRADE:

As a small business owner looking to offer competitive benefits to employees or to build your own retirement plan funded by your business venture, you can open the following small business retirement accounts:

While we don’t advise anyone to open a bank account at E*TRADE if not also investing through the online broker (instead, try one of these online banks), there is merit to each of the savings and checking options.

The Premium Savings Account has no monthly fees and is insured up to $1.25 million. This is a good option to hold funds that you’re planning to invest.

The Max-Rate Checking Account is not fee-free, but we do like that it offers unlimited ATM fee refunds nationwide and has an APY of 0.05%. But if you’re looking for a no-frills, no-fee checking account, go with E*TRADE Checking, which comes with a debit card.

You can also open a line of credit by borrowing against your investments. The variable APR on the loan varies depending on how much you borrow. At the start of 2022, a loan worth $65,000 or less had a variable APR of 5.405%.

One of our favorite hallmarks of the E*TRADE brokerage account is the wealth of educational content, offered via two platforms: the traditional platform and the Power E*TRADE platform for advanced investors.

Everyone has access to independent analyst research (from TipRanks, Thomson Reuters and other industry resources), market news, real-time quotes, charts and studies. The platform also offers multiple investing tools, screeners, and learning resources. You can browse videos, articles, tutorials and more to learn the basics of investing and more refined strategies and even attend monthly webinars and (prior to the pandemic) live events.

E*TRADE’s online platform is easy to use, but for active traders on the go, the E*TRADE mobile app is essential. The basic E*TRADE mobile app offers all the same functionality as the website. It currently has a 4.6 star rating on the Apple App Store based on nearly 140,000 reviews; on Google Play, it’s got a 4.4 star rating based on almost 40,000 reviews.

But advanced traders who like the expanded options and resources of Power E*TRADE can download a separate app called Power E*TRADE – Advanced Trading. This app is also highly rated (4.5 stars on the App Store and 3.9 stars on Google Play).

Opening a new E*TRADE brokerage account takes only 10 minutes, but funding the account may slow you down. You can use the free Transfer Money service that takes up to three days, deposit a check (which takes even longer) or do a wire transfer (for a fee) for same-day access.

Other brokerage accounts make it easier to fund your account right away.

While many online brokers make customer support challenging by offering email-only support, E*TRADE is available 24/7 via phone. Just be aware that call volumes continue to be higher during the age of COVID, so expect a wait time.

To contact E*TRADE customer support, call 800-387-2331.

E*TRADE also operates 30 branches across the country, however, they continue to be closed because of the pandemic. Here’s the full list of physical E*TRADE branches.

Weighing the pros and cons of E*TRADE before deciding to open a brokerage account? Good call. Below, we’ve spelled out what we love about E*TRADE — and what we don’t.

Still have questions about opening an account with E*TRADE? We’ve provided answers to the most common questions our readers are asking about E*TRADE.

E*TRADE’s bank accounts are insured by the FDIC (Federal Deposit Insurance Corporation).

E*TRADE’s trading platforms are free, whether you use the core web platform or the more sophisticated Power platform for advanced investors.

But E*TRADE is far more than mutual funds and futures. In addition to the brokerage account, you can use E*TRADE for retirement planning and everyday banking.

Timothy Moore covers bank and investment accounts for The Penny Hoarder from his home base in Cincinnati. He has worked in editing and graphic design for a marketing agency, a global research firm and a major print publication. He covers a variety of other topics, including insurance, taxes, retirement and budgeting and has worked in the field since 2012.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings