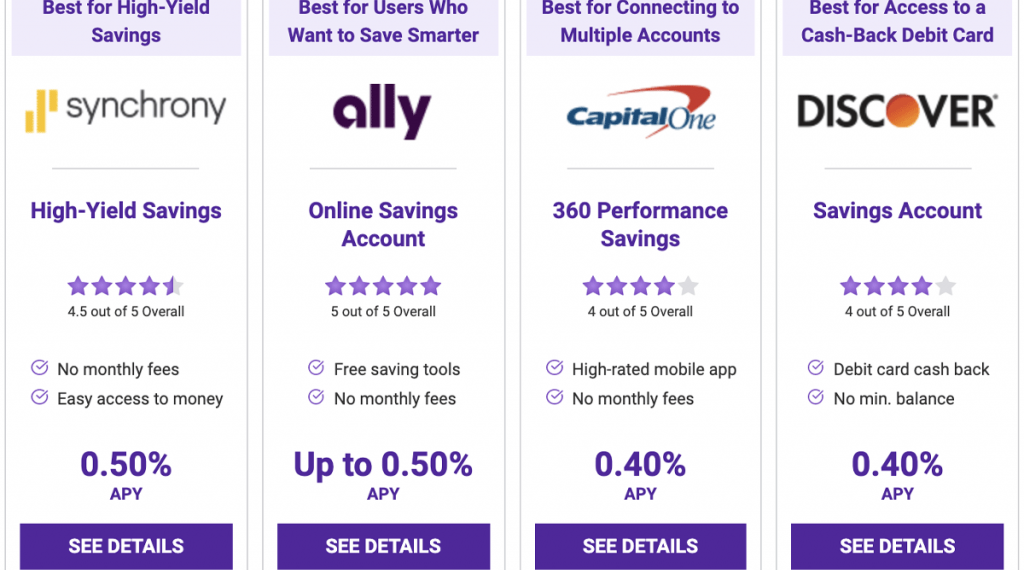

Best Savings Accounts for February 2022

Best for High-Yield SavingsHigh-Yield Savings0.50%APYBest for Users Who Want to Save SmarterOnline Savings AccountUp to 0.50%APYBest for Connecting to Multiple Accounts360 Performance Savings 0.40% APYBest for Access to a Cash-Back Debit CardSavings Account0.40%APYby Kathleen GarvinContributor When it comes to savings accounts, where do you even begin? Do a quick search, and you’ll find many savings accounts with different options with varying percentages, monthly fees and minimum requirements. Not to mention