by Timothy Moore

Contributor

Did the movie The Big Short go right over your head? Does Nasdaq sound more like a foreign country than a stock market index? When you hear about bear markets and bull markets, do you envision adorable cartoon mammals browsing for fresh produce at a local farmers market?

You’re not alone.

The stock market can be confusing, and if you’re not a financial wizard in the Wall Street inner circle, you might be tempted not to bother with stock and options trading at all. But you’d be missing out.

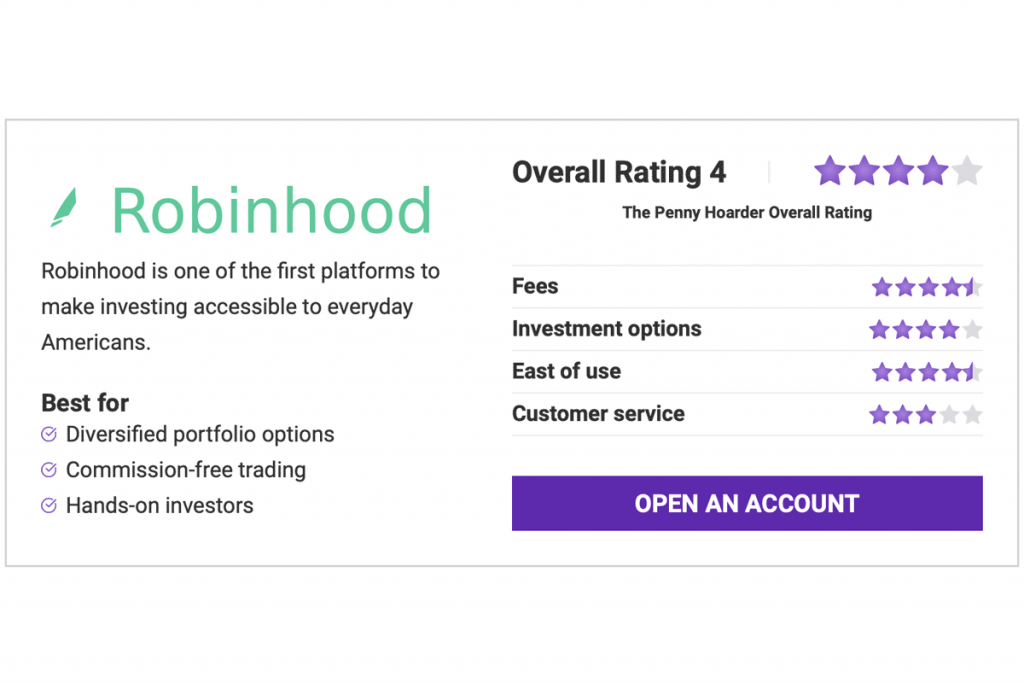

That’s where apps like Robinhood come in. In this Robinhood review, we’ll discuss how Penny Hoarders can go from novice traders to expert stock market gurus, no matter how much or how little they have to invest.

Robinhood offers a unique brokerage account that offers commission-free investing from your smartphone. Robinhood has been around for the better part of a decade. The company launched on April 18, 2013. Its two founders, Vladimir Tenev and Baiju Bhatt, met at Stanford University as roommates and eventually moved to New York City to build finance companies.

Upon seeing firsthand how Wall Street insiders and powerhouse firms paid almost nothing when trading stocks while average Americans had to pay a commission fee for every trade, they instead headed to California to develop a financial product that allowed everyone to trade easily and affordably.

The resulting financial product, of course, was Robinhood. The company today is headquartered in Menlo Park, California.

The company has not been without its challenges, famous for serious outages during market surges in 2020 and its role in the early 2021 market chaos related to the Reddit forum called r/wallstreetbets, where it restricted member access to securities like Gamestop, Nokia and AMC.

However, its overall mission to make stock market trading accessible for everyone is admirable, and it is one of many investment and trading tools that seeks to put power back in consumers’ hands to elevate the financial status of the average American.

That’s a product that, even with its flaws, we can get behind.

The Robinhood platform is a great solution for free(!) trading of stocks, options, ETFs (exchange-traded funds) and ADRs (American Depositary Receipts), as well as cryptocurrency trading. The trading platform requires no minimum balance, offers fractional shares and includes plenty of educational resources. While Robinhood is most known for trading stocks and crypto, you can also use it for cash management.

Robinhood does not, however, offer access to mutual funds and bonds. It also does not include retirement accounts, like IRAs.

New in 2021, Robinhood has also begun to offer IPO access, meaning investors can purchase shares of stock in new companies at the IPO price before they go public.

To sign up with a Robinhood brokerage account, simply visit the website and press the green “sign up” button.

Hot Tip: Robinhood is currently offering one free stock upon signup. There are 400 different stocks available, and you’ll randomly be assigned one. The value of those random stocks will fluctuate with the market, but Robinhood says that these stocks will range anywhere from $2.50 to $225 per share. However, 98% of the free stocks that Robinhood doles out to new members will range from $2.50 to just $10.

To open an account with Robinhood, you have to meet a few individual requirements:

Robinhood is accessible via the web or app (iOS and Android).

The process of activating your account can take some time. You’ll start by submitting an application. While Robinhood reviews the application, you can queue one deposit to fund your account, but you won’t be able to use that money to make trades until account approval.

Typically, Robinhood will take a few days to either approve your application or request more information. If they request more information or documentation, be prepared to allow five to seven days for review.

The best part of Robinhood — and the whole reason its founders launched the company — is that stock trading is absolutely free. That means you won’t pay commissions on equity trades or options trades. However, you could wind up having to pay account transfer fees, wire fees, check fees and live broker fees, among others.

In addition, Robinhood Gold allows you to trade on margin at a 2.5% annual rate. It also allows you to make bigger deposits with faster fund access. This fee is $5 per month.

Margin trading means trading with borrowed money. If you invest in a bad stock and lose money on the investment, you’ll owe that money back.

For example, say you borrow $500 to invest in a stock worth $500. But that stock plummets to $100. You will still owe the remaining $400 back to Robinhood. That’s what makes margin trading a little too risky for novice traders.

Not only that, but if you borrow more than $1,000 to trade on margin, you’ll owe 2.5% yearly interest on that borrowed money above that $1,000. Robinhood lowered this from 5% in December 2020, so if you’re browsing any older Robinhood reviews, note that the interest fee has decreased.

Because Robinhood is targeted at new investors — and margin trading is a risky practice that can break even the savviest stock market gurus — we recommend that you invest with your own money, and make sure it’s money that, if lost, will not financially ruin you.

If Robinhood is commission-free and not everyone uses Robinhood Gold, how does Robinhood make money off you? Robinhood spells this out transparently on its website:

In this section, we will break down some of the hallmark features of Robinhood.

Robinhood: At a Glance

Robinhood’s schtick has long been that it offers commission-free trading. That means you will spend $0 for stock trading and $0 for options trading. ETFs are also commission-free.

This was the original mission of the founders, but in the time since launching their revolutionary idea, some of the bigger, traditional players, like Fidelity and Charles Schwab, have latched onto the same idea — and are backed by a better customer support system and a better-supported platform.

That has meant that Robinhood has had to find new ways to differentiate, like cryptocurrency and fractional shares. More on these below.

Of course, you will need to put money in your account to invest, but Robinhood does not have an account minimum, nor does it charge you for having a low or zero balance. And with fractional shares being an option, you can get started investing with as little as a dollar in your account.

Note: To purchase a security on margin (through Robinhood Gold), you need to have at least $2,000 in your account. This is not a Robinhood requirement but rather a regulation set by the Financial Industry Regulatory Authority (FINRA).

Cryptocurrency is still a foreign concept to many investors, but just because something is new and scary (also, it’s been around since 2009, so it’s hardly new anymore) doesn’t mean you shouldn’t invest. Not all brokers allow you to buy and sell cryptocurrency, but Robinhood offers support for multiple cryptocurrencies, including Bitcoin, Dogecoin and Ethereum, with Robinhood Crypto (open 24/7).

Not only does Robinhood offer free trades on stocks, options, ETFs and ADRs, but it also has no account fees, inactivity fees or ACH transfer fees. Robinhood Gold, as mentioned, currently costs $5 a month.

Robinhood was concocted in the heart of Silicon Valley in Menlo Park, so unsurprisingly, its mobile app is streamlined and easy to use. At the time of writing, the Robinhood app has 4.2 stars in the App Store based on nearly 3.3 million reviews.

Its website, too, is streamlined. It doesn’t have a lot of extras, which is great if you are a novice trader. A more senior investor may find the site lacking, however.

While Robinhood offers customer support, this seems to be the biggest issue raised by members. Customer review sites are often littered with complaints that customer service is virtually nonexistent, especially pre- and post-market.

In an effort to improve its relatively low-rated customer support options, Robinhood rolled out a new customer service feature in 2021. This allows customers to request a call back, 24/7. Robinhood promises an agent should call within 30 minutes.

While commission-free stocks, options, ETFs and even crypto are a big pro of Robinhood, its lack of mutual funds and bonds can be frustrating for traders who want to diversify.

True to its goal of making growing financial wealth more accessible to average Americans, Robinhood released fractional share options in late 2019. This means, if you can’t afford an expensive stock valued at, say, $1,000, you could instead buy a fraction of the stock, maybe $100 worth of it, or even just $10.

Right now, Robinhood allows you to buy as small as 1/1,000,000 of a share. Just like full shares, trading of fractional shares can be done in real time and commission-free.

Another tool that Robinhood has introduced in recent years is recurring investments, which is a nice pairing with a fractional share investment strategy. For example, if Company X’s stock hovers around $200, you can set up a recurring investment in a fractional share at $25/week. Within roughly eight weeks, you could own a full share.

Most brokers structure recurring investments as buying by the share, which typically leaves your account funded with some uninvested cash. But Robinhood’s recurring investments are structured as buying by a dollar amount, which makes the best use of all your invested cash.

New in 2021, Robinhood gave customers access to purchase stocks in upcoming IPOs (initial public offerings) at the IPO price. No minimum account balances or special status requirements are necessary.

Another cool feature of Robinhood is the associated cash management account. You can have your paycheck deposited here, use it to pay bills and deposit checks, and, of course, fund your account. Like a proper bank account, this account gives you access to more than 75,000 fee-free ATMs (pretty much everywhere Mastercard is accepted) and comes with a debit card. And the best part: It earns 0.30% APY. For reference, the FDIC says the average interest rate for a savings account is 0.04% APY.

A lot of now-outdated Robinhood reviews mention the lack of educational resources. We couldn’t find anything to be less true of Robinhood. Perhaps in response to some of those reviews, Robinhood has stepped up its game, with plenty of online resources on the website as well as a daily financial newsletter called Robinhood Snacks. Robinhood markets it as a “3-minute newsletter with fresh takes on the financial news.”

Serious investors keep up with this kinds of news. It may not have the same appeal as celebrity gossip, but it will help you make wise decisions investments decisions.

Because of Robinhood’s role in the recent GameStop market chaos, many angry investors and emboldened Redditors spoke their minds online, meaning Robinhood’s current ranking on sites like the Better Business Bureau (BBB) and Google Play is suffering. This is more a reflection of reviewers’ overall criticisms of capitalism, hedge fund managers and the 1% than it is on Robinhood, which, if you take a step back, is really trying to help the average investor.

There’s a lot to love about Robinhood, especially if you are a new trader. More experienced traders may prefer a different approach to trading, however. Weigh these pros and cons before deciding on a Robinhood brokerage account.

If you want to stay away from major players like TD Ameritrade and Charles Schwab, Robinhood is arguably the most popular trading tool. Its most notable competitor is Webull. Both Robinhood and Webull have their advantages; it truly comes down to your personal preferences.

Still have questions about opening a Robinhood account? We’ve provided answers to some of the questions our readers are most commonly asking.

Further, the Robinhood app is safe to use.

Timothy Moore covers banking and investing for The Penny Hoarder from his home base in Cincinnati. He has worked in editing and graphic design for a marketing agency, a global research firm and a major print publication. He covers a variety of other topics, including insurance, taxes, retirement and budgeting and has worked in the field since 2012.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings