by Rachel Christian, CEPF®

Senior Writer

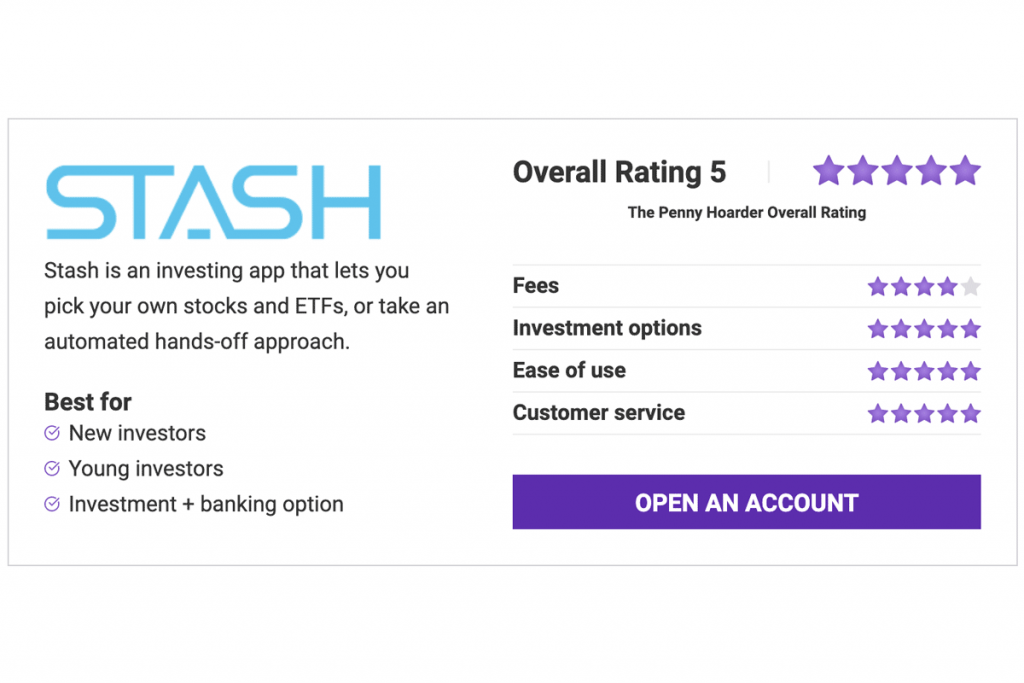

Micro-Investing apps aim to make investing more inclusive, easier to understand and less intimidating.

The Stash app is a popular choice for new investors because it lets you begin investing with just $5.

Stash can create a diversified investment portfolio for you based on your financial goals and risk tolerance, offering a user-friendly way to kickstart your investment journey.

Or you can pick from more than 3,000 individual stocks, exchange-traded funds (ETFs), as well as bonds if you want a more hands-on approach.

Trying to decide if Stash is right for you? To help you make the best choice, we’ve reviewed the app ourselves.

Stash Financial Inc. is a New York City-based financial services company that lets you incrementally put small sums of money into an investment portfolio. That’s a tactic known as micro investing.

Former Wall Street pros Brandon Krieg and Ed Robinson founded Stash in 2015 with the goal of helping everyday people create a more secure financial future.

The company operates both a website and a mobile app. Stash offers retirement, banking, individual brokerage and custodial accounts with a monthly flat-fee subscription model.

It also offers personal finance education and an automated investing option.

Stash has become one of the most popular micro-investing apps in the United States with over 6 million users in 2021, according to the company’s website. Stash was last valued at $1.4 billion in 2021.

In this Stash review, we’ll discuss the different investment accounts the app offers, pros and cons, pricing and more.

But first, let’s explain how to open your account with Stash.

You can easily sign up with Stash by visiting the website or downloading the app.

Stash doesn’t require customers to deposit a minimum amount of money to open an account, but you’ll need at least $5 to start investing. Once your account is up and running, you can invest smaller increments (like 5 cents or less).

Sign up for Stash through The Penny Hoarder and we’ll give you $5 to get started!

You’ll need to provide some personal information during the sign-up process, including your legal name and birth date (you must be at least 18 years old to use Stash). You also must provide your Social Security number to prove you’re a legal U.S. citizen.

Next, you’ll be asked to answer a few questions to help Stash gauge your risk tolerance: conservative, moderate or aggressive.

Once that’s done, you can take a moment to get familiar with the app.

Stash offers three subscription plans that charge monthly fees. There are no trading fees or commission fees.

The Stash Beginner plan costs $1 per month and gives you access to a personal portfolio investment account, a Stash bank account and a debit card. You can pick your own individual stocks and ETFs, but the automated portfolio option isn’t available with Stash Beginner.

If you want access to a retirement investment account, or the Smart Portfolio automated investing feature, you’ll pay a $3 monthly fee.

Stash+ costs $9 per month, and gives you access to two custodial investment accounts for children. Stash+ members get a fancy metal debit card and earn double Stock-Back® rewards, a program that lets you earn pieces of stock when you shop. You can also opt in to $10,000 worth of life insurance offered by Avibra.

Stash’s flat monthly fee is unlike many other robo-advisors and online brokers, which charge a management fee as a percentage of your portfolio balance.

For example, Betterment and Wealthfront charge a 0.25% annual management fee for their basic portfolios. So, if you had $1,000 in your Betterment investment account, you’d pay just $2.50 a year in management fees.

This can make Stash’s monthly fees a drawback for users with low account balances.

Still, at $1 a month, Stash Beginner is a fairly affordable taxable brokerage account, considering you also get access to a bank account and a Stash debit card. This entry-level option is cheaper than Acorns, Stash’s biggest competitor.

The fixed-cost $1 model also becomes more affordable if you invest a significant amount of money as your portfolio value goes up but your fees don’t.

However, the price of Stash Growth is a little hard to swallow. Paying $36 a year to access an IRA and an automated portfolio is expensive compared to other online brokers.

And paying more than $100 a year for Stash+ just to get two custodial investment accounts and $10,000 of life insurance is honestly a bad deal for the average investor.

Stash gives you a few ways to start investing. One is a hands-on, DIY experience while the other takes a more automated approach.

Stash previously only allowed users to purchase their own individual investments without guidance. That changed in March 2021, when the company rolled out Smart Portfolio, its automated, robo-investment feature.

Stash lets you buy stocks and ETFs, or exchange-traded funds, which bundle numerous stocks or bonds into a single fund.

Stash invests your money using fractional shares, which are tiny pieces of stocks or ETFs. Fractional shares let you start investing in more expensive stocks — such as Apple, Tesla or Amazon — even if you don’t have enough cash to buy an entire share at first.

Fractional share investing starts at 1 cent and is available for every investment account on the Stash platform.

Round-ups are another way to micro-invest with Stash. After linking a credit or debit card, Stash will round your purchases to the nearest dollar and invest the difference. It’s an easy and painless way to invest without thinking about it.

Stash also gives you the option to automatically reinvest dividends back into your portfolio, keeping your money working at all times. You can enable this feature on any Stash investing, retirement or custodial account.

The “Invest” button on the app’s bottom toolbar lets you explore your investment options.

You can look up specific stocks or ETFs in the search box, or if you want some guidance, Stash can offer suggested investments for you. Tap “Get Recommendations” to get feedback on how to better diversify your portfolio and manage your risk.

Another option is to search different company categories, such as energy, finance, media and technology.

Stash renames many of the ETFs with descriptive, fun titles that make it easy for new investors to understand what’s inside. For example, the Vanguard Emerging Markets Stock Index Fund (VWO) is titled “Up & Coming” while the SPDR Health Care Select Sector (XLV) is titled “Doctor, Doctor!”

You can read a brief overview of any investment, peep the risk level, and if you’re looking at an ETF, see a list of its top company holdings. You can tap over to the performance section for a visual representation of the asset’s past performance.

Once you choose your investments, select “Add to Portfolio.” You’ll be prompted to select how much you want to invest — whether with a one-time purchase or a scheduled, recurring investment.

As time goes by, you can check in on your investments by visiting your portfolio’s home page. Your Stash investment page breaks down your portfolio’s total value and total return.

The app also provides Stash Coach, a game where you earn points and level up after completing investment and personal finance challenges. It will help you with guidance and recommendations, too. You can find this feature when you tap “Home.”

Invest, Stash’s personal taxable brokerage account, is the company’s flagship feature.

However, the Stash app has expanded its services over time, giving you additional ways to build your financial foundation.

Stash Review: Services and Features

All Stash subscribers get access to two automated saving and investing tools called Auto-Stash. This can help set your finances to autopilot, so you don’t have to actively deposit money into your account.

You can enable or turn off Auto Stash at any time.

Auto Stash includes:

Stash Retire is the app’s individual retirement account (IRA) option. Through Stash, you can open a traditional or Roth IRA to save for retirement in a tax advantaged account. You can fund your Stash Retire account the same ways you fund a Stash Invest account.

However, Stash doesn’t offer automated management for IRAs, so you’ll need to pick your own investments.

Stash lets you open custodial accounts for minors, whether you’re their parent or not.

A custodial account is essentially a brokerage account for kids, with some investing and tax benefits.

These investment portfolios are technically known as Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) accounts. Different states typically allow one or the other, so Stash will pick the type of account that meets your state’s requirements.

You can fund custodial brokerage accounts the same ways you fund a personal Stash Invest account. When the child reaches the age of majority (this varies by state, but it’s usually 18 or 21), they get control of the account, and can continue to invest or withdraw the money.

The $9 per month Stash+ subscription lets you open up two custodial accounts for minors. It’s more expensive than Acorns, which gives you access to multiple custodial accounts for $5 a month.

All Stash subscribers can open a bank account through the company’s partner, Green Dot Bank.

The FDIC-insured digital bank account has no overdraft fees, minimum balance or monthly maintenance fees.

You also get mobile check deposits, bill pay and check writing services with your Stash debit account.

Stash bank accounts come with a Visa debit card linked to your account. You’ll also get access to over 19,000 fee-free ATMs nationwide with your Stash debit card.

Stash lets you earn stock investments while you shop.

When you use your Stash Visa debit card, you’ll earn Stock-Back® rewards, which are small pieces of stocks related to your purchase. For example, if you shop at Walmart, you’ll earn a piece of Walmart’s stock.

When you buy from a company that doesn’t have publicly traded stock — like your local hardware store — the Stash Stock-Back® program will invest a certain percentage into a stock or ETF of your choice.

You’ll earn 0.125% stock on everyday purchases, and up to 5% with certain merchants. Stash+ account users earn 2x stock.

You’ll receive the Stock-Back® debit card when you open and fund a Stash cash management account, which is available to all paid subscribers.

To take money out of your Stash investment account, you may have to sell some of your stocks or ETFs.

To sell investments in the app:

You can set investments to sell anytime, and Stash will execute your sell order when the market is open. The amount you get from the sale depends on the value of your asset during that selling window.

After that, Stash will release your money into your cash balance.

Keep in mind — and this is really important — selling stocks isn’t like withdrawing money from the bank.

if you sell when a stock is worth less than when you bought it, you’ll lose money. There’s also tax consequences, especially if you sell an asset you’ve owned less than one year.

And if you withdraw money from your Stash retirement account — especially a traditional IRA — you’ll get slammed with a 10% penalty from the IRS if you’re under the age of 59.5.

In general, it’s best to hold stocks over the long term.

Curious about the best time to sell a stock? Here are 3 good reasons and 3 not so good reasons to sell.

Follow these directions to properly close your account.

If you have a question the Stash FAQ page can’t answer, you can contact the company’s support team via phone or email Monday through Friday, 8:30 a.m. to 6:30 p.m. ET.

Their customer support phone number is 800-205-5164 and their email address is [email protected]. Email support is also available on weekends from 9 a.m. to 5 p.m.

Every investment app has its pros and cons. Here are some of the advantages and drawbacks of Stash.

Yes, Stash is legitimate, and no, it’s not a scam. The app is all about security, too. It has 256-bit encryption (that’s what a lot of banks use), and you can set up fingerprint or facial recognition access.

When you open an account, you’ll create a four-digit security code, which you’ll be required to enter each time you open the app. You can set up thumbprint access, too.

Yes. You’ll earn money as your investments gain value over time. Customers with a Stash Visa debit card can also earn 0.125% stock on everyday purchases and up to 5% in stock at certain retailers. Finally, Stash also offers referral bonuses to users who get their friends and family to sign up for the app.

Stash doesn’t “steal” your money, but if you have the Auto-Stash feature turned on, the app will automatically round-up purchases made with a linked debit card and/or make scheduled recurring transfers. But that money goes into your portfolio — so it’s still yours.

You can adjust your Auto-Stash settings or turn them off completely at any time.

Yes, you can trust Stash with your Social Security number. As a financial institution, Stash is required by law to obtain, verify and record this information. The company also needs your SSN to prepare an annual tax reporting form for you.

Rachel Christian is a Certified Educator in Personal Finance and a senior writer for The Penny Hoarder.

The Penny Hoarder is a paid Affiliate/ partner of Stash. Investment advisory services offered by Stash Investments LLC, an SEC-registered investment adviser.

*Offer is subject to Promotion Terms and Conditions To be eligible to participate in this Promotion and receive the bonus, you must successfully open an individual brokerage account in good standing, link a funding account to your Invest account AND deposit $5.00 into your Invest account.

Bank Account Services provided by Green Dot Bank, Member FDIC. Account opening of the bank account is subject to Green Dot Bank approval. Investment products and services provided by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.

Stock-Back® rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A. or any of their respective affiliates, and none of the forgoing has any responsibility to fulfill any stock rewards earned through this program.

For additional disclosures, click here.

This article contains general information and explains options you may have, but it is not intended to be investment advice or a personal recommendation. We can’t personalize articles for our readers, so your situation may vary from the one discussed here. Please seek a licensed professional for tax advice, legal advice, financial planning advice or investment advice.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings