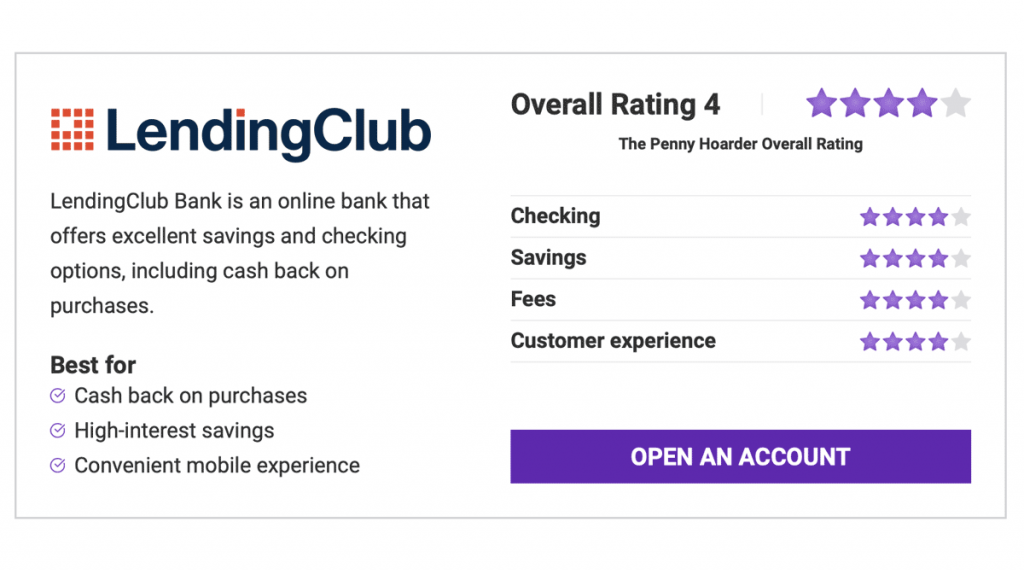

LendingClub Bank Review 2022: Checking and Savings Accounts

by Dave Schafer LendingClub is one of the more interesting online banks we’ve reviewed lately. First up — it is an online bank, which means no physical branches, though that’s not necessarily unusual anymore. What makes LendingClub Bank unique is that it’s the first proper mix of fintech and online banking.LendingClub Bank actually started life as Radius Bank in 1987 and transitioned to online-only banking in 2012, closing its brick-and-mortar