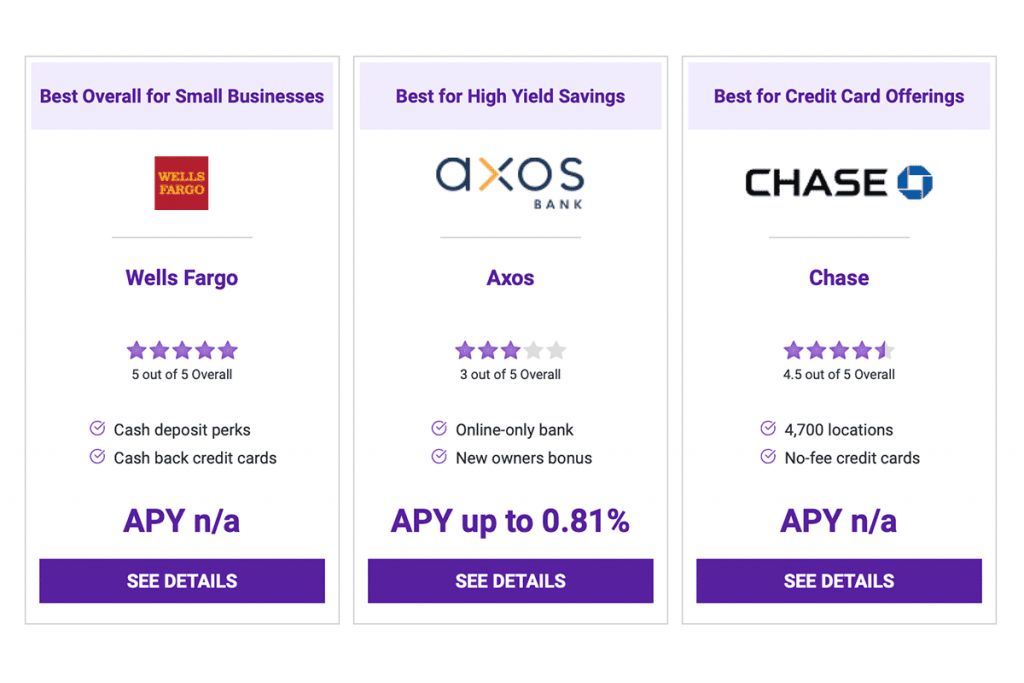

Best Overall for Small Businesses

Wells Fargo

APY n/a

Best for High Yield Savings

Axos

APY up to 0.81%

Best for Credit Card Offerings

Chase

APY n/a

by Dana Sitar, CEPF®, Jake Bateman

If you’ve started your own company — or you’re considering the move — you’ve likely marveled at the logistics required to pull it off.

Popular first-time small business owner (SMB) questions include:

- How do taxes work now?

- What do I need to know about buying health insurance?

- What exactly qualifies as a business expense?

There are many changes when you run your own show. And when you become a business owner, your banking needs to change, too.

That’s right, you need a business account.

Since vetting banks and business checking accounts probably isn’t how you want to spend your time when you’re self-employed, we did the leg work for you.

Here are some of the best bank accounts (specifically checking accounts) at a glance for small business owners.

Because we’re talking to SMBs about business savings and business checking accounts, we leaned into information specific to that audience. Meaning, we focused more on banking services that cater to those just starting out and whose cash flow might not be cracking six figures yet.

Best Banks for Small Businesses 2021

| Bank | Key Feature | Prime Perk | ||||

|---|---|---|---|---|---|---|

| Wells Fargo | 100 free transactions | 4,900 locations | SEE DETAILS | |||

| Chase | $400 signup bonus | 4,700 locations | SEE DETAILS | |||

| Capital One | Unlimited transactions | 70,000 ATMs | SEE DETAILS | |||

| Axos | $100 signup bonus | Digitally savvy | SEE DETAILS | |||

| Navy Federal Credit Union | Member owned | For military personnel | SEE DETAILS | |||

| BlueVine | High-yield checking | No overdraft fees | SEE DETAILS |

To be clear, none of these companies paid The Penny Hoarder to make the list. And a reminder: We don’t know your business finances or your cash flow like you do. The best bank for your small business is going to depend on your situation.

Now, here are our favorites.

Wells Fargo

- 100 fee-free transactions

- $5,000 in free cash deposits/month

- $25 minimum deposit

If your business can keep a reliable daily balance, Wells Fargo’s business accounts come cheap. It’ll only cost you $25 to open an Initiate Business Checking account at Wells Fargo. The Business Market Rate Savings Account also includes a $25 minimum opening deposit. Wells Fargo also offers unsecured business loans between $5,000 and $100,000 for fixed interest rates as low as 1.75% APR. Secured or unsecured business credit cards with 1.5% cash back and sign-up bonuses between $300 and $500 are also available.

Chase

- 4,700 brick-and-mortar branches

- Fee waivers for accounts with minimum balances

- $300 sign-up bonus

As another “big four” bank, Chase’s business checking account offers familiar perks: a reliable brand and enough resources to keep things convenient. But its credit card offerings are particularly worth noting. The Ink Business Unlimited and Ink Business Cash cards offer rewards and a $750 sign-up bonus. Unlimited earns you 1.5% cash back on all purchases, and the Cash card earns you 5% back on select categories. Chase also offers business loans starting at $10,000 with varying interest rates and lines of credit up to $350,000. There’s a $400 reward for opening a Chase Business Complete checking account through Jan. 20, 2022.

The Penny Hoarder review of Chase.

Capital One

- Free cash deposits up to $5,000/month

- 0.20% APY guarantee for 12 months

- $0 monthly fee with minimum balance

You can likely guess that the credit card options landed Capital One on the list, but the checking and savings account options are worth a nod as well. If your main priority is credit cards, Chase may beat Capital One out, but if you’re looking for comprehensive service (read: better savings and checking options), Capital One could be for you.

Along with an affordable bank account, Capital One offers three business credit cards and includes information upfront about the credit score you need to qualify for each one. Its cards offer between 1% and 2% cash back, free employee cards with spending limits and options for no annual fee. It also offers equipment loans, business installment loans and lines of credit that start at $10,000. Loan term lengths and repayment terms vary.

Axos

- Online-only bank

- Up to 0.81% APY

- $100 bonus for new business owners

Axos’ checking and savings offerings fall short of Capital One’s and Wells Fargo’s, and there are no credit cards. But if you’ve been in business for a few years, are looking for more substantial lending and don’t have a considerable sum of transactions each month, Axos Bank is worth a look. Your money will earn a high APY, but you’ll have to earn your fee waiver.

Axos Business Savings requires a $1,000 initial deposit and pays 0.20% APY. The $5 monthly fee is waived with an average daily balance of $2,500. The bank offers lines of credit and commercial loans starting at $250,000 to businesses at least two years old. It doesn’t offer any credit cards.

The Penny Hoarder review of Axos Bank.

Navy Federal Credit Union

- No monthly service fee

- 30 free non-electronic transactions

- Member-owned nonprofit institution

You’re a small business owner now. Maybe you don’t want to do business with a multibillion-dollar corporation. If that’s your speed, a credit union like Navy Federal might be right for you. These member-owned nonprofits can provide a comfort and familiarity that the big four can’t offer, even if they can’t match the perks.

In addition to its Business Checking account, Navy Federal offers secured and unsecured business loans starting at $35,000, and rewards credit cards from Visa and Mastercard with no annual fee.

BlueVine

- 0.60%% APY on balances up to $100,000

- No monthly fees or minimum balance requirements

- No overdraft or NSF fees

BlueVine is an honorable mention in this list, because it doesn’t offer a full suite of business banking services. But its 0.60% APY on your business checking account balance makes it stand out among even modern banks for businesses, so it’s worth mentioning. With the account, you can pay vendors and bills by ACH, wire or check and set up recurring payments. You can also apply for credit lines up to $250,000 with rates as low as 4.8%. If a brick-and-mortar location isn’t a top priority, add this one to your list.

What Is a Business Bank Account and Why Do You Need One?

A business bank account is where you keep your money for the company. It’s an account used specifically for the business — so, separate from your personal checking or savings accounts — where you hold your earnings, pay for related expenses (supplies, vendor services, utilities, etc.) and more.

Keeping these transactions separate is helpful come tax time. If you choose to apply for a business loan (some banks require you to have an account for a designated time period) or relief funds down the road, you’ll also need an account to share your financials and house the money.

No matter how big or small your operation is, it’s strongly recommended that you open a business bank account. At a minimum, a business checking account; it’s a good way to stay organized, period. You want a place to keep track of all the money coming in and out of your business and have a clear-cut record of your finances.

Banks for Small-Business Owners

Most major banks offer business accounts, as well as many credit unions. You can opt to open an account with an online-only bank or solely brick-and-mortar institution, or choose one that offers a hybrid model.

If your personal bank offers business bank accounts, that might incentivize you to open an account with your current organization — but run the numbers first. While you may have access to the merchant services you’re accustomed to and be able to link accounts (and seamlessly transfer money from your business bank accounts to your personal checking account, for example), there may be higher transaction fees or hidden costs.

You have lots of options when it comes to banks for small business, so do some research.

Common Types of Business Checking and Savings Accounts

Like with personal accounts, you have many options when it comes to choosing a business bank account. Here are the basics when it comes to business banking:

Business Checking Account

Some banks, specifically larger ones, may offer a variety of business checking accounts. Depending on factors such as your daily minimum balance, the number of transactions performed in a month and the amount of services you need, you can choose a checking account to fit your needs and budget.

Business Savings Account

You can select this type of account to build cash reserves and earn interest on your money. And similarly, some banks offer more than one type of account (ranging in monthly maintenance fees) based on how much money you plan on saving and the number of transactions you make in a month.

Business High-Yield Business Savings Account

With this type of account, you have an opportunity to earn higher interest rates on your money. Typically, there is a higher minimum deposit required and tighter restrictions around the number of monthly transactions allowed for this account.

Many banks offer business loans and business credit cards (more on those next) and certificate of deposit (CDs). You also want to keep an eye out for new-business-account bonuses (usually in the form of a couple hundred dollars) for owners just opening their account.

There’s no one “best bank for small business,” so it’s important to take inventory of what you want and need when it comes to business banking. With that said, keep reading for our picks for the best banks for small business owners.

What to Look for in Business Banking

There are several angles you could take to determine the best banks for small businesses, depending on the business needs of your company. To help you choose the best for your business, we focused on three banking services: Small business checking account and business savings account options; small business lending, and business credit cards.

Small-Business Checking Account and Business Savings Account Options

We looked at balance requirements, (monthly) fees and transaction and deposit limits.

In general, it’s a good idea to look for business bank accounts that offer the following:

- A low minimum balance requirement

- A low monthly maintenance fee (or one that can be easily waived)

- Minimum monthly service fees (bonus for no monthly fees!)

- Free business checking

- A business debit card

- Free cash deposits (at least up to a point)

- Online banking

- Mobile banking (an app)

- Online bill pay

- Payroll services

Unlimited and free transactions (or banks that offer a reasonable limit for your needs) are also good to look for. Related, if your small business is verging into medium-sized-business territory, you might be eligible for free XYZ until you reach a certain limit. In that case, it may be worthwhile to move up to the next business checking account level to match your needs.

Small-Business Lending

There are three main ways you can borrow money for your business. We compared what banks offered across these three categories:

- If you’re a qualified small business owner, you can take out SBA loans, which are backed by the Small Business Administration and, as a result, come with lower interest rates.

- You can also secure a business term loan, which operates in the same way as a personal loan.

- You can secure a business line of credit, which can provide you with flexibility if you’re not sure how much money you need.

Business Credit Cards

While we don’t advocate spending just to get credit rewards, there’s no reason to leave perks for your existing expenses on the table. We looked at the annual fees, interest rates and perks each bank offers with their small business credit cards.

Your needs may be more complicated, but they likely include these basic merchant services. So here’s how the best small business banks stack up.

Find the Best Bank for Your Small Business

You have many options when it comes to small business bank accounts. And your mileage with different banks and business checking accounts will vary depending on your wants and needs.

Ultimately, only you can determine the best business bank account for you and your business.

Do you want to use the same bank for your personal account, for example? Are you willing to step outside of the free checking options to earn more perks? Are you holding out for a debit card you can put your dog’s face on?

No matter what’s on your checklist, the options listed here should give you an idea of where to look next. If Wells Fargo and Chase were catching your eye, for instance, it might be worth comparing offerings from other big banks like Bank of America and Citibank as well.

And if you like the idea of Navy Federal, search for credit unions in your area to compare. If your small business is location-based and caters to a local cliente, working with a neighborhood credit union might benefit you in other ways a bigger bank cannot.

The right bank for your business and personal finances is out there. You’ve just got to hunt it down.

Frequently Asked Questions (FAQs) About Small-Business Banks

We’ve rounded up and answered some of the most common questions about small business banks.

Dana Sitar is a Certified Educator in Personal Finance and has been writing and editing for online audiences since 2011, covering personal finance, careers and digital media. She is a former staffer at The Penny Hoarder. Her work has appeared in the New York Times, CNBC, The Motley Fool, Inc. and more. Information from former contributor Jake Batemen is included in this review.

If you’ve started your own company — or you’re considering the move — you’ve likely marveled at the logistics required to pull it off.

Popular first-time small business owner (SMB) questions include:

There are many changes when you run your own show. And when you become a business owner, your banking needs to change, too.

That’s right, you need a business account.

Since vetting banks and business checking accounts probably isn’t how you want to spend your time when you’re self-employed, we did the leg work for you.

Here are some of the best bank accounts (specifically checking accounts) at a glance for small business owners.

Because we’re talking to SMBs about business savings and business checking accounts, we leaned into information specific to that audience. Meaning, we focused more on banking services that cater to those just starting out and whose cash flow might not be cracking six figures yet.

Best Banks for Small Businesses 2021

To be clear, none of these companies paid The Penny Hoarder to make the list. And a reminder: We don’t know your business finances or your cash flow like you do. The best bank for your small business is going to depend on your situation.

Now, here are our favorites.

If your business can keep a reliable daily balance, Wells Fargo’s business accounts come cheap. It’ll only cost you $25 to open an Initiate Business Checking account at Wells Fargo. The Business Market Rate Savings Account also includes a $25 minimum opening deposit. Wells Fargo also offers unsecured business loans between $5,000 and $100,000 for fixed interest rates as low as 1.75% APR. Secured or unsecured business credit cards with 1.5% cash back and sign-up bonuses between $300 and $500 are also available.

As another “big four” bank, Chase’s business checking account offers familiar perks: a reliable brand and enough resources to keep things convenient. But its credit card offerings are particularly worth noting. The Ink Business Unlimited and Ink Business Cash cards offer rewards and a $750 sign-up bonus. Unlimited earns you 1.5% cash back on all purchases, and the Cash card earns you 5% back on select categories. Chase also offers business loans starting at $10,000 with varying interest rates and lines of credit up to $350,000. There’s a $400 reward for opening a Chase Business Complete checking account through Jan. 20, 2022.

The Penny Hoarder review of Chase.

You can likely guess that the credit card options landed Capital One on the list, but the checking and savings account options are worth a nod as well. If your main priority is credit cards, Chase may beat Capital One out, but if you’re looking for comprehensive service (read: better savings and checking options), Capital One could be for you.

Along with an affordable bank account, Capital One offers three business credit cards and includes information upfront about the credit score you need to qualify for each one. Its cards offer between 1% and 2% cash back, free employee cards with spending limits and options for no annual fee. It also offers equipment loans, business installment loans and lines of credit that start at $10,000. Loan term lengths and repayment terms vary.

Axos’ checking and savings offerings fall short of Capital One’s and Wells Fargo’s, and there are no credit cards. But if you’ve been in business for a few years, are looking for more substantial lending and don’t have a considerable sum of transactions each month, Axos Bank is worth a look. Your money will earn a high APY, but you’ll have to earn your fee waiver.

Axos Business Savings requires a $1,000 initial deposit and pays 0.20% APY. The $5 monthly fee is waived with an average daily balance of $2,500. The bank offers lines of credit and commercial loans starting at $250,000 to businesses at least two years old. It doesn’t offer any credit cards.

The Penny Hoarder review of Axos Bank.

You’re a small business owner now. Maybe you don’t want to do business with a multibillion-dollar corporation. If that’s your speed, a credit union like Navy Federal might be right for you. These member-owned nonprofits can provide a comfort and familiarity that the big four can’t offer, even if they can’t match the perks.

In addition to its Business Checking account, Navy Federal offers secured and unsecured business loans starting at $35,000, and rewards credit cards from Visa and Mastercard with no annual fee.

BlueVine is an honorable mention in this list, because it doesn’t offer a full suite of business banking services. But its 0.60% APY on your business checking account balance makes it stand out among even modern banks for businesses, so it’s worth mentioning. With the account, you can pay vendors and bills by ACH, wire or check and set up recurring payments. You can also apply for credit lines up to $250,000 with rates as low as 4.8%. If a brick-and-mortar location isn’t a top priority, add this one to your list.

A business bank account is where you keep your money for the company. It’s an account used specifically for the business — so, separate from your personal checking or savings accounts — where you hold your earnings, pay for related expenses (supplies, vendor services, utilities, etc.) and more.

Keeping these transactions separate is helpful come tax time. If you choose to apply for a business loan (some banks require you to have an account for a designated time period) or relief funds down the road, you’ll also need an account to share your financials and house the money.

No matter how big or small your operation is, it’s strongly recommended that you open a business bank account. At a minimum, a business checking account; it’s a good way to stay organized, period. You want a place to keep track of all the money coming in and out of your business and have a clear-cut record of your finances.

Most major banks offer business accounts, as well as many credit unions. You can opt to open an account with an online-only bank or solely brick-and-mortar institution, or choose one that offers a hybrid model.

If your personal bank offers business bank accounts, that might incentivize you to open an account with your current organization — but run the numbers first. While you may have access to the merchant services you’re accustomed to and be able to link accounts (and seamlessly transfer money from your business bank accounts to your personal checking account, for example), there may be higher transaction fees or hidden costs.

You have lots of options when it comes to banks for small business, so do some research.

Like with personal accounts, you have many options when it comes to choosing a business bank account. Here are the basics when it comes to business banking:

Some banks, specifically larger ones, may offer a variety of business checking accounts. Depending on factors such as your daily minimum balance, the number of transactions performed in a month and the amount of services you need, you can choose a checking account to fit your needs and budget.

You can select this type of account to build cash reserves and earn interest on your money. And similarly, some banks offer more than one type of account (ranging in monthly maintenance fees) based on how much money you plan on saving and the number of transactions you make in a month.

With this type of account, you have an opportunity to earn higher interest rates on your money. Typically, there is a higher minimum deposit required and tighter restrictions around the number of monthly transactions allowed for this account.

Many banks offer business loans and business credit cards (more on those next) and certificate of deposit (CDs). You also want to keep an eye out for new-business-account bonuses (usually in the form of a couple hundred dollars) for owners just opening their account.

There’s no one “best bank for small business,” so it’s important to take inventory of what you want and need when it comes to business banking. With that said, keep reading for our picks for the best banks for small business owners.

There are several angles you could take to determine the best banks for small businesses, depending on the business needs of your company. To help you choose the best for your business, we focused on three banking services: Small business checking account and business savings account options; small business lending, and business credit cards.

We looked at balance requirements, (monthly) fees and transaction and deposit limits.

In general, it’s a good idea to look for business bank accounts that offer the following:

Unlimited and free transactions (or banks that offer a reasonable limit for your needs) are also good to look for. Related, if your small business is verging into medium-sized-business territory, you might be eligible for free XYZ until you reach a certain limit. In that case, it may be worthwhile to move up to the next business checking account level to match your needs.

There are three main ways you can borrow money for your business. We compared what banks offered across these three categories:

While we don’t advocate spending just to get credit rewards, there’s no reason to leave perks for your existing expenses on the table. We looked at the annual fees, interest rates and perks each bank offers with their small business credit cards.

Your needs may be more complicated, but they likely include these basic merchant services. So here’s how the best small business banks stack up.

You have many options when it comes to small business bank accounts. And your mileage with different banks and business checking accounts will vary depending on your wants and needs.

Ultimately, only you can determine the best business bank account for you and your business.

Do you want to use the same bank for your personal account, for example? Are you willing to step outside of the free checking options to earn more perks? Are you holding out for a debit card you can put your dog’s face on?

No matter what’s on your checklist, the options listed here should give you an idea of where to look next. If Wells Fargo and Chase were catching your eye, for instance, it might be worth comparing offerings from other big banks like Bank of America and Citibank as well.

And if you like the idea of Navy Federal, search for credit unions in your area to compare. If your small business is location-based and caters to a local cliente, working with a neighborhood credit union might benefit you in other ways a bigger bank cannot.

The right bank for your business and personal finances is out there. You’ve just got to hunt it down.

We’ve rounded up and answered some of the most common questions about small business banks.

Dana Sitar is a Certified Educator in Personal Finance and has been writing and editing for online audiences since 2011, covering personal finance, careers and digital media. She is a former staffer at The Penny Hoarder. Her work has appeared in the New York Times, CNBC, The Motley Fool, Inc. and more. Information from former contributor Jake Batemen is included in this review.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings