It’s important to maintain your automated financial system. Every year, I spend a few hours re-reviewing my system and making any changes necessary. For example, have I added subscriptions that I don’t need anymore? Should I adjust my Conscious Spending Plan to account for new short-term goals? Set aside some time every year—I recommend December so you can start the next year off right—to go through each of the steps below.

Use these as general guidelines, but take them seriously: If your money is following these suggested percentages, that’s a Big Win toward a Rich Life.

Many companies will offer you introductory rates or lower your monthly fees if you ask. You can use my word-for-word scripts.

I’ve never sold a single one of my investments. Why would I? I’m investing for the long term. But I still get questions about selling investments. In general, anytime you sell your investments, you’ll be eligible to pay taxes when April 15 rolls around. The government has created incentives for long-term investing: If you sell an investment that you’ve held for less than a year, you’ll be subject to ordinary income tax, which is usually 25 to 35 percent. Most people who buy a stock and make $10,000 in nine months and stupidly decide to sell it really pocket only $7,500.

If, however, you hold your investment for more than a year, you’ll pay only a capital-gains tax, which is much lower than your usual tax rate. For example, take the same person who sold their stock in nine months and paid 25 percent in ordinary income taxes. If they’d held that stock over a year, then sold it, they would have only paid 15 percent in capital-gains taxes. Instead of only netting $7,500, they would have ended up with $8,500. (Now imagine that happening with $100,000, or $500,000, or millions of dollars. If you save and invest enough by following the IWT system, that’s extremely likely.) This is a small example of big tax savings from holding your investments for the long term.

Here’s the trick: If you’ve invested within a tax-advantaged retirement account, you don’t have to pay taxes in the year that you sell your investment. In a 401(k), which is tax deferred, you’ll pay taxes much later, when you withdraw your money. In a Roth IRA, by contrast, you’ve already paid taxes on the money you contribute, so when you withdraw, you won’t pay taxes at all.

Since you presumably made a good investment, why not hold it for the long term?

Previously, I showed you how buy-and-hold investing produces dramatically higher returns than frequent trading. And once you’ve factored in taxes, the odds are stacked against you if you sell. This is yet another argument for not buying individual stocks and instead using target date funds or index funds to create a tax-efficient, simple portfolio. Remember, all of this assumes that you made a good investment.

Bottom line: Invest in retirement accounts and hold your investments for the long term.

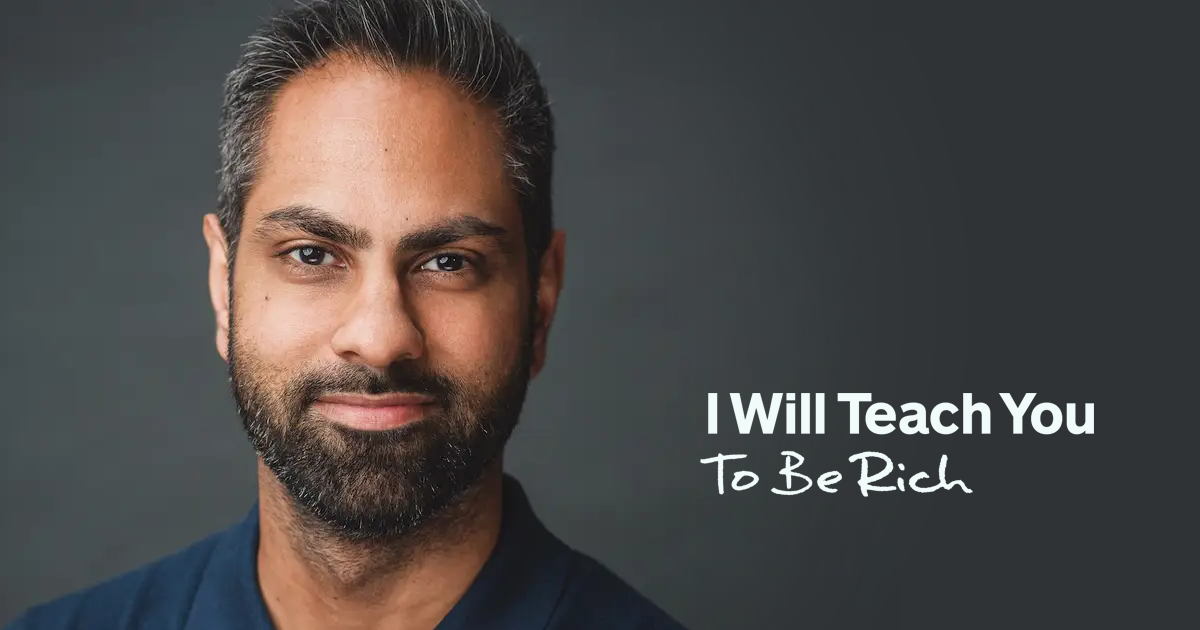

Copyright I Will Teach YouTo Be Rich ©2022