by Dave Schafer

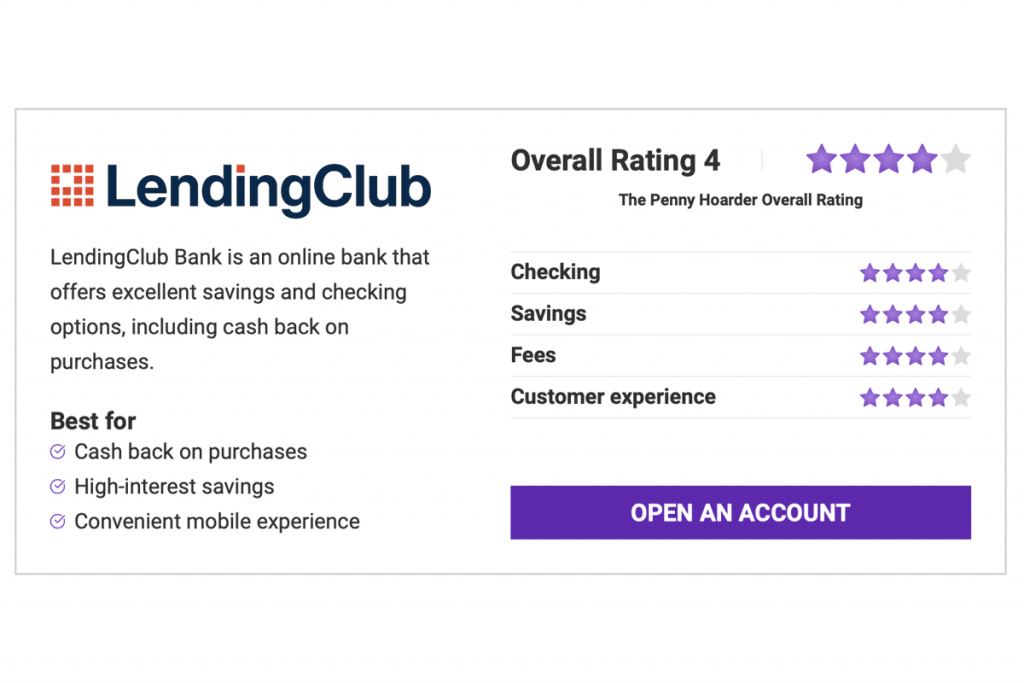

LendingClub is one of the more interesting online banks we’ve reviewed lately. First up — it is an online bank, which means no physical branches, though that’s not necessarily unusual anymore. What makes LendingClub Bank unique is that it’s the first proper mix of fintech and online banking.

LendingClub Bank actually started life as Radius Bank in 1987 and transitioned to online-only banking in 2012, closing its brick-and-mortar locations. LendingClub is also a fintech — financial technology — company that offers personal loans online. In 2020, LendingClub acquired Radius and renamed it LendingClub Bank. This acquisition marked the first time a fintech company had purchased a U.S. bank, and the promise was that LendingClub Bank would be able to offer the best of both worlds.

Today, LendingClub Bank offers an array of competitive online banking accounts and services, including a very compelling checking account option.

Is LendingClub Bank right for you? Read on to find out.

LendingClub offers one of our favorite checking accounts right now: Rewards Checking. Unfortunately, if you don’t qualify for it, you don’t have many other options.

The LendingClub Bank Rewards Checking account offers account holders a fee-free checking experience with a $100 minimum starting balance and no monthly minimum balance requirement. The account earns a reasonable interest rate of between 0.10% and 0.15% (depending on balance), which is a nice bonus that many checking accounts don’t offer.

Even more interesting is the cash back available on this account — as long as you maintain an average balance of $2,500 or more each month, or receive at least that much in direct deposits each month, you can earn 1.00% cash back on your debit card purchases. While maintaining a $2,500 average balance may be a stretch for some, the direct deposit criteria is much more achievable and makes this a compelling checking account option.

If you don’t qualify for the Rewards Checking because of a low credit score, you can also check out the Essential Checking account. This option is available to select customers and is billed by LendingClub as a way to rebuild your credit score and improve your personal finance situation.

The Essential Checking account differs from Rewards Checking in a couple key areas. First, there’s a $9 monthly service fee. Second, there are daily limits of $500 on debit card transactions and $1,000 on check deposits. The upshot is that after 12 months of establishing a positive banking history, you may be eligible to upgrade to a Rewards Checking account.

LendingClub Bank’s single savings account option offers a very competitive interest rate, provided you meet the minimum balance requirement of $2,500. Below that, it’s less interesting.

The LendingClub High-Yield Savings account is frankly fantastic. As long as your balance is over $2,500, you earn an excellent 0.60% APY, and you only need a minimum deposit of $100 to get started. On top of that, you get a free ATM card with no fees, so your funds are easily accessible.

The only real issue we can pick out is that accounts with balances below $2,500 earn a much lower 0.05% APY. That said, some smart savings strategies should help you get that balance up in no time.

LendingClub’s other offerings are fairly standard. There’s a CD option with a wide range of term lengths, as well as the expected array of personal loans. Most interesting are the personal finance options available through partnerships with other institutions.

LendingClub Bank offers an array of CDs for longer-term investments. Terms run the gamut from 3 months to five years and offer interest rates of 0.10% APY across the board.

CDs differ from standard savings accounts in a couple of ways:

For these reasons, they don’t necessarily make the best general-purpose savings accounts. They’re better-suited to situations where you know your money will have time to mature and earn.

The LendingClub CD options are decent, though we think they’d be best as an additional savings account if you’re already using LendingClub Bank, rather than as a standalone product.

LendingClub also offers personal loans — in fact, that’s how the company got its name. LendingClub offers loans up to $40,000 for credit card consolidation, balance transfers, debt consolidation, and more. The rates are fixed, and funding can be available in just a few days. Unfortunately, there are no small business loans available.

If you’re already using LendingClub Bank and need to take out a personal loan, it may make sense to keep things under one roof. At any rate, it certainly doesn’t hurt to have the option.

The mobile experience is important with any bank, but for online banks it can make or break the experience. We’re happy to report that LendingClub Bank’s suite of apps is outstanding.

The standard mobile app is easy to use and offers all the features you’d expect, including:

There are also features available to help you better manage your finances, set a budget, and keep track of trends in your income or spending. Finally, the LendingClub Marketplace is a tool built into the app that helps customers find financial products from LendingClub partners, including life insurance, student loan refinancing, and health savings accounts.

Wondering if LendingClub Bank is right for you? Our list of pros and cons could help you decide.

Have questions about LendingClub Bank? We have answers.

Penny Hoarder contributor Dave Schafer has been writing professionally for nearly a decade, covering topics ranging from personal finance to software and consumer tech.

Ready to stop worrying about money?

Get the Penny Hoarder Daily

Privacy Policy

© 2021 The Penny Hoarder. – All rights reserved.

Privacy Policy and Terms of Service | Do Not Sell My Personal Information | Cookies Settings