by Timothy Moore

Contributor

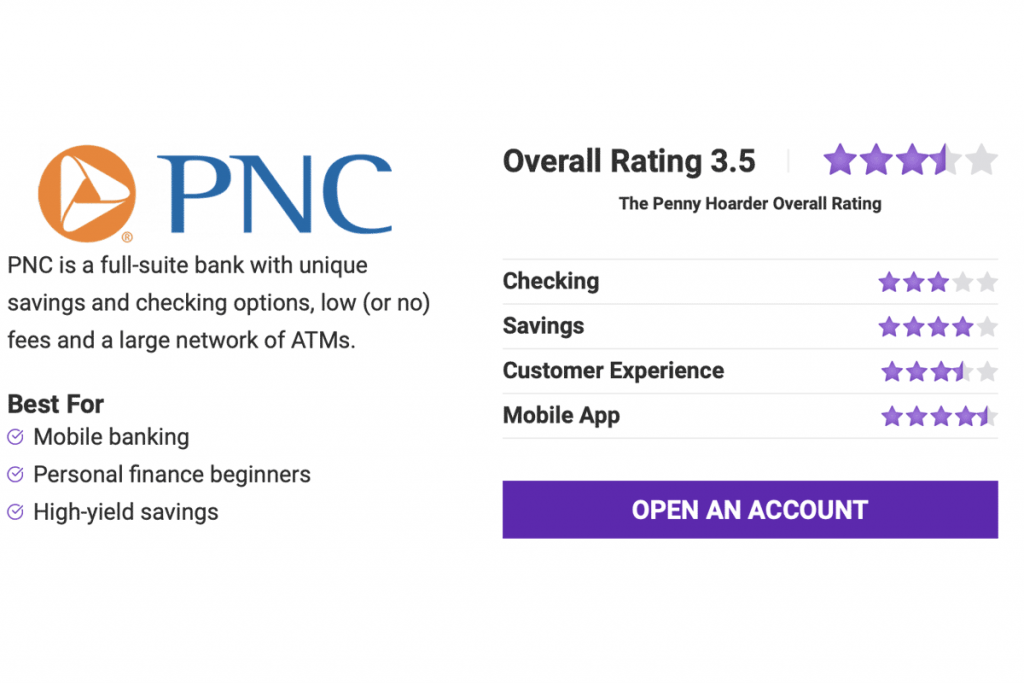

PNC Financial Services may have a small geographic footprint, but it’s mighty when it comes to its assets.

In fact, PNC bank, which only operates in 25 states and the District of Columbia, is ranked as the nine largest bank in the U.S. based on assets.

While living in one of the states with physical branches is ideal for PNC customers, PNC does offer checking accounts and savings accounts to customers outside of its physical locations with the advent of online banking.

In our PNC bank review, we will examine some of the core accounts offered, including the Virtual Wallet offerings and the High-Yield Savings. We’ll also take a look at small business banking, mobile banking, customer service and convenience before weighing the pros and cons of a PNC checking account and a PNC savings account (and the different options available) and tackling any final unanswered questions about PNC Bank.

Below we focus on two PNC checking accounts — Virtual Wallet Checking Pro with Spend and Virtual Wallet Checking Pro with Spend, Reserve & Growth —in detail and then touch on its offering for students, which combines checking and savings.

PNC’s Virtual Wallet account with Spend does not earn interest. There are plenty of online checking accounts that do accrue interest or reward you with cash back for debit card swipes.

ATMs are an important part of checking accounts, as they let you deposit and withdraw money quickly and easily. PNC Bank has a shockingly low number of in-network ATMs (meaning ATMs that do not charge you ATM fees for usage).

In total, PNC has 19,000 ATMs across the U.S. Some of the top banks and credit unions have more than 80,000 ATMs in their networks.

However, PNC Bank does offer up to $20 of ATM surcharge fee reimbursement per month. Given that the average ATM surcharge is roughly $3, that means you could use an out-of-network ATM just under seven times a month.

The PNC Mobile App currently has a 4.8 star rating on the App Store (based on roughly 1 million ratings) and 4.5 stars on Google Play (based on nearly 170,000 ratings).

The app does everything you would expect an online bank app to do in terms of personal finance. With the PNC Mobile App for your Virtual Wallet with Performance Spend account, you can:

Android users can also utilize PNC Pay to pay with their mobile devices. Otherwise, you can use the traditional Visa debit card (PNC Banking Card) or the old-fashioned checkbook for the Virtual Wallet account.

While there is no monthly maintenance fee associated with the PNC Virtual Wallet with Performance Spend account, Virtual Wallet does have other fee types:

The overdraft fees stand out here, especially as other financial institutions are doing away with them entirely.

In addition to foreign transaction and overdraft fees, PNC changes fees for ATM statements and outgoing domestic wire transfers and incoming and outgoing international wire transfers.

The PNC Virtual Wallet Checking Pro with Spend account now comes with Low Cash Mode, which alerts you when your balance is low. It also allows you to determine whether you want certain payments to go through or be returned (and gives you a 24-hour grace period to fund the account).

The core of this account is the same. The Spend portion of the account functions in the exact same way:

The Reserve account is a separate checking feature for short-term planning. Think of it as a place where you can transfer money for an upcoming vacation, concert tickets or an upcoming student loan payment. This money is untouchable for everyday transactions; it’s essentially a resource to keep you from burning through your rent money on an accidental, wine-influenced online shopping spree.

Previously, PNC called the Reserve account an interest-bearing checking account. However, Reserve no longer accrues interest. (The difference is hardly noticeable; when it was an interest-bearing checking account, that interest was just 0.01%.)

While the Reserve account, much like the core Spend checking account, does not earn interest, you will earn interest on any funds that are in the Growth account, as this is your traditional savings account.

In fact, you’ll earn 0.40% APY on balances over $1 in the Growth account. This APY outperforms the national average, which is currently hovering around 0.04%. That makes PNC’s interest rate 10x higher than the national average.

The Reserve and Growth accounts also serve as overdraft protection. PNC calls it “two layers of overdraft protection.” Essentially, if you are at risk of paying an overdraft fee, PNC will first attempt to pull money from these two accounts to cover the charge.

PNC does offer a checking and savings account combo for students called the Virtual Wallet Student account. It includes an automatic courtesy refund for your first overdraft but then overdraft fees kick in after that. It provides $5 of ATM reimbursement.

PNC offers a high-yield savings account, plus a standard savings, money market and CD options. Below, we take a closer look at the high-yield savings, currently with an APY of 0.40%.

APY (Annual Percentage Yield)

Like the Growth portion of the Virtual Wallet Checking Pro, the PNC High-Yield Savings account currently boasts a 0.40% interest rate.

PNC Mobile App

Because this is a savings account only, many of the features that you’d use for personal finance are not applicable. However, you can use the mobile app for account transfers (from external accounts or PNC checking accounts), mobile check deposit and an automatic savings plan.

Funding the Account

You can fund your High-Yield Savings account through wire transfer, direct deposit or an external transfer from a linked bank account.

Other PNC Savings Options

While the High-Yield Savings account is the flagship option, PNC does offer other deposit accounts that accrue interest:

PNC Standard Savings requires a minimum deposit of $25, carries monthly maintenance fees that can be waived and is FDIC insured. To waive the fee, maintain an average monthly balance of $300, link your account to a Virtual Wallet or set up an auto savings transfer of $25 or more each month. The fee is automatically waived if you are under 18 years old.

The PNC Premiere Money Market account rewards you for investing more. The more money in the account, the higher the interest rate. However, there are monthly fees that are only waived if you have at least $5,000 in the account or if you have a linked Virtual Wallet account.

PNC Bank offers fixed rate CDs (certificates of deposit) ranging from seven days to 10 years. There is a minimum $1,000 to open with early withdrawal penalties. Alternatively, you can open a Ready Access CD ranging from three to 12 months.

In addition to the core PNC accounts, this review will cover banking with PNC as a small business, as well as our analysis of the mobile app, customer service and convenience.

Small business owners can choose from several small business checking accounts at PNC:

The Business Checking account requires a $100 minimum deposit to open.

The monthly service fee is only $10, but it doesn’t take effect for the first three statement cycles. But you can get that waived if you:

PNC Business Checking allows for up to 150 transactions and $5,000 in cash deposits per month at no charge.

You can also get free online banking and bill pay as well as set up an overdraft protection for no fee. They charge $2 each month for paper statements, but you can easily avoid that by going paperless.

You can also browse small business savings account options:

Currently, PNC has physical locations in 25 states and the District of Columbia.

If you’re looking for an ATM, PNC has 19,000 while competitors often have 80,000+. However, PNC does offer a high ATM reimbursement amount each month.

While this review looks at checking and savings options, you can get a full suite of services from PNC, including credit cards, mortgages, car loans, personal loans, lines of credit, student loans, student loan refinancing, military banking and investment accounts.

PNC’s mobile app is intuitive and easy to use and has garnered high ratings on the App Store (4.8 stars) and Google Play (4.5 stars). The recent addition of Low Cash Mode is a game changer for beginners.

Many of the financial wellness features mentioned in this review are available on the app. You can set your savings goals and automatic savings deposits. You can create budgets for different categories. It is designed to be an all-in-one banking and budgeting app, which means you won’t need to set foot in a branch if you don’t want to.

Because PNC operates physical locations but also acts as an online bank, customer service is relatively good. You can go into branches if you want in-person help, but you can also chat online or even call for help.

PNC customer service has various numbers and hours depending on your need and account.

Our pros and cons about PNC may help you decide if this is the right bank for you.

Still have questions about banking with PNC? We’ve provided answers to some of the most common questions readers like you are asking.

Note: ATM reimbursements apply to domestic ATMs only. PNC will not reimburse fees at foreign ATMs.

PNC Bank does not have a monthly fee and does offer interest on its savings products. However, for both checking and savings accounts, there are online banks offering a higher annual percentage yield, no monthly fee, and better convenience. That said, the PNC Mobile App is its saving grace.

Some of the personal finance tools offered digitally through the app can be great for those just learning money management, but the risk of an overdraft (and the high cost to address it) would deter me from recommending this to beginners, for whom those very tools are designed.

PNC and Best Bank Bonuses

PNC Bank often makes our list of the best bank bonuses, meaning you can frequently count on a reward for starting an account. Typically, you need to meet some criteria to earn the bonus, like receiving qualifying direct deposits. Qualifying direct deposits are typically direct deposits that come from an employer or the government. Peer-to-peer payments, like Venmo, do not count as a direct deposit.

States Where PNC Bank Operates

You can find physical branches of PNC in the following states, as well as the District of Columbia:

Timothy Moore covers bank accounts for The Penny Hoarder from his home base in Cincinnati. He has worked in editing and graphic design for a marketing agency, a global research firm and a major print publication. He covers a variety of other topics, including insurance, taxes, retirement and budgeting and has worked in the field since 2012. Information from former contributor Tyler Omoth is included in this report.

Editorial Disclosure: This content is not provided by the bank advertiser. Opinions expressed here are the author’s alone, not those of the bank advertiser.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings