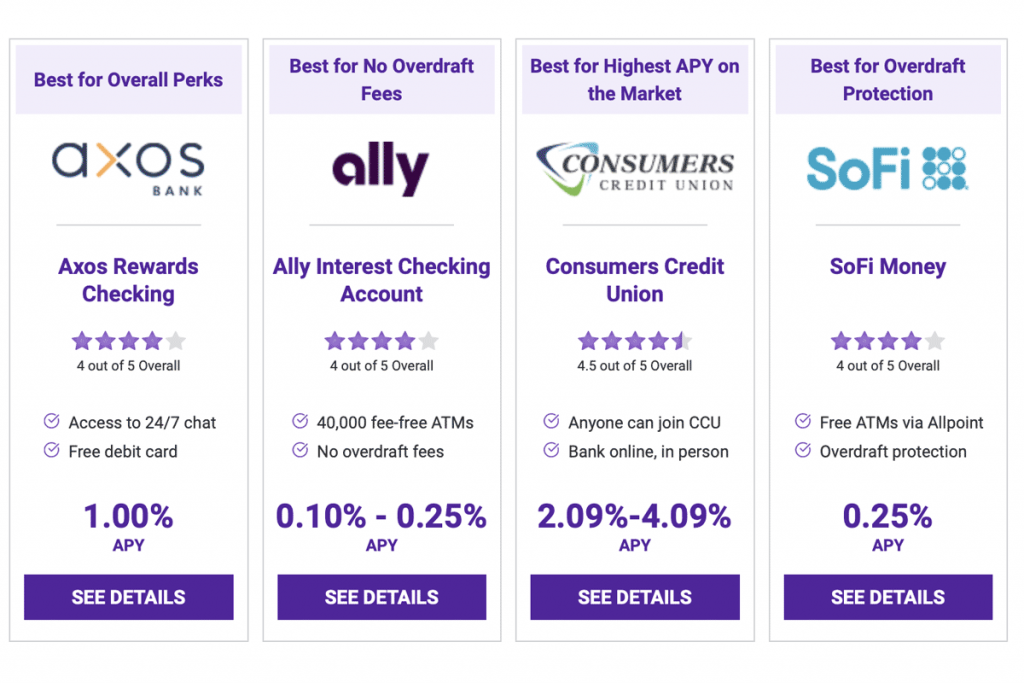

Best for Overall Perks

Axos Rewards Checking

1.00%

APY

Best for No Overdraft Fees

Ally Interest Checking Account

0.10% – 0.25%

APY

Best for Highest APY on the Market

Consumers Credit Union

2.09%-4.09%

APY

Best for Overdraft Protection

SoFi Money

0.25%

APY

by Kathleen Garvin

Contributor

When you think of interest-generating bank accounts, your mind likely goes to savings. After all, that’s your reward for building an emergency fund or socking away money for a future expense, right? A regular, end-of-month deposit into your savings account, courtesy of your bank.

The good news: You can also earn interest with select checking accounts.

What Is a High-Interest Checking Account?

A high-interest, or high-yield, checking account offers a higher interest rate (annual percentage yield, or APY) on your money. Unlike a traditional checking account, you may have to keep a minimum balance in the account at all times and meet other requirements — for instance, pay a monthly fee, make a certain number of debit card purchases or schedule a recurring direct deposit — to earn the higher interest rate.

High-interest checking accounts are a solid way to earn more for your money. Whether you bank with a federal credit union, online bank or other type of financial institution, high-yield checking accounts can be a great place to store your cash.

Here’s an overview of high-yield checking accounts, what you need to know when choosing one and the top checking accounts available in the market today.

The 7 Best High-Interest Checking Accounts

| Name | APY | Monthly Fees | |||

|---|---|---|---|---|---|

| SoFi Money | 0.25% | None | SEE DETAILS | ||

| NBKC Everything Checking Account | 0.15% | None | SEE DETAILS | ||

| Consumers Credit Union | 2.09% to 4.09% | None | SEE DETAILS | ||

| Charles Schwab High Yield Investor Checking | 0.03% | None | SEE DETAILS | ||

| Capital One 360 Checking Account | 0.10% | None | SEE DETAILS | ||

| Ally Interest Checking Account | 0.10% to 0.25% | None | SEE DETAILS | ||

| Axos Rewards Checking | 1.00% | None | SEE DETAILS |

Here are the seven best high-interest checking accounts where you can save your money and make a little more at the same time.

SoFi Money

- Free debit card

- Fee-free ATM usage via Allpoint

- Overdraft protection

NBKC Everything Checking Account

- 24/7 mobile banking

- Up to $12 monthly ATM-fee reimbursement

- No foreign transaction fees

Consumers Credit Union

- Free nationwide checking

- Anyone can join CCU

- Can bank online or in person

Capital One 360 Checking Account

- 70,000 fee-free ATMs

- 24/7 banking

- Options for overdraft protection

Charles Schwab High-Yield Investor

- Low opening requirement

- Unlimited ATM fee rebates worldwide

- Need linked brokerage account

Ally Interest Checking Account

- 40,000 fee-free ATMs

- No overdraft fees

- Super-transparent fees

Axos Rewards Checking

- Access to 24/7 to virtual financial assistant

- Free debit card

- Low minimum opening deposit

Why You Should Consider High-Yield Checking Accounts

We’ll be honest — with today’s interest rates, you won’t be raking in the dough like in years past. The national average for interest checking accounts is a not-so-hot 0.03% annual percentage yield (APY), according to the FDIC.

However, if you can earn something versus nothing for keeping your money in a checking account, we think it’s worth exploring. Any secure account where you can safely store and grow your money is a win in our book.

Check out our current list of bank promotions for a chance to gain a monetary bonus when signing up for a new bank account.

Who Can Get a High-Yield Checking Account?

The short answer? Anyone 18 years old and up. To open any account in the U.S., you typically need the following:

- Be age 18 and older

- A U.S. citizen

- Your social security number

- A government-issued ID

Certain accounts might suit different individuals better. For instance, a super-organized person who can meet some banks’ regular requirements to earn a higher interest rate might fare better with one type of account than someone who’s more of a “set it and forget it” type who will be fine with a lower rate and fewer requirements.

Regardless, anyone can benefit from a high-interest checking account.

How Banks Offer Higher Interest Rates

Banks offer attractive rates to incentivize people to open accounts with and keep their money with them. Some companies are able to offer even higher rates than their competitors. For example, online-only banks typically have an edge here. They have less overhead than their brick-and-mortar counterparts and can pass these savings (in the form of higher interest rates) on to consumers.

What to Look for When Opening a High-Interest Checking Account

You want to have a lay of the land before you sign on the (digital) dotted line for a new bank account. Here are some key items you want to review before going with a high-interest checking account:

- The APY

- Minimum to open the account

- Monthly maintenance fee

- ATM fee

- Minimum deposit requirement

- Direct deposit requirement

- Daily balance requirement

- Number of debit card transactions you need to hit

Rates can change, so make sure you review your account offerings compared to others on the market from time to time to ensure you have the best setup for you.

How to Choose a High-Interest Checking Account

If you’re thinking about moving to a high-interest checking account, take a few things into consideration.

- Look for accounts that won’t negate those interest earnings by charging you fees. However, if you carry a high balance, it may be worth paying a small monthly fee to get a better interest rate. Do the math.

- Keep an eye on minimum balance requirements. We focused on accounts that don’t require a minimum balance, but if you know that you’ll consistently have at least $1,000 in your account at all times, you may want to shop around a bit more. There may be a great deal out there.

- Look at the requirements. Maybe you don’t use your debit card that much or you don’t want to have a direct deposit. Choose an account that fits with the way you like to use your account.

- Keep ATMs in mind if you use them. It’s 2021, and you shouldn’t have to pay those fees. There are too many banks that are willing to cover those for you.

- Look for accounts with a mobile app. If you do a lot of banking on your phone, make sure the bank you choose has a solid banking app. Once you find the checking account that checks all the right boxes for you and how you like to use your account, sign up and start earning money on your money already.

- Think outside the box. If your primary bank doesn’t offer a high-yield checking account (or the rates or monthly fees are a no-go), see what else is available. Consider all your options for opening a checking account — whether it’s a brick-and-mortar bank, credit union, digital-only service or other institution altogether, it quite literally pays to open an account with a bank that will reward you for having an account with them.

Frequently Asked Questions (FAQs) About High-Interest Checking Accounts

Here, we’ve answered popular questions about high-interest checking accounts.

How We Picked the 7 Best Checking Accounts That Pay Interest

Our methodology for this list is simple: According to the FDIC, the average interest rate for interest-bearing checking accounts is currently 0.03%. So, we looked for accounts that came in around that range or, ideally, were higher. (Note: APR fluctuates over time, so a lower rate now could rise in the future.)

Beyond the interest rate, we looked at what else the account brings to the table. We gave preference to ones that don’t have maintenance fees or require minimum balances and that offer ATM fee reimbursement.

Contributor Kathleen Garvin (@itskgarvin) is a personal finance writer based in St. Petersburg, Florida, and former editor and marketer at The Penny Hoarder. She owns a content-writing business and her work has appeared in U.S. News, Clark.com and Well Kept Wallet.

When you think of interest-generating bank accounts, your mind likely goes to savings. After all, that’s your reward for building an emergency fund or socking away money for a future expense, right? A regular, end-of-month deposit into your savings account, courtesy of your bank.

The good news: You can also earn interest with select checking accounts.

A high-interest, or high-yield, checking account offers a higher interest rate (annual percentage yield, or APY) on your money. Unlike a traditional checking account, you may have to keep a minimum balance in the account at all times and meet other requirements — for instance, pay a monthly fee, make a certain number of debit card purchases or schedule a recurring direct deposit — to earn the higher interest rate.

High-interest checking accounts are a solid way to earn more for your money. Whether you bank with a federal credit union, online bank or other type of financial institution, high-yield checking accounts can be a great place to store your cash.

Here’s an overview of high-yield checking accounts, what you need to know when choosing one and the top checking accounts available in the market today.

The 7 Best High-Interest Checking Accounts

Here are the seven best high-interest checking accounts where you can save your money and make a little more at the same time.

We’ll be honest — with today’s interest rates, you won’t be raking in the dough like in years past. The national average for interest checking accounts is a not-so-hot 0.03% annual percentage yield (APY), according to the FDIC.

However, if you can earn something versus nothing for keeping your money in a checking account, we think it’s worth exploring. Any secure account where you can safely store and grow your money is a win in our book.

Check out our current list of bank promotions for a chance to gain a monetary bonus when signing up for a new bank account.

The short answer? Anyone 18 years old and up. To open any account in the U.S., you typically need the following:

Certain accounts might suit different individuals better. For instance, a super-organized person who can meet some banks’ regular requirements to earn a higher interest rate might fare better with one type of account than someone who’s more of a “set it and forget it” type who will be fine with a lower rate and fewer requirements.

Regardless, anyone can benefit from a high-interest checking account.

Banks offer attractive rates to incentivize people to open accounts with and keep their money with them. Some companies are able to offer even higher rates than their competitors. For example, online-only banks typically have an edge here. They have less overhead than their brick-and-mortar counterparts and can pass these savings (in the form of higher interest rates) on to consumers.

You want to have a lay of the land before you sign on the (digital) dotted line for a new bank account. Here are some key items you want to review before going with a high-interest checking account:

Rates can change, so make sure you review your account offerings compared to others on the market from time to time to ensure you have the best setup for you.

If you’re thinking about moving to a high-interest checking account, take a few things into consideration.

Here, we’ve answered popular questions about high-interest checking accounts.

Our methodology for this list is simple: According to the FDIC, the average interest rate for interest-bearing checking accounts is currently 0.03%. So, we looked for accounts that came in around that range or, ideally, were higher. (Note: APR fluctuates over time, so a lower rate now could rise in the future.)

Beyond the interest rate, we looked at what else the account brings to the table. We gave preference to ones that don’t have maintenance fees or require minimum balances and that offer ATM fee reimbursement.

Contributor Kathleen Garvin (@itskgarvin) is a personal finance writer based in St. Petersburg, Florida, and former editor and marketer at The Penny Hoarder. She owns a content-writing business and her work has appeared in U.S. News, Clark.com and Well Kept Wallet.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings