by Timothy Moore

Contributor

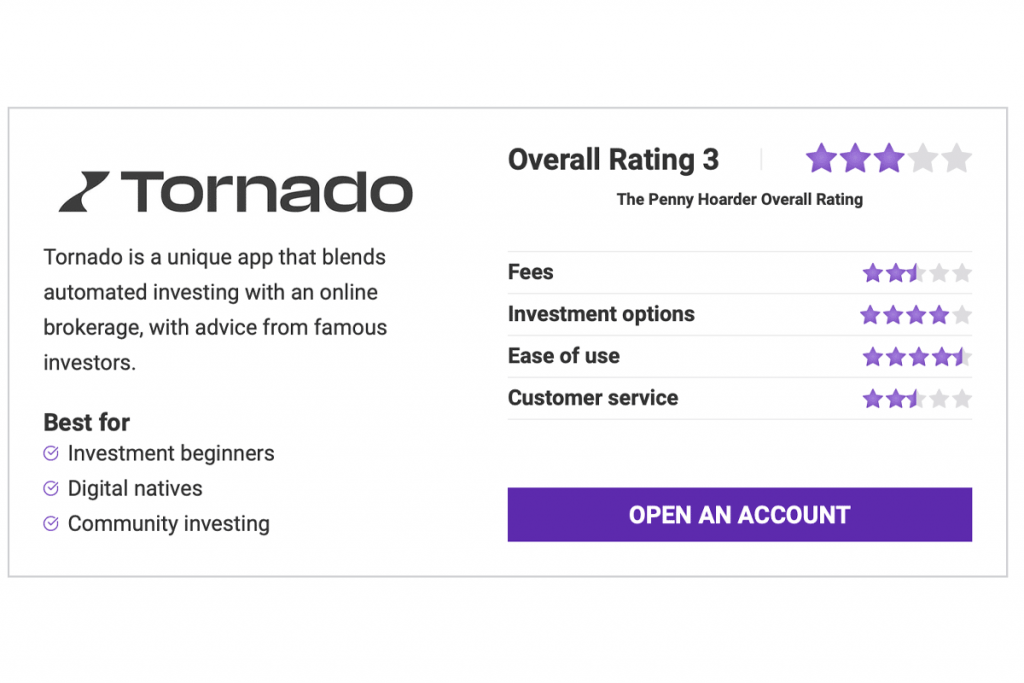

Tornado is one of many investment newcomers that seeks to shake up traditional investment practices. Rather than handing your money over to a traditional asset management firm like Fidelity, Vanguard, Goldman Sachs or JPMorgan Chase, Tornado leaves the power of investing in your hands (literally, as it’s all done via your smartphone).

Tornado, which was founded as Nvstr in 2015 by two hedge fund industry experts, Bernard George and Patrick Aber, is a hybrid platform that attempts to deliver the best of traditional online brokerages with the appeal of automated investing platforms (think robo-advisors).

George and Aber started Nvstr with the goal of leveling the playing field: making it just as easy for novice investors to strategically buy and trade stocks as it is for institutional investors.

As Tornado explains it, the platform is the first to offer advanced tech and tools for everyday investors and hyper-personalized news and discussions with other like-minded investors about personal finance, including stocks and exchange-traded funds (ETFs). The subscription fee is $4.99 per month.

In this Tornado review, we’ll explore the pros and cons of investing with Tornado to see if it has the features you want in a robo-advisor.

Creating an account with Tornado is easy, and there’s no minimum account balance to get started. But before you move forward with starting the service, let’s make sure that what it offers is actually what you’re looking for.

Services and Features at a Glance

If the 25 fee-free trades were all you got for Tornado’s monthly fee, it would patently not be worth it. However, Tornado makes a case for itself with several key features and investing tools that you can’t get elsewhere.

At its core, a membership with Tornado gets you 25 commission-free trades each month. If you reach these 25 trades, you’ll pay $4.50 per additional trade until the next month. If you don’t use your 25 trades in the current month, the remaining trades do not carry over into the next month.

To get these commission fee-free trades, you pay a monthly $4.99 subscription fee for the Tornado investing service.

Through the Tornado mobile app, you will be able to join a community of investors. You can see what other Tornado users are buying and selling and how their portfolios are doing and even chat 1-on-1 with community Thought Leaders to discuss your investment ideas and strategies. These Thought Leaders also share pros and cons of various stocks so you can weigh out decisions on your own.

Perhaps the coolest part of this community of investors is that you can access what some of the biggest names in investing are focusing on. Some of these professional investors include:

You can also chat with other investors at your level and swap strategies for successful portfolios.

Tornado saves you the trouble of parsing through the, well, tornado of news about stocks, bonds, ETFs, and personal finance by offering you ultra-personalized news related to your investments. Just make sure you have push notifications on so you can get real-time news alerts that are personalized to your portfolio.

Each day, scroll through the app for a deep dive into each stock in your investment portfolio, with news from only reputable sources. You can also add a particular stock to your watchlist to get news updates about investments you are considering.

One of the best features of Tornado — the portfolio optimizer tool — is somewhat gated. Though there is no minimum account balance for Tornado, you’ll find in the fine print that, to access one-click portfolio optimization, you need to have a brokerage account balance of at least $3,000. That makes Tornado less for casual investors looking to throw a couple hundred bucks in and see what happens—and instead for more serious investors who have the money to get started.

If you are going to pay the $4.99/month fee for Tornado, make sure you can maintain at least $3,000 in the brokerage account, as portfolio optimization is an important key feature that helps justify the monthly cost.

With a single click, Tornado will work like a robo-advisor, generating a diversified portfolio for you based on your risk tolerance.

You can feed information and investment ideas to Tornado to ensure the portfolio optimizer builds a portfolio to your liking. In addition to risk tolerance, you can indicate your interest and goals and, over time, perhaps more advanced preferences like minimum dividend income, investment horizon or stocks with a high conviction rating.

Many users like Tornado’s mix of hands-on investing and the automated portfolio optimization tool. You can choose your own stocks as you learn and monitor the market or just use the one-click portfolio optimizer to ensure a diversified account that is still in line with your own investment ideas.

Our Take: We think optimization should be standard for everyone regardless of account balance. Customers paying $4.99/month should have access to all the tools regardless of how much they can afford to invest.

If you are interested in the world of investing but concerned about risking actual money because you’re still a beginner, you can “practice” with Tornado’s simulated trading accounts. This is a free tool.

Simulated trading accounts allow you to experience the ups and downs of trading on the exchange using Tornado’s features like reviewing new investment ideas and one-click portfolio optimization.

In November 2021, Tornado launched its Learn and Earn program as a way to promote “financial wellness” among its clients. Investors can earn rewards — read money — by completing a series of modules on topics such as investing, stock markets and economics. The monetary rewards, up to $50, will be deposited into your brokerage account, usually within two days of being earned.

The bonus money can be invested as soon as it’s received, and it can be withdrawn one year after receipt if the account is in good standing. Tornado is considering future non-monetary rewards.

Tornado makes an appealing case for choosing it as your investment app, thanks to the multilayered security and abundance of insurance protecting your investments.

For starters, you will use either an iOS or Android mobile app for Tornado. All data is stored with 256-bit AES encryption.

Tornado is registered with FINRA (Financial Industry Regulatory Authority) and SEC (the US Securities and Exchange Commission). Tornado is also a member of SIPC (Securities Investor Protection Corporation) and promises up to $37.5 million in insurance with Lloyds of London.

Tornado’s mobile app functions much like a social media account, with news and community engagement. The app is easy to use and very intuitive for digital natives.

At the time of publication, the Tornado mobile app has a 4.6 star rating on the Apple App Store (based on 681 ratings) and a 4.5 star rating on Google Play. Though the number of reviews for Tornado is small compared to other investing apps, our own review of the app confirms these higher scores.

This is an area where Tornado is currently lacking. As an app-based company, there are no physical locations to go to for help. There is also no phone number to call. Customer service support is limited to email: [email protected].

The website has an extensive FAQ section, but we could not find an online chat option.

With Tornado, you can invest in US stocks, ETFs and American Depositary Receipts (ADRs); the latter is less commonly offered on platforms in this sphere.

However, while Tornado lets you purchase most stocks available on the New York Stock Exchange and NASDAQ, you are not able to trade foreign stocks or call options.

Tornado does not allow short selling for stocks and ETFs.

Let’s talk about one of the biggest reasons to consider opening a Tornado account: the promise of a sizable reward.

When you open a brokerage account with Tornado, you will be randomly assigned a reward value, ranging from $10 to $1,000. The $1,000 reward is rare, of course; only 0.02% of new users win it.

Sign-up Bonus Breakdown

Each time you refer someone to open a Tornado account (and they successfully sign up), you’ll be entered to win a reward as well.

There is a lot of fine print to the reward bonus, so be sure to give it a read before signing up, especially if this is the sole factor leading you to an account with Tornado.

So does an account with Tornado make sense for you? Let’s weigh out the pros and cons.

Still have questions about Tornado? We compiled some of our readers’ most commonly asked questions and found the answers.

Tornado is an innovative investment platform, but it’s not for everyone. If you are looking to be hands off, you can get better portfolio optimization from other robo-advisors at a lower (or no) cost. And if you don’t have $3,000 to invest, you cannot even take advantage of the portfolio optimization tool.

If you want to be hands on and are still learning, you might benefit from the educational tools within the Tornado app, as well as the conversations with other investors about your investment strategies. Having access to real-life investing pros like Warren Buffett is also a strong appeal.

Timothy Moore covers bank and investment accounts for The Penny Hoarder from his home base in Cincinnati. He has worked in editing and graphic design for a marketing agency, a global research firm and a major print publication. He covers a variety of other topics, including insurance, taxes, retirement and budgeting and has worked in the field since 2012.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings