by Rachel Christian, CEPF®

Senior Writer

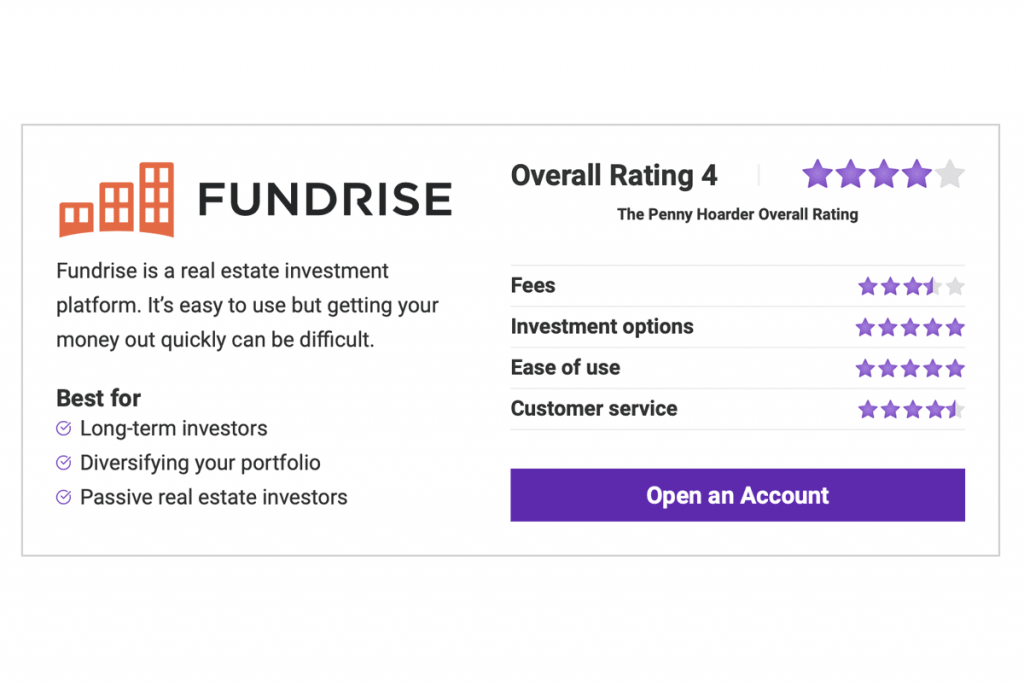

Fundrise is a crowdfunding platform for private real estate investing. Unlike traditional real estate investments, which require thousands of dollars in capital, Fundrise users can invest with as little as $10.

Instead of buying a single piece of property by yourself, you and other investors buy shares in a fund that owns or finances multiple apartment buildings, office buildings, single-family homes, hotels, retail space and other properties.

When those properties make money through rental income, mortgage payments or appreciation in value, the profits flow to the fund’s shareholders (including you).

Fundrise prides itself on making real estate more accessible to everyday investors. There’s no income or net worth requirements to get started.

In contrast, many other real estate investment platforms require you to be an accredited investor — defined in U.S. securities law as having a net worth of more than $1 million and an annual income of at least $200,000 for individuals.

Still, Fundrise has drawbacks.

Your money is rather illiquid, meaning you can’t cash out your investments as easily as you can with other asset classes like stocks, ETFs and mutual funds.

Fundrise takes a long-term growth approach to investing, so expect to hold these real estate funds for several years. Otherwise you’ll pay a 1% penalty, and may need to wait at least two months to access the money.

While investors can create a starter portfolio for as little as $10, Fundrise charges several fees, including a combined 1% annual advisory fee and asset management fee.

So is Fundrise a good way to invest in real estate? In this Fundrise review, we break down everything you need to know, including features, investment choices, cost and fees.

Fundrise Review: Benefits and Features

Fundrise will tailor your specific portfolio allocation based on your personal investment goals and strategy.

However, you can’t log in to Fundrise and pick the specific individual real estate projects or eREITs you want.

Rather, Fundrise determines the mix of underlying real estate properties in your portfolio based on your selected preferences.

Your real estate funds generate quarterly dividends, and they have the potential to grow in value over time.

Returns from eREITs and eFunds ultimately come from the individual real estate assets inside your portfolio. This includes interest or rental income collected, as well as potential appreciation in the property’s value.

Fundrise also offers dividend reinvestment. When this option is enabled, any dividends you earn are reinvested back into your Fundrise investments.

You should expect to hold onto your eREITs and eFunds for at least five years.

Real estate is an inherently illiquid asset, meaning it’s hard to get your money out quickly once it’s invested.

It’s like owning a home. You may have $200,000 invested in your home, but that doesn’t mean you can liquidate its full value for cash tomorrow.

Fundrise says its platform is best suited for investors who hold their investments at least five years.

You’ll pay a 1% fee on all eREIT and eFund redemptions processed before an investment is five years old. You’ll also undergo a minimum 60-day waiting period before the shares are sold.

After five years, you can request to redeem your eREITs or eFunds at any time for their full value with no penalty.

As an alternative, the Interval Fund offers quarterly liquidity. This basically gives you four chances a year to liquidate these shares with no penalty or cost.

eREITs are non-traded — meaning they aren’t publicly traded on a stock exchange — so they generally have less liquidity than traditional REITs.

You can’t sell eREITs and other Fundrise investments as quickly as you can sell stocks held inside a traditional brokerage account because there’s no guarantee there will be buyers for your real estate shares.

Final note: Fundrise reserves the right to suspend redemptions, particularly during turbulent market conditions.

Fundrise most recently flexed this restriction from March 2020 to July 2020 in response to the Covid-19 pandemic.

Fundrise offers five account levels with different minimum balance requirements: Starter, Basic, Core, Advanced and Premium.

Each account type invests your money in a mix of eREITs and eFunds.

The Fundrise Starter Portfolio is the most affordable option, with a $10 minimum requirement. This low-cost plan doesn’t include IRA access or other advanced features.

With an investment of $1,000, you’ll be upgraded to the company’s Basic plan. This account level lets you set investment goals and open an IRA.

The three other Fundrise account levels include:

All Fundrise investors pay a 1% annual fee on their portfolio balance.

This fee is the combination of:

Fundrise doesn’t charge any transaction fees or sales commissions on its funds. Its low fees are a big selling point for many investors.

However, other Fundrise costs may be less apparent.

The company notes that it “could potentially charge other fees, such as development or liquidation fees, for our work on a specific project.”

Fundrise isn’t transparent on the exact cost of these additional fees, and they’re not easily accessible on the company’s main website.

Finally, remember, Fundrise charges a 1% fee if you sell your eREIT or eFund shares before the five year mark.

Fundrise offers the option to open a traditional or Roth IRA. You can also choose to roll over an existing IRA or 401k.

In addition to the standard fee structure charged on all Fundrise accounts (1% a year), Fundrise’s IRA custodian — Millennium Trust Company — charges an annual fee of $125.

That’s right — $125 a year plus a 1% annual fee.

That’s in stark contrast to most brokerage firms and robo-advisors nowadays. Most — like Fidelity, Betterment, SoFi, Merrill Edge and Vanguard — charge an annual advisory fee under 0.5% with no additional annual fees on IRAs.

It’s hard to justify the cost: Fundrise’s website doesn’t mention any perks or unique investment opportunities associated with this $125 fee.

If you’re an experienced real estate investor interested in a self-directed IRA, then a Fundrise retirement account might be a good fit.

But our advice to the average investor? Open an IRA elsewhere.

Rachel Christian is a Certified Educator in Personal Finance and a senior writer for The Penny Hoarder.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2022 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings