Charles Schwab’s robo advisor offering Schwab Intelligent Portfolios combines the brokerage’s expertise alongside technology to build portfolios for their investors.

You can put your investment dollars to work by allowing the brokerage to build a portfolio based on a combination of their 51 low-cost exchange traded funds (ETFs).

After signing up for an Schwab Intelligent Portfolios account, you’ll answer a series of questions designed to understand your investment goals and personality such as your risk tolerance and why you’re investing.

Based on these answers, Charles Schwab will build you a diversified portfolio. In addition to the variety of ETFs offered, Charles Schwab also offers portfolios for six risk profiles — from conservative to aggressive growth — and three different investment strategies based on the types of securities you want to invest in.

In addition, the ETFs are based on factors such as how close they are to their targeted index, expense ratios, and their exposure to broad asset classes. Even though you don’t need to pay portfolio management (or advisory) fees, there are ETF expense ratios — they’re still pretty low since they range from 0.04% to 0.18%.

After you’ve created and funded your account with Schwab Intelligent Portfolios, the broker will continue to monitor your portfolio and automatically rebalance it whenever your portfolio veers away from your predetermined allocations. You can also take advantage of their tax loss harvesting services when you have invested at least $50,000.

The brokerage also offers another offering called Schwab Intelligent Portfolios Premium for an additional fee. You’ll need to invest in a minimum of $25,000 — features include unlimited assistance from a Certified Financial Planner (CFP).

Schwab, like other robo advisors, will create a customized investment portfolio based on answers you give such as your risk profile, financial goals, and time horizon. You can also customize their recommended allocations by removing up to three ETFs and replacing it with ones of your choosing. Plus, whatever your allocation is, Schwab will ensure it purchases other ETFs based on what it initially recommended to you.

Investors can open as many Intelligent Portfolios as they want as long as each account is funded with a minimum of $5,000. It might be a smart move if you’re interested in investing based on different financial goals and risk tolerance.

Schwab Intelligent Portfolios at a Glance

Investors with Schwab Intelligent Portfolios can open a wide variety of account types, including:

This feature projects how much you’ll be able to withdraw each month to help fund your retirement or have your investments provide you with income. Schwab will also consider how your withdrawals will affect your taxes. You can choose to set up automatic withdrawals on a recurring basis to be deposited into your account.

Investors who have at least $25,000 can sign up for Schwab’s premium version of their robo advisor services. Called Schwab Intelligent Portfolios Premium, you’ll receive unlimited one-on-one help with a Certified Financial Planner, access to online financial planning tools, and a written customized financial plan to help you meet your financial goals. Keep in mind Schwab doesn’t automatically pair you with a dedicated advisor, but you can request to work with the same one.

The financial plan you receive is intended to help you with your financial goals. You can ask the CFP for advice for planning around major life events such as purchasing a home, saving for college, starting a family, increasing your income, budgeting tactics, and even retirement strategies.

To become a premium client, you’ll need to pay an initial one-time financial planning fee of $300, then an ongoing fee of $30 per month (billed quarterly at $90). Schwab is the only robo advisor so far that charges an upfront fee for similar services. Plus, while the flat-fee seems pretty low considering you’re getting personalized advice, it can cost more compared to other competitors depending on your investment balance.

Schwab Intelligent Portfolios doesn’t change any management fees on their end, making it an affordable option compared to other robo advisors. However, there are expense ratios for your underlying investments, which range from 0.04% to 0.18%. Schwab mentions that most ETFs it uses in their client portfolios are on the lower end of this range.

Customers can get 24/7 customer service with Schwab Intelligent Portfolios by calling 855-694-5208 or via life chat. The brokerage is also accessible at any of their branch locations and through the Schwab mobile app, available on both Android and iOS.

Here is our roundup of the pros and cons associated with Schwab Intelligent Portfolios.

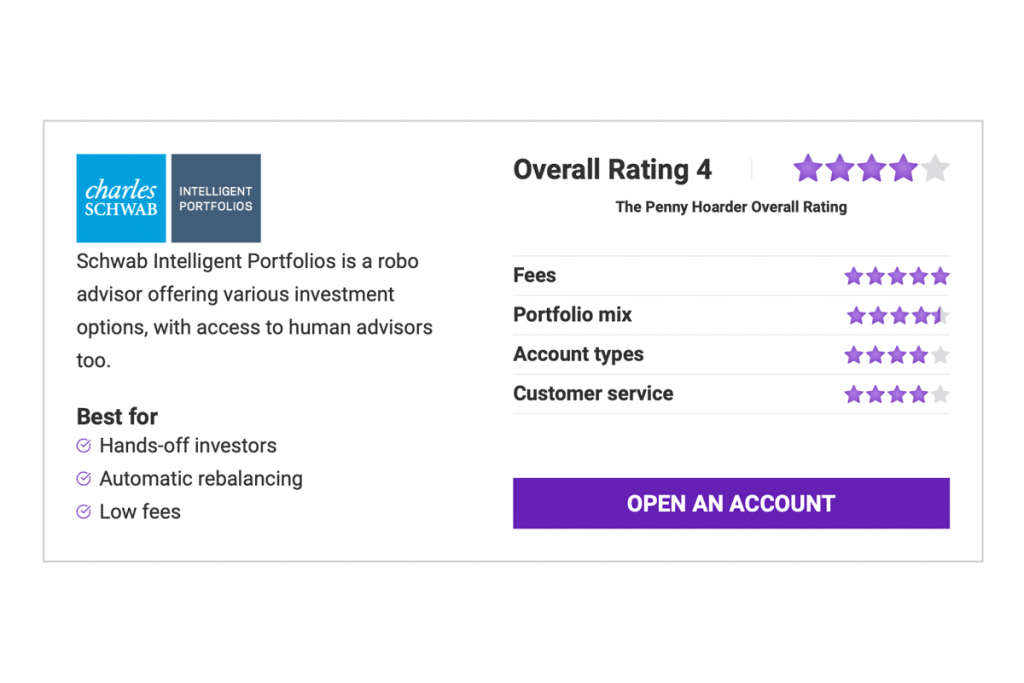

Schwab Intelligent Portfolios stands out because it offers some great services for investors who want to invest with robo advisors. The brokerage has a long-standing reputation, there are no management fees, and portfolio options have low-cost ETFs.

However, the higher cash allocation may not be ideal for more aggressive investors and we’re not too keen on the fact that tax loss harvesting is only for those who have invested at least $50,000 with Charles Schwab.

The Schwab Intelligent Premium option is pretty decent, though it’s priced higher compared to other robo-advisors. Still, it’s cheaper than hiring your own financial planner, so that’s something to consider. Overall, we think Schwab Intelligent Portfolios is worth a second look, especially if you have a decent amount to invest.

Schwab Intelligent Portfolios is a robo-advisor that helps you allocate your portfolio based on information you provide, such as your risk tolerance and financial goals.

A robo advisor uses technology to manage investments and sometimes provide financial advice without much human intervention. The point of a robo-advisor is so that investors are as hands-off as possible and typically at lower costs. Read more about robo advisors and how they can help you invest.

Schwab Intelligent Portfolios has 51 ETFs across 20 different asset classes and an FDIC-insured cash account option. The brokerage outlines all of their investment options here, including expense ratios and the reasons these assets were chosen.

Contributor Sarah Li-Cain is a personal finance writer based in Jacksonville, Florida, specializing in real estate, insurance, banking, loans and credit. She is the host of the Buzzsprout and Beyond the Dollar podcasts.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings