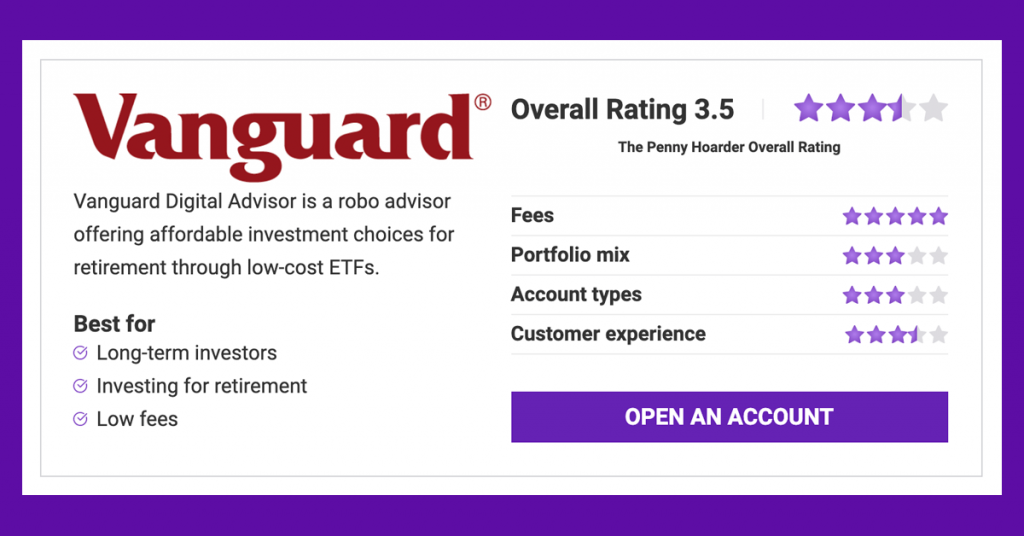

Vanguard Digital Advisor is the brokerage’s new automated advisor service, combining their low-cost exchange traded funds (ETFs) with some of the services of a traditional financial advisor.

Investors can receive a personalized plan to help them reach their retirement goals using varying allocations of Vanguard’s ETFs.

Vanguard Digital Advisor is a new offering from the Vanguard Group, a brokerage offering some of the world’s most popular exchanged traded and mutual funds. This Vanguard funds product is an offshoot of another investment management service called Vanguard Personal Advisor Services. Personal Advisor Services helps clients with portfolios of at least $50,000 and Vanguard Digital Advisor offers a lower barrier to entry.

This fully automated investing service requires that you have at least $3,000 in a Vanguard brokerage account — choose from either a Traditional or Roth IRA, or a taxable account. If you’re not an existing client, then you’ll need to create a new account.

To continue signing up, you’ll need to answer a few questions including your employment status and then led to an overview of what you can expect from Vanguard Digital Advisor:

For each step, you’ll answer a series of questions, with explanations on why Vanguard is asking them — you can also connect external accounts to provide more insight. If you have other Vanguard accounts like your 401k, you can link those and the brokerage will help you manage them. Otherwise, external accounts will be accounted for in spending projections but Vanguard won’t manage them.

Other questions you’ll be asked include spending estimates for your household and your risk tolerance. You’ll be measured from a scale of one to one hundred, which will help to decide on the types of allocations recommended for your portfolio.

After you’re enrolled in the service, Vanguard will take your assets and invest it in a portfolio of four Vanguard ETFs:

The percentages or allocations will be customized to match factors such as your age and risk tolerance. Vanguard’s algorithms will monitor your account daily to ensure the allocations are at the desired percentages.

Vanguard Digital Advisor has various tools, such as offering suggestions on saving for unexpected events, optimizing debt payments, where to hold extra cash, and more. You’ll also be able to look at what your debt payoff journey may look like if you used different payoff strategies.

For instance, you can use the debt payoff calculator to look at accounts you’ve connected, such as your mortgage, car loan or student loans. You can look at using the avalanche payment strategy — paying off the one with the highest loan amount first — or if you were only to make the minimum payments.

Another tool you can use is learning how to handle a windfall — an unexpected sum of money you receive — like an inheritance or a bonus at work. You will be advised to either pay off debt or use it to invest toward a goal.

Investors will need to pay around a 0.15% annual net advisory fee across all your enrolled Vanguard accounts.However your actual advisory fee will depend on what you have in each enrolled account.

How this works is that Vanguard Digital Advisor will start by applying a 0.20% annual gross advisory fee to manage your Vanguard brokerage accounts.Then, you’ll be credited for any revenue that the brokerage or its affiliates gets from the Vanguard expense ratios from funds in your portfolio.

Aside from that, you’ll pay expense ratios from the Vanguard ETFs held in your portfolio, which averages to about 0.05%.

Vanguard Digital Advisor at a Glance

Vanguard’s proprietary algorithm, will take the information you provide in the initial questionnaire to recommend a portfolio, taking into account your asset allocation, time horizon, and risk tolerance that aligns with your goals.

There are four Vanguard exchange traded funds that may be recommended for your portfolio:

You may be able to access two additional ETFs: Vanguard FTSE Developed Markets ETF, and Vanguard FTSE Emerging Markets ETF. To do so, you’ll need to enroll in both Vanguard brokerage accounts and participant accounts.

The allocations can change to match your risk exposure, time horizon for your retirement goals, and glide path trajectory (your asset allocation as you approach a target date). These allocations are based on fairly straightforward goals.

Keep in mind that recommendations from Vanguard Digital Advisor won’t guide you to purchase individual stocks, bonds, options, CDs, annuities, or other types of individual securities.

Clients’ portfolios consist of a well-diversified portfolio, which includes investments from different asset classes and market sectors — their ETFs broadly investing in US- and global-centric stocks and bonds. It doesn’t make any decisions based on short-term performance or market timing, and instead focuses on low-cost securities and indexing that’s based on long-term goals.

Vanguard Digital Advisor monitors portfolios daily and automatically rebalances if any asset allocation deviates by more than 5%. Rebalancing may also happen if there’s excess cash holdings.

One of the main downsides to Vanguard Digital Advisor is that you won’t be able to take advantage of automatic tax loss harvesting for your account. Being about to use tax loss harvesting can help to minimize taxes — investments that have a loss are sold to offset any gains you made in your portfolio.

However, Vanguard Digital Advisor does try to help investors be more tax efficient by using the minimum tax cost basis method. It involves selling units of securities that have the greatest loss during each sale.

Vanguard also helps to optimize for taxes by making sure it puts less tax-efficient investments in retirement accounts, and more tax-efficient ones in taxable accounts — assuming you have both types.

You won’t be able to find any human financial advisors since Vanguard Digital Advisor is a completely digital experience. You can find customer service representatives to help you with questions (though don’t expect personalized financial advice) through their phone service. That’s available from 8 a.m. to 8 p.m., ET Monday through Friday.

If you want to stick with Vanguard but want access to human advisors, you can consider switching to Vanguard Personal Advisor Services, though you’ll need a higher investment minimum.

As with any investing platform, there are pros and cons and we’ve rounded them up as part of our Vanguard Digital Advisor review.

Vanguard Digital Advisor is a great fit if you’re fine with not getting the help of a human financial advisor and instead use online tools and technology instead. It’s also best for those looking for a solution to help them with creating a retirement investment plan by investing in low-cost ETFs and designing a portfolio that’s aligned with their goals.

However, if you want to leverage multiple investment goals, be able to customize portfolio offerings, or have the option to work with a human financial advisor, you’re of luck. You may want to hold out to see if there are additional features in the future, or look at other alternatives.

Contributor Sarah Li-Cain is a personal finance writer based in Jacksonville, Florida, specializing in real estate, insurance, banking, loans and credit. She is the host of the Buzzsprout and Beyond the Dollar podcasts.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings