by Robin Hartill, CFP®, Whitney Hansen

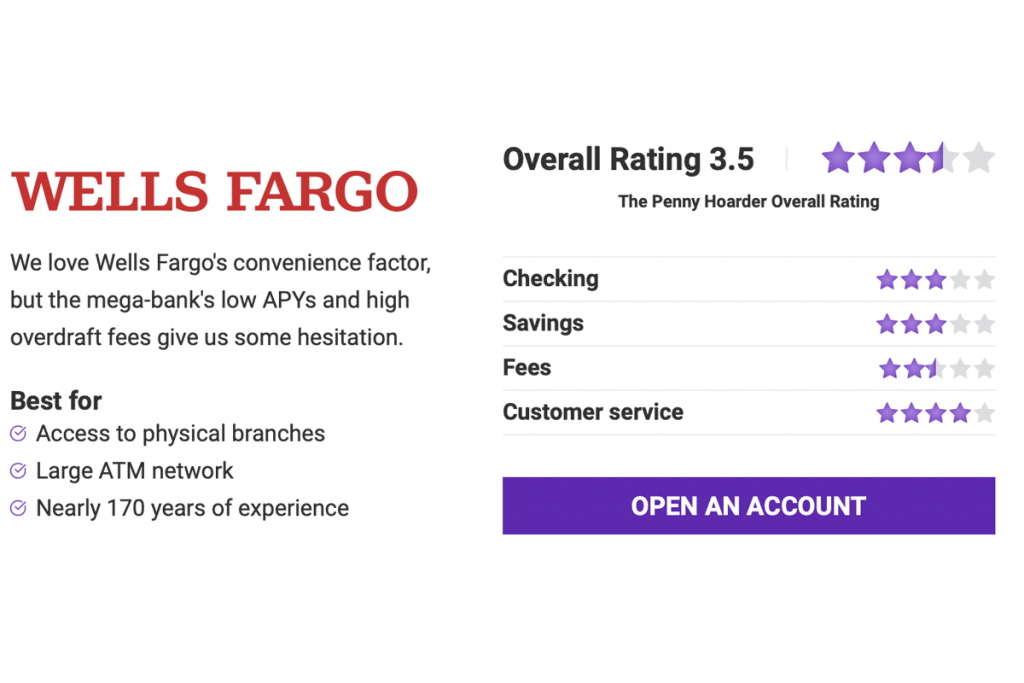

Wells Fargo is a Big Four bank that made big headlines back in 2016 and 2017 over a scandal where employees created millions of fake accounts to hit their sales targets.

They’ve come a long way since then, working on earning trust back with strong customer service and new mobile services, but ultimately it’s up to you to decide whether you should or shouldn’t trust Wells Fargo with your money.

We’re here to give you an honest look at the bank’s checking and savings account features for individuals and small businesses, as well as its overall convenience and mobile banking features.

Wells Fargo offers three checking account options: Everyday Checking, Portfolio by Wells Fargo, and Clear Access Banking. Each account has a $25 minimum starting deposit and monthly fees between $5 and $30.

The Everyday Checking account allows you to write checks and pull money out of Wells Fargo’s many ATMs, but there is no opportunity to earn interest on your balance. With so many interest-bearing checking account options on the market, the lack of APY is a major downside.

One thing we do like about this account is the many options to waive the $10 monthly service fee. Wells Fargo will waive it if you meet one of the following conditions:

On the other hand, Wells Fargo’s overdraft fees are a steep $35, with a limit of three per day. Overdraft protection is available if you have a linked Wells Fargo savings account or credit card — but the transfer to cover your overdraft will cost you a hefty $12.50.

However, we do like the Automatic Refund feature, which will waive some overdraft fees if Wells Fargo receives an automatic transfer that covers at least the amount you overdrafted by before 9 a.m. the following business day. This feature is free and is automatically applied to most checking accounts.

In keeping with Wells Fargo’s other checking accounts, the Portfolio by Wells Fargo account has a pretty doable starting deposit of $25, but besides that, the account really caters to a high-rolling crowd. For instance, the only option to avoid the $25 monthly service fee is to have $20,000 combined statement end balance — a far cry higher than the $500 needed to waive the monthly fee on an Everyday Checking account.

From there, the Portfolio by Wells Fargo account divides its users into two categories: under $250,000 and over $250,000. Those in the higher tier get .02% APY, unlimited reimbursed fees from non-Wells Fargo ATMs, waived Overdraft Protection transfer fees, and no international transaction fee. The lower tier gets an even tinier .01% APY and similar perks just with limits like one waived overdraft protection transfer fee and one reimbursed non-Wells Fargo ATM fee per pay period.

These perks are nice, but if your goal is to accrue wealth, there are other banks offering high yield accounts that will grow your wealth more quickly. In fact, Wells Fargo doesn’t even come in above the national average of .06% APY.

Wells Fargo’s Clear Access Banking account is touted as a simple way to spend only what you have. With a $5 monthly fee that is waived if you’re between the ages 13 to 24, the Clear Access Banking account almost feels like a starter checking account. It’s checkless, and you can only draw out what you have on hand.

Because of that, you’ll never experience an overdraft fee. If you do run into a negative balance from an added charge after authorization like a tip, then you’ll just carry a negative balance and be unable to pull out money until you pay off the negative amount.

Although it’s a pretty basic checking account, you still get access to the contactless debit card, Wells Fargo app, and digital payment platform like Zelle.

If you’re looking to keep all your banking in one place, Wells Fargo offers two primary savings accounts to use alone or link to the Wells Fargo checking account of your choice. Like the checking accounts, both Wells Fargo savings accounts have a $25 minimum opening deposit and the ability to waive the monthly maintenance fees.

The Way2Save account only has a $5 monthly maintenance fee and several easy ways to waive it. You can waive it if:

We love how simple it is to waive it, but it’s worth noting that there are many saving accounts on the market without any fees at all. Plus, the Way2Save Account isn’t exactly a way to earn interest, earning just 0.01% APY, which is well below the national average. .

So why do people choose Wells Fargo? The convenience and comfort of access to your cash. It’s easy to find an ATM or even a brick-and-mortar branch. People like the comfort of easily moving their money.

We’re also fans of the optional Save As You Go program, which transfers $1 into your savings account for each non-recurring debit purchase and automatic online bill pay transaction.

Wells Fargo’s Platinum Savings account only offers a base tier APY of .01% — again, well below the national average — and requires a minimum balance of $3,500 to avoid the $12 monthly maintenance fee. If you link your Portfolio by Wells Fargo checking account, then Wells Fargo bumps you up to a, still small, but better, .02% APY. You do get unlimited branch and ATM withdrawals, so if you already plan on having multiple accounts at Wells Fargo, the Platinum Savings account is a nice option.

If you’re looking for more, Wells Fargo Bank most likely has it. Take a look at other financial services and benefits Wells Fargo offers.

We think Wells Fargo is one of the best banks for small businesses in general. We like its small business checking and savings account offerings because of their low fees.

We bet Wells Fargo will meet your small business needs with its three main business checking options:

While we’ll touch on all of them, Initiate Business Checking is the most popular — and we think the best, beginning choice for most — so we’ll focus there first.

The Initiate Business Checking Account has a $25 minimum opening deposit. There’s a $10 a month service fee that’s waived with a daily balance of $500 or $1,000 average ledger balance. With the account, you get 100 free transactions and $5,000 worth of free cash deposits each month. After that, transactions cost $0.50 and cash deposits cost $0.30. Plus, you have access to the Wells Fargo mobile app and their small business customer service phone center.

The other two business solutions go up in cost and offerings. The Navigate Business Checking is $25 a month, waived by a daily balance of $10,000 or $15,000 average combined deposit balance. The account has no fee for only the first 250 transactions but also no fee for the first $20,000 in cash deposits. Similar transaction rates apply after you hit these free limits. However, you have the possibility of earning interest on this account, so that’s a plus.

Similarly, the Optimize Business Checking account goes up to a $75 a month (non-waivable), but the earning allowance included in the account can be used to offset the cost. It includes up to five linked Optimize Business Checking accounts and access to treasury management services.

Basically, you decide what your business needs, and Wells Fargo Bank almost certainly has a checking account to match it.

Wells Fargo does offer several options for fixed rate CDs. But, with a steep minimum opening deposit of $2,500 and low interest rates of .01% to .02% APY, Wells Fargo just can’t hold its own against other CD offerings on the market. Unless you’re set on Wells Fargo, we suggest you keep looking.

With no fee and low APRs, both of Wells Fargo’s Credit Cards are solid options when it comes to credit spending. The only question is which one. We suggest the Wells Fargo Active Cash℠ for its unlimited 2% cash back on all purchases. Plus, right now, you get a $200 cash reward bonus when you spend $1,000 in purchases in the first 3 months. If that card doesn’t fit your needs, then the Wells Fargo Reflect Card also presents a strong showing with lowest intro APR for up to 21 months. After the introductory period, the APRs range from 12.99% to 24.99%.

Wells Fargo offers personal loans, home loans, and auto loans with competitive rates. You can check out the rates published daily.We think you should pay more attention to how the rate compares to other lenders than to your feelings of bank loyalty. Pick the best rate for your budget.

Wells Fargo offers a lot of different options for investing and retirement with varying amounts of hands-on control, support, and requirements. For example, The WellsTrade® brokerage account has a minimum initial investment of $0 while the Dedicated Advisor account has a minimum of $100,000. It’s best to decide what you’re looking for and then Wells Fargo probably has an option to fit your needs.

While Wells Fargo doesn’t have a college-specific checking account, they do offer college benefits to users who have Wells Fargo Everyday Checking account and go to one of these universities. If you’re one of the lucky few, you can get a Wells Fargo Campus ATM card that doubles as an official campus ID and ATM card.

Customers give the Wells Fargo Mobile app solid reviews. It gets 4.8 out of 5 stars in the Apple App Store and 4.6 out of 5 stars in the Google Play Store.

We also like the Control Tower option that lets you easily turn your card off if you’ve misplaced it. There’s also a cool cardless ATM option that allows you to access cash using your mobile phone — no debit card required.

The app has several neat financial management tools that let you track your spending in real time, create a budget and make a savings plan. Granted, there are tons of other budgeting apps that do the same things, but it’s nice to have these features rolled into your banking app.

Wells Fargo is hard to beat on convenience, with more than 5,400 branches and 13,000 ATMs in the U.S. There’s also 24/7 customer service.

Of course, like most banks, Wells Fargo offers a lot of digital features like mobile deposit and text banking that make it less important to be able to visit a physical location or interact with an actual human.

While this review is focused on its checking and savings options, it’s a convenient place to bank if you want a full suite of financial products, like credit cards, mortgages, car loans and investment accounts, all under the same roof.

So how does Wells Fargo compare overall to other banks? Take a look at the pros and cons to get a general idea of how Wells Fargo Bank stacks up.

Still wondering? Look below, we’ve answered some of the top questions people have about Wells Fargo.

Wells Fargo struggles, however, with below national average APYs and steep fees for overdrafts. If you have a habit of overdrafting, it will run you $35 a draw for up to three transactions a day — that adds up to a lot of money.

Robin Hartill, CFP®, is a senior editor and writer at The Penny Hoarder. She writes The Penny Hoarder’s “Dear Penny” personal advice column and also about investing, retirement, taxes and insurance. Personal finance writer Whitney Hanson is a contributor to The Penny Hoarder.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings